Denmark.

Denmark ranked 7th globally with an average total score of 61.

The public disclosures of the largest Danish pension providers were reviewed. The country’s primary public pension system consists of a basic pension and a pension supplement paid to the most financially disadvantaged. This primary pension is supplemented by ATP Lifelong Pension, to which most people contribute. Certain employees also participate in mandatory occupational pension schemes determined by collective bargaining. In combination, these programs cover about 90 per cent of the employed workforce.

Almost all plans in Denmark are of the defined contribution type, in part driven by the prevalence of industry-wide collective labour market agreements. The collective bargaining agreements often mandate both employee and employer participation in supplementary schemes, so while technically voluntary, participation is effectively compulsory. The occupational pension pillar is chiefly funded by employees paying into these schemes. The occupational schemes themselves are offered by a variety of providers who compete for the same customers.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

Denmark.

Danish funds maintained their 5th place ranking in this year’s review with an average overall score of 60. The Danes did not perform well across all four factors however. Governance and RI factors continued to be bright spots, with the Danish funds ranking 4th overall in each component. Scores for cost discloses and particularly performance lagged their global peers.

Cost

Denmark ranked 9th globally in the cost factor with an average score of 45. Fund scores ranged from 20 to 65, a larger spread than last year, with the majority of the differential attributable to how prominently cost disclosures were featured and the completeness of external management costs. The Danish funds continue to score strongly in their member service disclosures but continue to fall short in detailed asset class and transaction cost level disclosures, though the asset class disclosures have improved slightly since last year.

Governance

The Danish funds continue to score well in this factor with an average score of 78, 4th highest globally. While the range of scores was fairly wide, from a low of 69 to a high of 93, overall funds scored consistently well in all areas except disclosures on board competencies and qualifications. Of particular note were much improved disclosures of organizational strategy, which are the most complete for the countries reviewed. The Danes continue to score well with their organizational and HR disclosures including details of internal headcount, diversity initiatives and board compensation.

Performance

Performance continued to be the weakest factor for the Danish funds, with an average country score of 56 and a global ranking of 12th. Overall we observed little change in disclosures in this area year-on-year with small improvements notes in several areas. Disclosures for total fund and asset class returns as well as benchmarks continued to be lacking or minimal. Disclosures on risk management policies and practices were excellent. Explanation of results were also good.

Responsible Investment

RI continued to be a relatively strong factor for the Danish funds, despite a drop in global rank from 3rd to 4th. The average score increased from 62 to 68 with improved disclosures observed at four of the five funds reviewed. Improvements were largest for funds that scored the lowest last year, which led to the tightening of the range of scores. The improvements largely came about due to funds releasing more documentation around active ownership policies and more detail around impact investments. All five funds received a perfect score an disclosure of exclusion policies. While RI governance scores did improve slightly, they are still low compared to other funds that score similarly on RI at the total level.

