Funds around the world do a good job of disclosing governance frameworks and policies related to financial and investment risks, as revealed in the Global Pension Transparency Benchmark. However, what is best practice for communicating governance around addressing large, one-off events such as the impact of COVID or war? Mike Reid says outlining governance approval frameworks and processes is a step in the right direction.

“Reports that say that something hasn’t happened are always interesting to me, because as we know, there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know.” Donald Rumsfeld

As this article was being written in March 2022, it was more apparent than ever that successfully navigating risks is key to the success of investment management organisations both in the near and long term. For the second time in two years, funds across the globe are facing a major upheaval that has the potential to greatly impact financial markets. Stakeholders are right to be concerned and need to be informed about how funds are navigating through this tricky environment. Are global funds being transparent about how the view and manage risk?

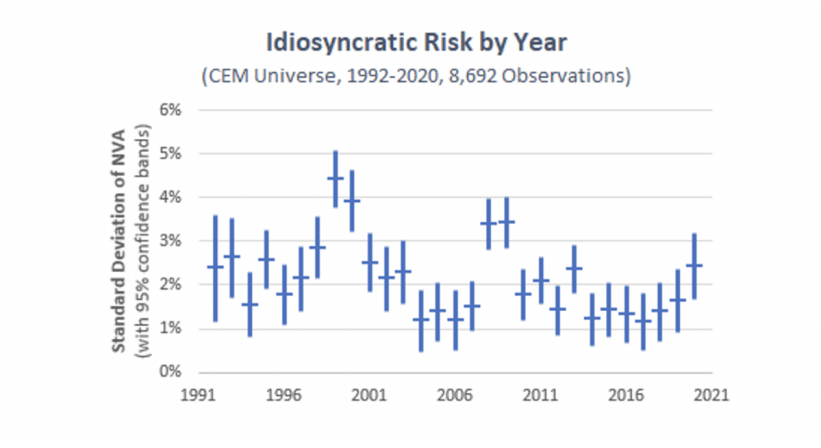

Risk management frameworks need to adequately address both the more predictable risks that funds face continuously in their day-to-day as well as larger scale, less predicable “Black Swan” events. The exhibit below shows the standard deviation of net value added observed among CEM’s clients from 1992 through 2020. A higher standard deviation represents a higher level of idiosyncratic risk, which all else being equal is a drag on long-term returns.

This clearly illustrates that idiosyncratic risk is heightened during large, global events. Peaks are easily observed both for the dot-com bust and the global financial crisis. Idiosyncratic risk in 2020 was also elevated from the levels observed after the financial crisis. In fact, one can even observe an increase in 2013 due to the “taper tantrum”. This demonstrates the value of an effective risk management framework is heightened in times of extreme stress.

First the good news. The vast majority of funds do disclose their views on risk, both financial and other risk, and related risk policies and governance.

The Global Pension Transparency Benchmark, this year’s review of 75 of the world’s largest funds revealed that:

– 96 per cent of funds reviewed disclose their governance framework and policies related to financial and investment risks, and 81 per cent of funds provide at least some quantifiable measures around these risks.

– Although not as universal, disclosures of a fund’s governance framework and policies related to non-financial risks were observed at 81 per cent of the funds reviewed.

However two issues were identified:

– the quality of the disclosures varied considerably among funds; and

– risk disclosures invariably focus on common, easily definable risks of the sort that funds encounter continuously as part of the day-to-day management of the fund.

What is almost entirely lacking are defined plans or processes to deal with “Black Swan” events.

Before addressing the latter point, let’s first look at some of the better examples of risk disclosures that were observed.

