Australia.

Australia maintained their 4th place rank globally with an overall average country score of 64.

The first pillar of Australia’s pension system is a means-tested, unfunded age-based pension that provides a basic benefit. The backbone of the country’s pension system is the second pillar, a mandatory defined contribution system with minimum required contributions for all workers which was introduced in 1992. Before the compulsory superannuation system was introduced, defined benefit schemes were the more popular form of occupational pension provision.

The environment is competitive, individuals are permitted to select the ‘superannuation fund’ of their choice for their contributions. There are many superannuation providers, or supers, which can generally be categorised as either being 1) not-for-profit industry funds or 2) retail funds which are offered to the public by financial services companies. Most of the largest funds are in the not-for-profit industry sector.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

Australia.

Australia maintained its 4th place rank globally with an overall average country score of 64. The Australian funds maintained their 2nd place ranking in governance disclosures and 8th place ranking in responsible investing disclosures despite higher scores in both areas. Conversely, the Australian superfunds are now ranked 3rd globally for performance disclosures despite a lower overall score.

Cost

Australian funds had an average cost factor score of 53 resulting in a rank of 7th globally. Individual scores were widely dispersed, from a low of 31 to a high of 65. Completeness of external management fees and transaction cost disclosures continue to be strengths of the country relative to the global universe, attributable to the high degree of regulatory rigour surrounding cost disclosures in Australia.

Governance

The Australian funds continue to do very well on this factor with an average score of 86, second behind Canada. The range of scores was narrow: from a low of 80 to a high of 95. The five funds reviewed improved their disclosures in all areas and scored above average in all areas except organisational strategy, disappointing since four of the funds are fully integrated investment management and member service organisations. Members would benefit from a clearer picture of where their super fund is heading. Australian funds did particularly well in compensation, human resources and organisation disclosures, receiving the top grade in this area. Compensation disclosures for both the board and management were especially impressive – all funds received top marks.

Performance

The Australian funds scored well in performance with an average fund score of 71 and a global ranking of 3rd, an improvement on last year’s 4th place finish. Scores were quite consistent across funds, ranging in a narrow band from 60 to 79. Scores on most performance components were good, however benchmark disclosures continued to be weak at the asset class level. Disclosures on member service continued to be a strong point, reflecting the fact that four of the five funds reviewed compete in the market for member accounts.

Responsible Investing

The Australian funds had an average country score of 55 on RI and ranked 8th globally, maintaining the same ranking as last year. Individual fund scores showed a wide range, from a low of 20 to a high of 78. Areas of relative strength continued to be disclosures around active ownership policies and exclusion policies and practices. Disclosures around impact investing saw the biggest year-over-year improvement.

What We Liked

The disclosures of the Aussie funds, and the supers in particular were generally very clear and well laid out, likely reflecting their focus on individual members. Below are two examples that particularly stood out.

