Canada.

Canada ranked 1st globally with an average total score of 83.

Canada’s pension system is characterized by a mixture of public and private pension schemes. Approximately half of all Canadians rely on the public pension system which consists of two tiers: 1. Old age security – set amounts paid to all Canadians of retirement age, based solely on residency 2. Canada Pension Plan (CPP) – a mandatory earnings related pension covering all workers. The third tier of Canada’s pension system is made up of voluntary pension savings. Defined benefit plans remain the most common type of scheme in Canada, particularly for public sector employees. Like many other countries, defined contribution plans are now the plan of choice for private sector employers. We reviewed the public disclosures of the CPP and four organisations that manage mainly DB plan assets for provincial public sector employers.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

Canada.

Canadian funds continued to have impressive public disclosures. They ranked 1st globally with an average total score of 74. By factor they ranked 1st in governance; 2nd in performance; 3rd in cost and 3rd in responsible investing.

Most of what was scored focused on ‘what’ was disclosed. Canadian funds also excelled on communication dimensions that were not scored. Their annual reports were well organised, cohesive and packed with important information for stakeholders. The narratives typically went beyond just ‘what we do’ to add insights about ‘how we do things’ and ‘why we do it this way’. They also realise that less can be more, making good use of infographics, summaries, pictures, charts and less text to add impact and keep readers engaged.

Cost

The average score for cost disclosure was 64 and scores for funds ranged from a low of 49 to a high of 81. Disclosures were consistently good for total fund level and for external manager fees. Asset class and transaction cost disclosures were inconsistent across the funds and scored low on average. Disclosures for external manager fees increased from last year from an already impressive base, unfortunately already spotty disclosures on transaction costs became even less prevalent.

Governance

The biggest Canadian public funds collectively have a global reputation for superior performance and governance excellence is often cited as a key driver (the Maple Model). The CEM benchmarking database provides empirical evidence that the Maple Model funds do indeed outperform over the long term. Building on last year’s first place performance, four of the five funds reviewed increased their governance disclosure year over year. Given the overall high scores last year, these improvements are best described as “completing the picture” and occurred across all areas of review.

Performance

The average score of 81 for Canadian funds marked a slight improvement in disclosures from last year. Funds continued to score consistently well across the various components with no areas seeing a reduction in score. Risk, asset mix and portfolio composition, as well as total fund return and value add disclosure were especially good. Canadian funds also typically provided clear and detailed disclosures of the basis for their return and valued added reporting. Returns were explicitly stated as time-weighted for the total fund and most asset classes and occasionally as IRR for private market asset classes. Total fund returns were consistently and explicitly stated as net of all investment costs and the cost basis for asset class returns was clear. Surprisingly, this level of detail for returns and value added was not universal. Return basis disclosures were often cryptic or non-existent. This makes understanding and comparing results across funds very difficult.

Responsible Investment

In last year’s review Canadian funds received their lowest relative score among the four factors in RI. A somewhat surprising result given that RI is most certainly a focus of many large Canadian funds. The Canadian funds partially addressed this in 2020 and improved their score from 58 to 70, the largest improvement in any factor. This improvement was apparent in all funds, but particularly among the couple that achieved lower scores last year and in areas that were lower scoring. Disclosures on RI governance as well as exclusion principles continued to be relative weak spots, but to a lesser extent. Four of the five Canadian funds achieved a score of 70 or higher this year as compared to only one last year.

Examples

CPPIB

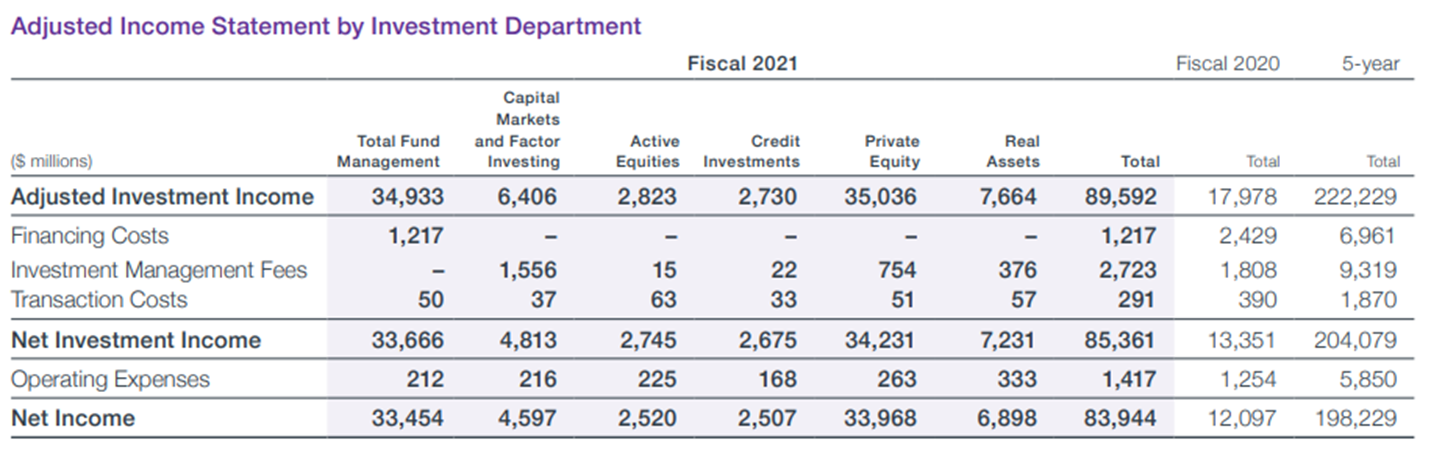

CPPIB had several examples of good disclosure across all factors, including cost. The exhibit below shows costs split by type and asset class, all in single easy to read exhibit.

Source: CPPIB 2021 Annual Report, pg. 65

British Columbia Investment Management Corporation

BCIMC produced a special annual report centered entirely on it’s ESG initiatives. While there are many best practice examples in this report, of not was the shared details on its UN PRI score card, including how it scored against peers.

Source: BCI ESG Annual Report, 2020 – pg. 7

Overall Results

Canada.

Funds Analysed

British Columbia Investment Management Corporation (BCI)

BCI manages the assets of public sector pension plans as well as insurance and benefit funds for the province of British Columbia.

Caisse de dépôt et placement du Québec (CDPQ)

CDPQ invests funds for several public and parapublic pension plans and insurance programs in the province of Quebec.

CPP Investments (CPPIB)

CPPIB manages the assets of the Canada Pension Plan, the national pension scheme for Canadian workers.

Ontario Teachers’ Pension Plan (OTPP)

OTPP is responsible for managing plan assets and administering defined-benefit pensions for school teachers in the province of Ontario.

Public Sector Pension Investment Board (PSP)

PSP invests funds for the pension plans of the Public Service, the Canadian Armed Forces, the Royal Canadian Mounted Police and the Reserve Force.