Effective benchmarking separates the wheat from the chaff in pension management, according to Keith Ambachtsheer who argues the Top1000funds.com /CEM Benchmarking Global Pension Transparency Benchmark will help reduce the material ‘saying-doing’ gap in the global pension industry.

Possibly the most famous aphorism attributed to management philosopher Peter Drucker is “what gets measured gets managed”. Taking Drucker at his word in a pension management context, what outcomes should be measured? And does measurement really lead to better outcomes?

The CEM Benchmarking Inc. story suggests the answer is ‘yes’. The firm has been offering ‘value for money’ benchmarking services to pension organisations around the world since 1992. Today, it has over 400 clients in 25 countries that in turn serve 80 million members and collectively manage some $15 trillion in retirement savings.

Responding to increasing client demand over time, CEM’s suite of databases and benchmarking services has grown to cover public and private markets investment performance and costs, benefit administration performance and costs, organisational structure, asset/liability management, stakeholder communications, and more. Evidence suggests that this benchmarking is indeed leading to better outcomes. For example, a recent study using the CEM‘s benchmarking databases documented that key success drivers of the admired ‘Canadian Pension Model’ were scale, insourcing (especially private markets investing), and investing in internal R&D capabilities (link).

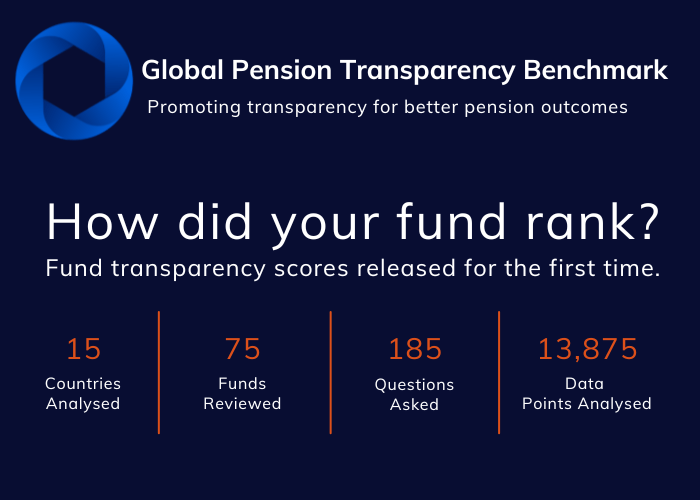

In this context, I commend the Top1000funds.com / CEM Benchmarking Inc. initiative to launch the Global Pension Transparency Benchmark (GPTB). This initiative will further catalyse pension organisations to clearly report how they are creating value for their stakeholders, and thus drive the sustainable delivery of adequate pensions to a country’s retirees at a reasonable cost.

The Mercer CFA Institute Global Pension Index (MCGPI) is a companion benchmarking tool to that same end. Its 12th version published late last year ranked the quality of the retirement income systems of 39 countries on this basis, handing out 2 ‘A’s, 12 ‘B’s, 17 ‘C’s, and 8 ‘D’s. Are these measurements triggering public policy actions? While it would take an in-depth study to answer this question in detail, we do know that the annual MCGPI findings receive significant media attention around the world and are triggering important national pension improvement discussions. The new GPTB will add further insights to guide these discussions.

The CEM, MCGPI, and GPTB benchmarking stories are harbingers of more to come in the world of pensions and investments. For example, recent studies by UK-based ShareAction and NL-based VBDO have thrown important new light on the asset owner/asset manager ‘saying-doing’ gap in integrating responsible investing/ESG principles and practices into their investment programs.

ShareAction benchmarked the RI/ESG implementation effectiveness of the globe’s top 75 asset managers, while VBDO did the same for the top 50 Dutch pension funds.

Table 1 presents the findings from the two studies. Note that in both studies, in contrast to the strong RI/ESG implementation claims of many asset owners and asset managers, only very few achieved ‘A’ ratings, while in both samples, about half received failing ‘D’ and ‘E’ grades. Conclusion: there continues to be materially more saying than doing in implementing RI/ESG principles and practices around the world, and much more action is required to change this reality.

Table 1 Comparing the ShareAction and VBDO RI/ESG Implementation Rankings

Percentage of Funds in each Ranking Category

A B C D E

ShareAction 7% 26% 16% 31% 20%

VBDO 6% 20% 33% 23% 18%

Sources: ShareAction, VBDO, KPA Advisory Services

Effective benchmarking does indeed separate the wheat from the chaff in pension management. The Top1000funds.com /CEM Benchmarking Global Pension Transparency Benchmark will help reduce the still-material ‘saying-doing’ gap in the global pension industry. What gets measured does indeed get managed.

Keith Ambachtsheer is Director Emeritus of the International Centre for Pension Management and President of KPA Advisory Services. He is a co-founder and co-owner of CEM Benchmarking Inc., and an Advisory Council member of both the Mercer CFA Institute Global Pension Index and of the Top1000funds / CEM Benchmarking Global Pension Transparency Benchmark.