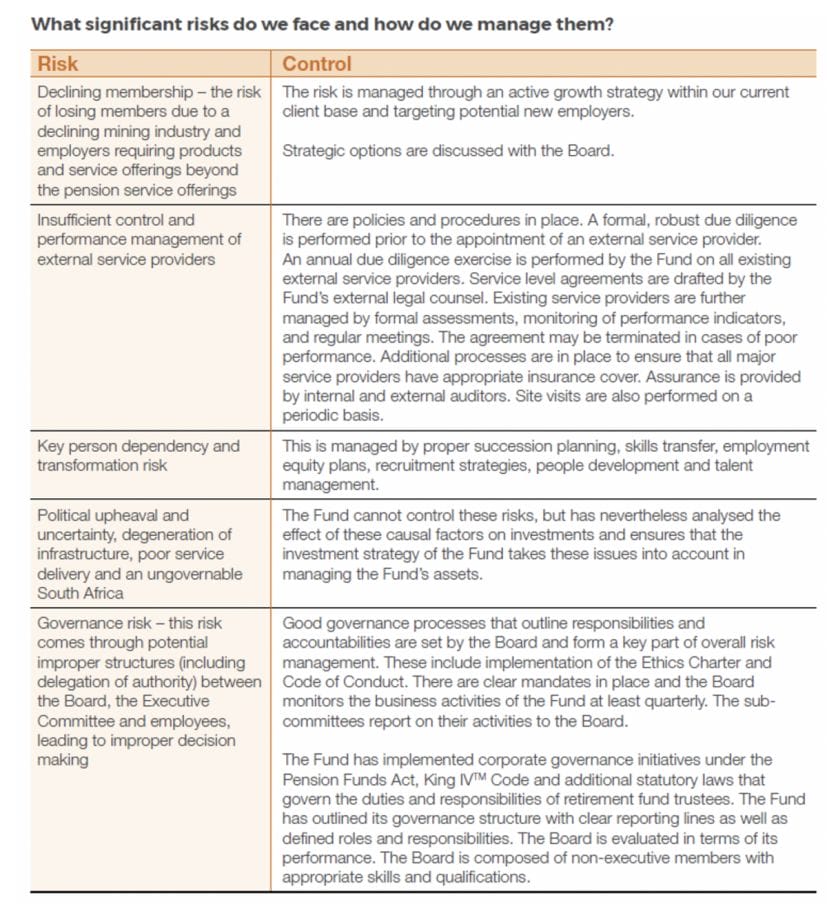

South Africa’s Sentinel Retirement Fund provided very comprehensive risk disclosures. Not only was their list of risks exhaustive, including 21 risks, covering most elements of their business, they did so in tabular format with the relevant risk control framework expressed in plain language beside each risk.

Source: Sentinel Retirement Fund 2020 Annual Integrate Report pg. 73-77

In the United Kingdom, pension schemes are required to maintain a risk register. These risk registers are meant to document the full range of risks a pension scheme faces and include a judgement of the relative risk posed by each risk.