Examples

AustralianSuper

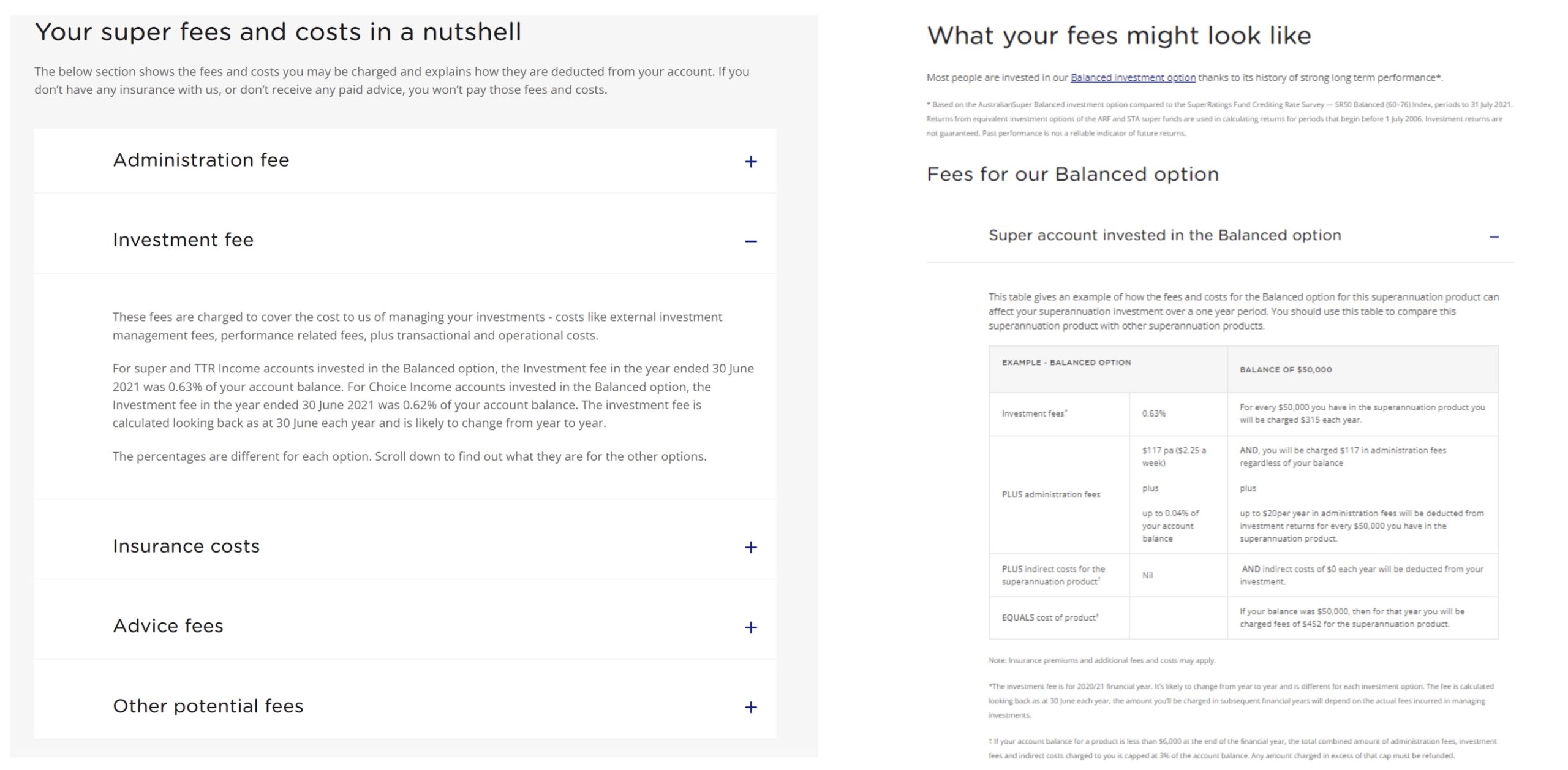

AustralianSuper provides members with clear definitions of the different types of fees charged on their investments (left) and illustrates these fees through concrete examples (right).

Source: https://www.australiansuper.com/compare-us/fees-and-costs

AwareSuper

Very few funds reviewed delineated the desired competencies for the board and fewer still contrasted the desired skills against those actually possessed by their board. Aware Super’s board skills matrix does both in a single easy to read and comprehensible exhibit.

Source: Aware Super 2021 Governance Report pg. 4-5.

Overall Results

Australia.

Funds Analysed

AustralianSuper

AustralianSuper is the largest Australian superannuation and pension fund, with approximately one in every 10 Australian workers as members. It is a not-for-profit industry superannuation fund.

Aware Super

Aware Super is a not-for-profit industry fund with a new name but a history going back to 1992. It is Australia’s third largest largest fund, with $150 billion under management following the merger between First State Super, VicSuper and WA Super.

Future Fund

Future Fund is Australia’s sovereign wealth fund, responsible for investing for the benefit of future generations of Australians. Future Fund was established in 2006 to strengthen the Commonwealth’s long-term financial position and manages six public asset funds.

QSuper

*At the time of the review, QSuper was a standalone fund. It has since merged with Sunsuper to create Australian Retirement Trust.

UniSuper

UniSuper is a not-for-profit superannuation fund with origins as a provider of superannuation for employees of Australia’s higher education and research sector.