Examples

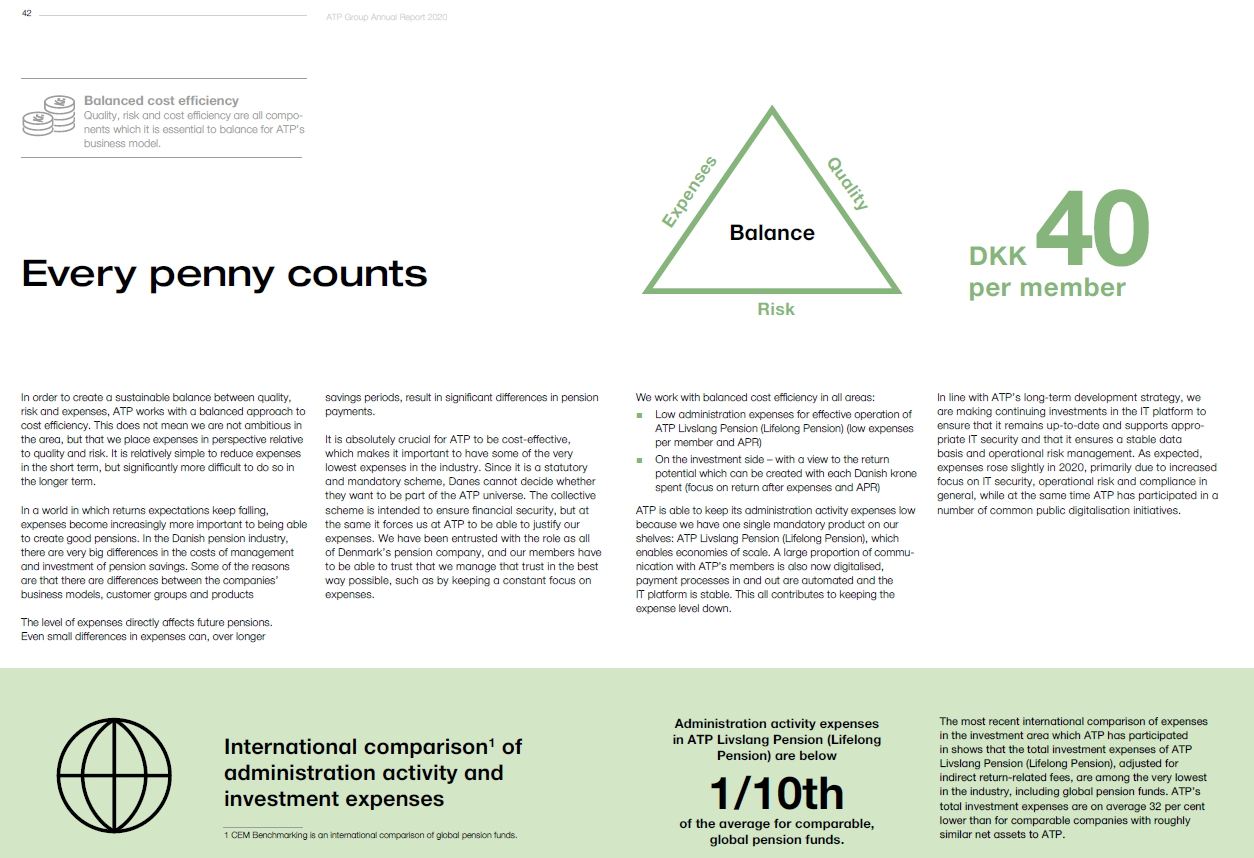

ATP Group

Denmark’s ATP does a great job of clearly articulating how it approaches cost effectiveness and the need to balance cost and performance, both in investments and member service.

Source: The ATP Group Annual Report 2020, p 42-46

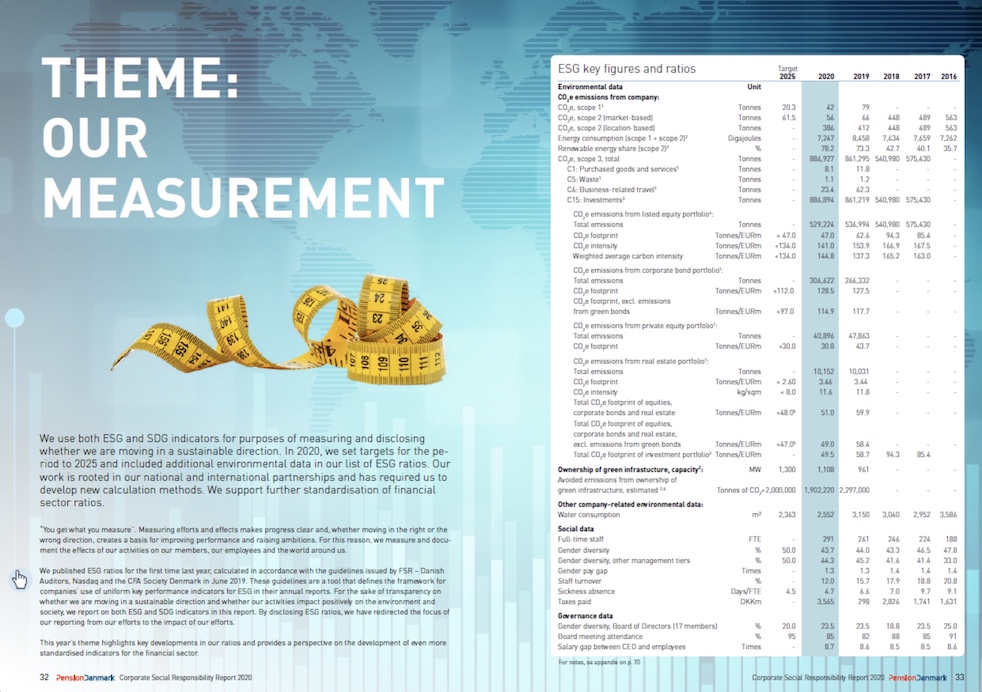

Pension Danmark

As part of a trend to more quantitative measures in RI, PensionDanmark provided good detail on how the measure ESG, both for external investments and internal HR. Trends for the past five years are provided as are applicable goals for 2025.

Source: PensionDanmark 2020 CSR Report pg. 32-33

Overall Results

Denmark.

Funds Analysed

ATP Group

ATP Group is Denmark’s largest pension and processing company with 5.2 million members and pension assets exceeding DKK900 billion. It provides lifelong pensions to Danish citizens.

Industriens

Industriens manages a compulsory labour market pension scheme with approximately 400,000 members from approximately 8,000 companies. It is a defined contribution scheme with assets of approximately DKK200 billion. Profits are returned to the members.

Pension Danmark

Pension Danmark is a member-owned labor market pension fund with DKK260 billion under management. It serves approximately 750,000 members from 23,400 companies.

PFA Pension

PFA Pension is Denmark’s largest commercial pension, insurance, and healthcare products company. It manages pension assets of more than DKK680 billion for more than 1.3 million members.

Sampension

Sampension is a customer-owned pension company with assets of close to DKK300 billion and around 300,000 customers. It manages industry-wide pension schemes for white collar employees in Danish municipalities and central government.