Brazil.

Brazil ranked 12th globally with an average total score of 48.

In Brazil, the first pillar consists of two schemes. The General Regime of Social Security (RGPS) is a mandatory scheme covering the private-sector workforce. The Regime of Social Security for Public Servants (RPPS) includes multiple pension schemes covering public sector employees. In general, these pension plans are financed on a pay-as-you-go basis with the employee paying a percentage of their salary.

The first pillar is complemented by a voluntary, private savings scheme called the Complementary Pension Regime (RPC). Employer sponsored pensions have a long history in Brazil and the country has the oldest system in Latin America. Two pension vehicles exist that can be used to finance private pension benefits. Closed private pension entities are non-profit organisations that can be established on a single-employer or multi-employer basis and by labor unions. Authorised financial institutions also provide pensions through open private pension entities. The closed approach is typically chosen by large employers whereas the open approach is mostly chosen by small and medium-sized employers and offered to their employees. Closed funds, sponsored mainly by large private companies, traditionally provided defined benefit pensions. Like many other countries, Some of these DB plans are now closed and DC plans are on the rise.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

Brazil.

Brazil ranked 13th globally overall with an overall average country score of 43. The range of overall scores across funds was fairly narrow: from 30 to 56. Brazil scored in the bottom quartile of countries on three factors: governance and organisation, performance and responsible investing. In contrast, cost disclosures were relatively good and Brazil ranked in the top half of country scores.

Cost

Brazil ranked 8th globally with a factor score of 49. Individual scores ranged from a low of 40 to a high of 58. Scores have fallen overall since last year and declined at four of the five funds reviewed. These changes were primarily driven by poorer disclosures of member service costs and funding information, as well as less detailed external management fee discussions. Despite the decline, disclosure of member service scores remained strong, the 5th best among countries reviewed. Disclosures at the total fund level were also strong.

Governance

The Brazilian funds did not do well on this factor with an average overall score of 51 and a global ranking of 13th. While the overall score was a slight improvement on last year, Brazil’s global rank fell one place. The range of scores increased slightly, with a low of 40 to a high of 60, reflecting improvements at some funds. Compensation, HR and organisational disclosures continued to be weak. Disclosures related to organisational strategy saw the largest year-on-year improvement and Brazil’s score in this regard is now close to the global average.

Performance

Performance disclosure for Brazilian funds were lacking relative to the other countries. Funds had an average score of 43, the lowest in the review. Individual fund scores ranged from 27 to 69, with only one of the five funds receiving a score above the average. Of the nine areas scored, Brazilian funds scored the lowest in two, and had no areas in which they excelled. Risk disclosures were notably lacking.

Responsible Investment

Despite an increase in the average funds score and more fulsome disclosures in all but two areas reviewed, Brazilian funds continue to rank 13th in the RI disclosures. Individual fund RI scores ranged from 3 to 46. Exclusion was the weakest component with only one fund providing disclosures in this area, however improvements were made within active ownership and ESG integration reporting. Despite improvements in many areas, scores trailed global averages in each area reviewed.