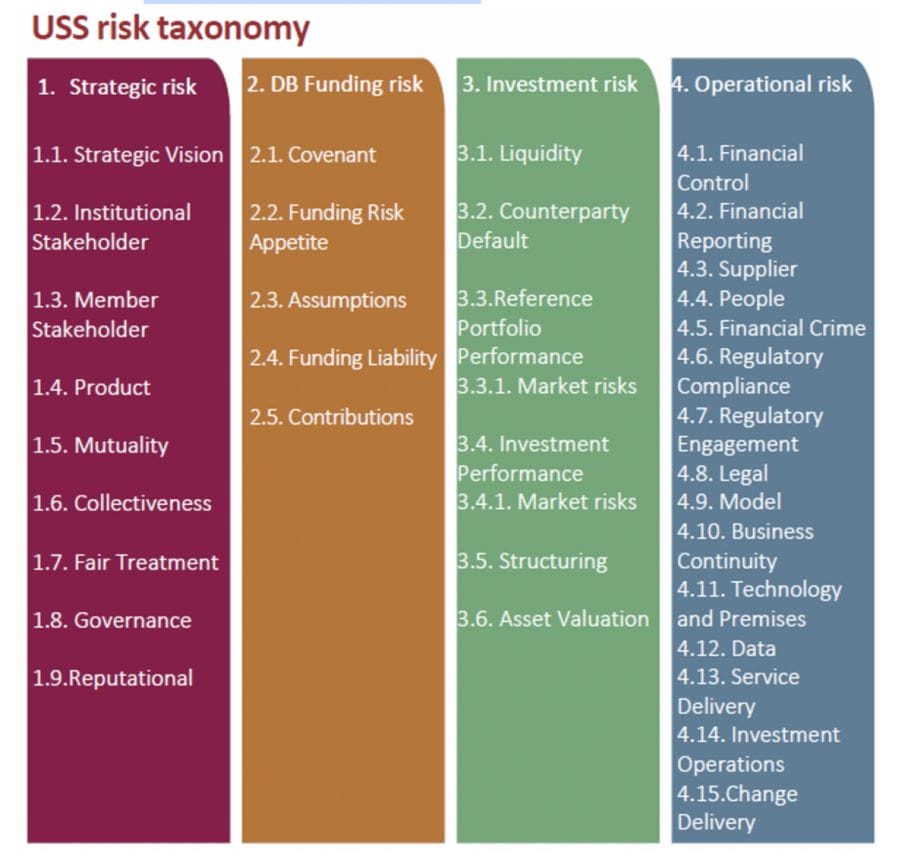

Universities Superannuation Scheme (USS) produces an annual Risk Management Supplement which summarises their views on risk. In this document:

– USS outlines its risk taxonomy and the risks it has identified, by type, in an easy to understand exhibit.

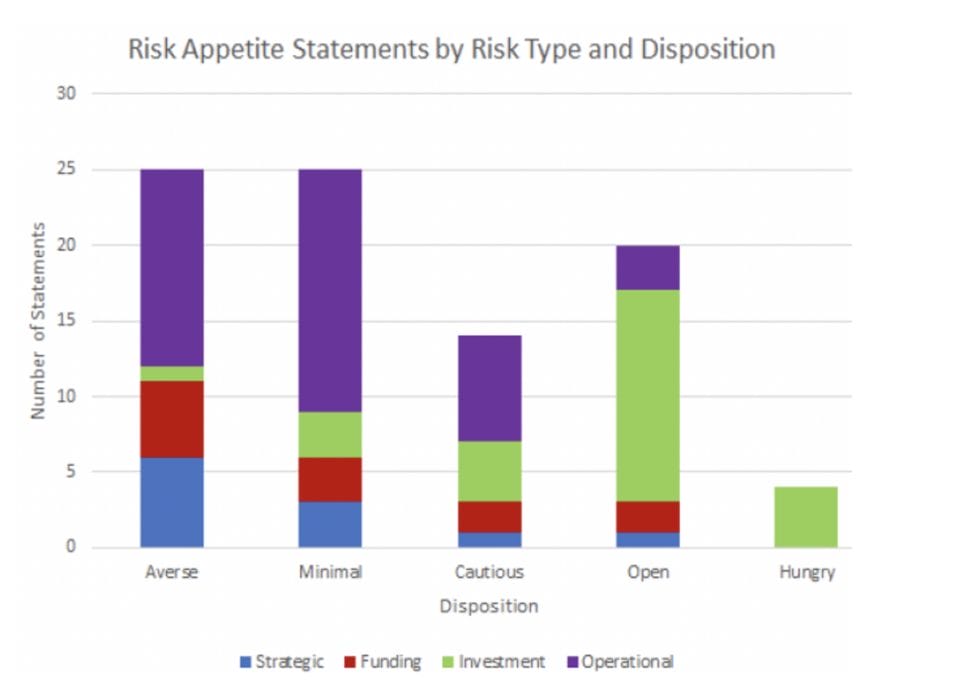

-USS then explains that it translates these risks into 88 individual appetite statements where it outlines its views on the level of risk it is willing to assume for each risk statement using a five category scale which ranges from “averse” to “hungry” which are clearly described. These assessments are summarised graphically using the risk taxonomy.

