Canada.

Canada ranked 1st globally with an average total score of 74.

Canada’s pension system is characterised by a mixture of public and private pension schemes. Approximately half of all Canadians rely on the public pension system which consists of two tiers: 1. Old age security – set amounts paid to all Canadians of retirement age, based solely on residency 2. Canada Pension Plan (CPP) – a mandatory earnings related pension covering all workers. The third tier of Canada’s pension system is made up of voluntary pension savings. Defined benefit plans remain the most common type of scheme in Canada, particularly for public sector employees. Like many other countries, defined contribution plans are now the plan of choice for private sector employers. The public disclosures of the CPP and four organisations that manage mainly DB plan assets for provincial public sector employers were reviewed.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

Canada.

Canadian funds had impressive public disclosures. They ranked 1st globally with an average total score of 74. By factor they ranked: 1st in governance; 2nd for performance; 2nd for cost; and 4th in responsible investing.

Most of what was scored focused on ‘what’ was disclosed. Canadian funds also excelled on communication dimensions that were not scored. Their annual reports were well organised, cohesive and packed with important information for stakeholders. The narratives typically went beyond just ‘what we do’ to add insights about ‘how we do things’ and ‘why we do it this way’. They also realise that less can be more, making good use of infographics, summaries, pictures, charts, etc., and less text, to add impact and keep readers engaged.

Cost

The average score for cost disclosure was 69 and scores for funds ranged from a low of 59 to a high of 83. Disclosures were consistently good for total fund level and for external manager fees. Asset class and transaction cost disclosures were inconsistent across the funds and scored low on average.

Governance

The biggest Canadian public funds collectively have a global reputation for superior performance and governance excellence is often cited as a key driver (the Maple Model). The CEM benchmarking database provides empirical evidence that the Maple Model funds do indeed outperform over the long term. The #1 governance ranking and average score of 86 for the five largest Canadian funds also supports their collective reputation for governance excellence. From many, two examples that illustrate Canadian governance best practices in action have been selected.

Performance

With an average score of 84, Canadian funds ranked 2nd globally and generally scored consistently well across the various components. Risk, asset mix and portfolio composition, as well as total fund return and value add disclosure were especially good. Canadian funds also typically provided clear and detailed disclosures of the basis for their return and valued added reporting. Returns were explicitly stated as time-weighted for the total fund and most asset classes and occasionally as IRR for private market asset classes. Total fund returns were consistently and explicitly stated as net of all investment costs and the cost basis for asset class returns was clear. Surprisingly, this level of detail for returns and value added was not universal. Return basis disclosures were often cryptic or non-existent. This makes understanding and comparing results across funds very difficult.

Responsible Investment

Canadian funds had an average RI factor score of 58. RI component scores varied widely across the funds. The weakest area overall for this factor was governance. For implementation, active ownership disclosures were consistently very good, while exclusion policy disclosures were consistently very low.

Examples

PSP Investments

PSP Investments provides an excellent overview of its governance mission, structure and processes as well as director qualifications, competencies, performance and compensation. Here are selected excerpts from the governance section of its annual report.

Board responsibilities

In accordance with the Act, the Board of Directors manages or supervises the management of the business and affairs of PSP Investments. In discharging their duties, Directors are required to act honestly and in good faith with a view to the best interests of PSP Investments, and to exercise the care, diligence and skill that a reasonable person would exercise in comparable circumstances. The Board performs three vital functions:

• Decision-making—the Act provides for a number of decisions that cannot be delegated to management.

• Where appropriate, the Board makes such decisions with advice from management.

• Oversight—supervising management and overseeing risks.

• Insight—advising management on matters such as markets, strategy, stakeholder relations, human resources and negotiating tactics.

The Board’s specific responsibilities include:

• Determining the organization’s strategic direction in collaboration with senior management;Selecting and appointing the President and CEO and annually reviewing his or her performance;

• Reviewing and approving the Statement of Investment Policies, Standards and Procedures (SIP&P) for each pension plan on an annual basis;

• Ensuring that risks are properly identified, evaluated, managed, monitored and reported; Approving benchmarks for measuring investment performance;

• Establishing and monitoring compliance with PSP Investments’ Code of Conduct;

• Approving human resources and compensation policies related to attracting, developing, rewarding and retaining PSP Investments’ talent;

• Establishing appropriate performance evaluation processes for Board members, the President and CEO, and other senior management members;

• Approving quarterly and annual financial statements for each pension plan and for PSP Investments as a whole; and Establishing Terms of Reference for the Board, Board committees, and Board and committee chairs.

Director appointment process

Director appointment process Directors are appointed by the Governor in Council on the recommendation of the President of the Treasury Board of Canada for terms of up to four years. When their term expires, they may be reappointed for an additional term or continue in office until a successor is appointed. Candidates are selected from a list of qualified Canadian residents proposed by an external nominating committee established by the President of the Treasury Board of Canada. The Nominating Committee operates separately from the Board, the President of the Treasury Board of Canada and the Treasury Board Secretariat. The appointment process is designed to ensure that the Board has a full contingent of high-calibre Directors with proven financial ability and relevant work experience. The Governance Committee regularly reviews and updates desirable and actual competencies, experiences and attributes to ensure that decisions are made with a view to having a diverse Board that can provide the oversight and guidance needed for PSP Investments to fulfill its mandate. Our Board currently has gender balance with women representing five out of the 11 Directors. In addition, two Directors have self-identified as belonging to a visible minority.