Examples

Itau Unibanco

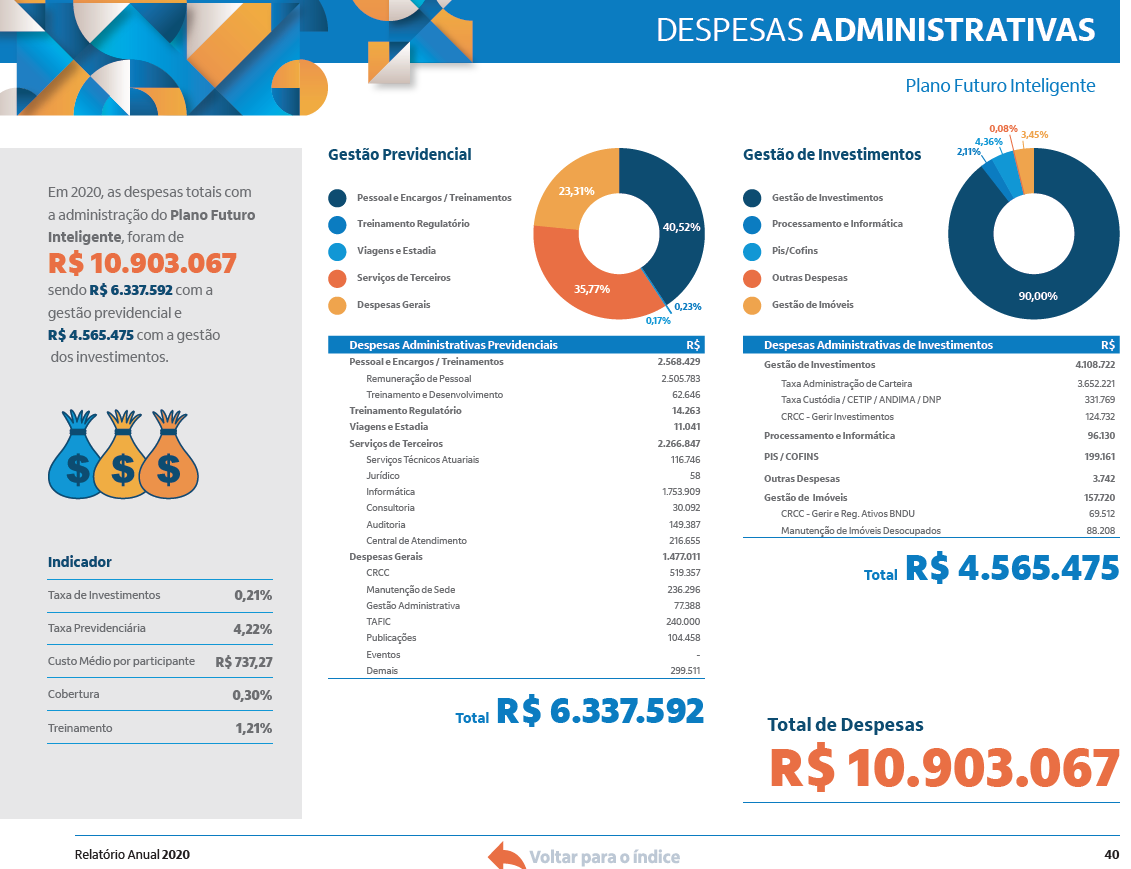

Source: Itau Unibanco annual report pg. 40.

FunCEF

FunCEF provided a detailed summary of changes to governance processes as well as transparency and anti-corruption initiatives. In addition, quantified results of the initiative are provided. Too bad that future initiatives are not included for completeness.

Source: FunCEF 2020 annual report pg. 36-37

Overall Results

Brazil.

Funds Analysed

Funcef

Funcef is the third largest pension fund in the country, with more than R$70 billion in assets and 135,000 participants. Its members are employees of CAIXA, a Brazilian bank that is the largest 100% government-owned financial institution in Latin America.

Itau Unibanco

Itau Unibanco provides a number of pension schemes for its employees and for subsidiary companies. Itau Unibanco is the largest private sector bank in Brazil and the largest in Latin America. It has operations in eight countries in the Americas as well as eight other countries.

Petros

Petros is a pension entity created by Petrobas, the national oil company. It has legacy DB plans for Petrobas and subsidiary companies, newer DC plans for them, and it now offers pension plan services for other employers and organisations in Brazil.

Previ

Previ has a long history, dating back to 1904. It is now among the largest pension funds in Latin America. Previ is the pension fund for employees of Banco do Brasil, and its own employees. There are two main plans: a DB scheme that has been closed to new entrants for some time, and a newer, open DC plan – Previ Futuro.

Vivest

Vivest was known as Funcesp until recently and it started as a provider of pension and health benefit programs for CESP, a large electricity generation company in the State of São Paulo. Today, Vivest is the largest private pension fund in Brazil.