The exhibits shown above are just two examples, the supplement as a whole provided a 360 degree view of their risk management program, presented in an easily accessible manner. While both examples given above provide valuable information to stakeholders, they focus almost entirely on risks that are encountered in the regular course of business. It is important however for stakeholders to know how a fund would react during a large-scale world or market event.

How can a fund best communicate to stakeholders on its governance for large one-off events when these events, by definition, are unpredictable? One way to address this issue is by clearly outlining governance approval frameworks and processes. How quickly can a fund respond to external events? Who has authority to make decisions, and what are the relevant thresholds? Is there an emergency framework in place?

If a fund must convene its investment committee for approval, approvals may come too late. Most funds will have some sort of operational business continuity plan, stakeholders would benefit from knowing how investment decision making will occur during emergency times.

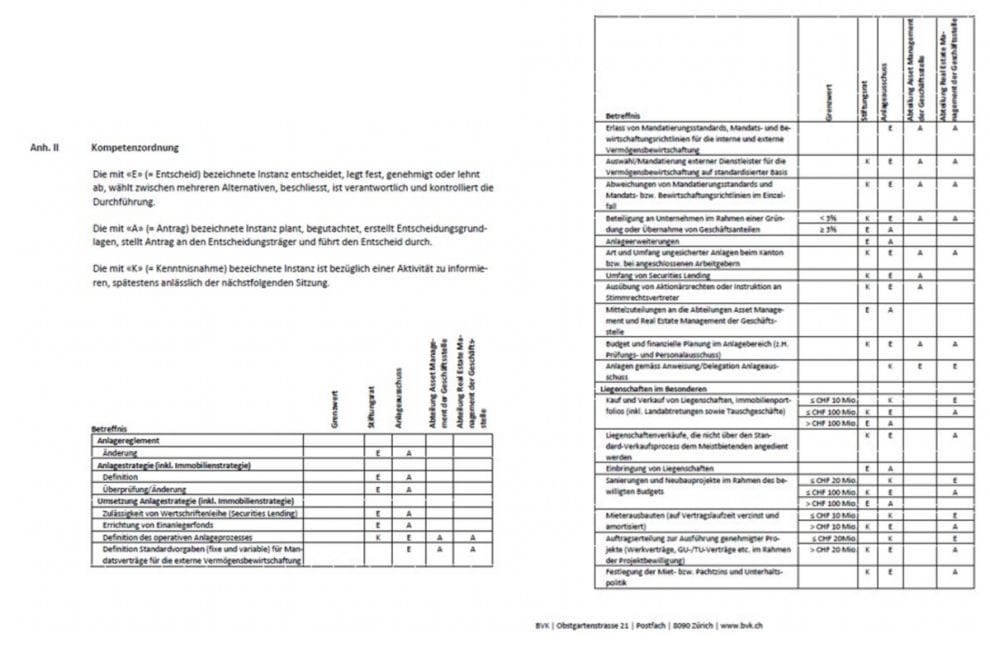

One example of how this could be addressed was observed in the disclosures of Swiss fund BVK, the manager of funds underlying pension for employees in the canton of Zurich. This exhibit, from BVK’s investment policy presents the approval processes for many major investment functions. Additionally, it shows how these processes vary based on certain investment limits when applicable. This information can allow stakeholders to assess how the fund’s governance structure would allow the fund to respond in times of market stress.

Source: BVK Zurich Investment Policy pg. 21-22

Unfortunately disclosures such as this were extremely rare.

We would like to see more funds disclose this information. An added bonus would be if they discussed how the process may change in times of stress, perhaps building on real world experiences from both the global financial crisis and the market crash at the beginning of the pandemic.