Director orientation and education

Director orientation and education Newly appointed Directors participate in a structured orientation program that introduces them to PSP Investments’ culture and operations, so they can contribute effectively as Board members. The Governance Committee has created a Director education program to support ongoing professional development. Through this program, Directors are allocated an education and training budget to be used primarily for taking courses, attending conferences and procuring reading material to strengthen their understanding of investment management and other relevant areas. Directors report annually on their individual development plans. On occasion, internal and outside speakers are invited to make presentations that contribute to the individual and collective expertise of Board members.

Board committees

The Board fulfills its obligations directly and through four standing committees:

Investment and Risk Committee—oversees PSP Investments’ investment and risk management functions.

Audit Committee—reviews financial statements and the adequacy and effectiveness of internal control systems, and oversees the internal audit function.

Governance Committee—monitors governance matters, develops related policies, and oversees the application of the Code of Conduct.

Human Resources and Compensation Committee— ensures policies and procedures are in place to manage the human resources function efficiently and effectively, and to offer all employees fair and competitive compensation aligned with performance and risk targets.

Fiscal year 2020 key activities

Investment and Risk Committee

• Reviewed and approved 16 investments.

• Approved changes to the Risk Appetite Statement.

• Recommended for Board approval a new custodian for PSP Investments’ assets.

• Reviewed the fund strategy of the Private Equity asset class.

• Reviewed market downturn scenarios and related stress-testing in preparation for a market downturn.

Audit Committee

• Reviewed PSP Investments’ cybersecurity and cloud strategies.

• Examined cost containment measures as part of the annual budget process and projected future costs.

• Approved the launch of the next special examination.

• Reviewed PSP Investments’ valuation procedure for private assets (this occurred post fiscal year-end).

Governance Committee

• Reviewed Board and Committee responsibilities and recommended new Terms of Reference for the Board, its committees, and the Board and committee chairs.

• Proposed enhancements to the Board evaluation process.

• Recommended for Board approval committee composition changes, including a new Chair for the Human Resources and Compensation Committee as part of the succession planning process.

• Recommended for Board approval amendments to PSP Investments’ Responsible Investment Policy and approved new Proxy Voting Principles.

• Conducted a review of Director remuneration.

Human Resources and Compensation Committee

• Conducted a full review of succession planning for the CEO and Officers.

• Recommended for Board approval a new benchmark, threshold level of performance and value-added objectives based on a total fund approach.

• Adopted a new Human Resources Policy confirming PSP Investments’ commitment to attracting, developing, rewarding and retaining our talent.

Source: PSP Annual Report 2020 (pages 49 – 54)

British Columbia Investment Management Corporation

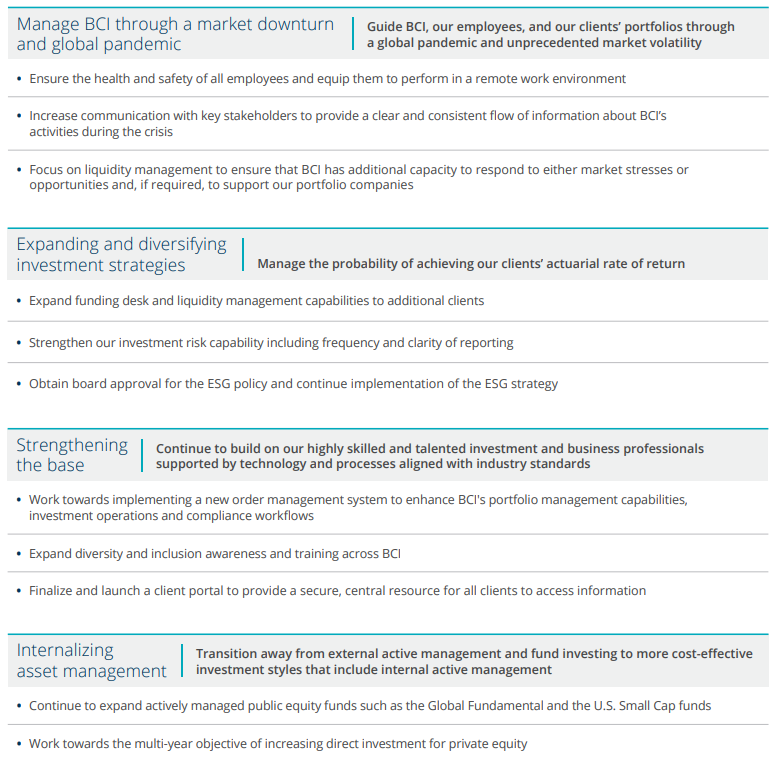

British Columbia Investment Management Corporation’s annual report includes a concise two page summary of its previously published key corporate development goals for the year, along with a progress report card. Objectives for the upcoming year are disclosed in tandem.

Source: BCI Corporate Annual Report 2019 – 2020 (pages 16 and 17)

Overall Results

Canada.

Funds Analysed

British Columbia Investment Management Corporation (BCI)

BCI manages the assets of public sector pension plans as well as insurance and benefit funds for the province of British Columbia.

Caisse de dépôt et placement du Québec (CDPQ)

CDPQ invests funds for several public and parapublic pension plans and insurance programs in the province of Quebec.

CPP Investments (CPPIB)

CPPIB manages the assets of the Canada Pension Plan, the national pension scheme for Canadian workers.

Ontario Teachers’ Pension Plan (OTPP)

OTPP is responsible for managing plan assets and administering defined-benefit pensions for school teachers in the province of Ontario.

Public Sector Pension Investment Board (PSP)

PSP invests funds for the pension plans of the Public Service, the Canadian Armed Forces, the Royal Canadian Mounted Police and the Reserve Force.