Chile.

Chile ranked 14th globally with an average total score of 38.

The public disclosures of the largest Chilean private sector Pension Fund Administrators (AFPs) were reviewed. In 1981, Chile introduced a mandatory defined contribution pension system. Employees are required to contribute 10% of their salary and choose a private Pension Fund Administrator (AFP). AFPs are chartered as pension providers by the Chilean government and compete for individual accounts. This pension system has become known as the ‘Chilean Model’ and versions of it have been implemented in many Latin American countries.

AFP investment programs are dictated by regulation. AFPs are allowed to offer up to five investment funds, called Funds A to E, which have different proportions of their portfolios invested in equities. All AFPs must offer funds B to E, while fund A, the highest equity/highest risk fund is optional. All funds operate within regulated investment limits that cover investments in various asset classes and investment vehicles. AFPs must meet a minimum level of return for each fund that is tied to the average return for all funds of that type. There is a guarantee obligation that requires AFPs to top-up their underperforming funds. Not surprisingly, most AFPs invest in a similar way to ensure they are not required to inject capital into their funds.

AFPs set the administration fees they charge members, but the fee must be the same percentage of salary for all their members. These fees are known as commission and they are applied to contributions into the funds. Commissions are intended to cover all AFP costs and generate a profit margin.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

Chile.

Chilean AFPs scored in the bottom quartile of countries overall and on three of the four factors. They ranked 14th globally with an average total score of 38. By factor they ranked: 9th in governance; 13th for performance; 12th for cost; and 14th in responsible investing. AFP websites were focused on engaging with members and attracting new business and were generally appealing. However, disclosures for many of the transparency elements in the benchmark were often missing or minimal, both on websites and in public documents like annual reports. Most AFPs are part of larger commercial organisations. Only disclosures specific to the AFPs themselves were scored. Disclosures of parent companies were not scored. It is possible that AFP members have access to more detailed information on their secured member portals.

Cost

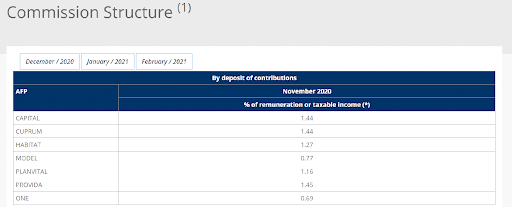

The average score for cost disclosure was 39, corresponding to a global rank of 12th. Individual AFP scores ranged from a low of 25 to high of 51. Scores were uniformly high for total cost, or ‘commission’, disclosures. Much of this information was sourced from the website of the Superintendencia de Pensiones, the Chilean pension regulator. More detailed cost disclosures by the AFPs directly were typically missing and scores were low for other components: member services, asset classes, external manager fees, and transaction costs.

Governance

The AFPs did relatively well on this factor with an average score of 51 and a global ranking of 9th. The range was quite wide: from a low of 38 to a high of 63. They scored highly in governance structure and mission disclosures, although in most cases it was necessary to review several different documents. This information could be summarised in a more cohesive and useful format. There was generally little information on board competencies and qualifications but better disclosures for board compensation. The weakest area was organisational strategy.

Performance

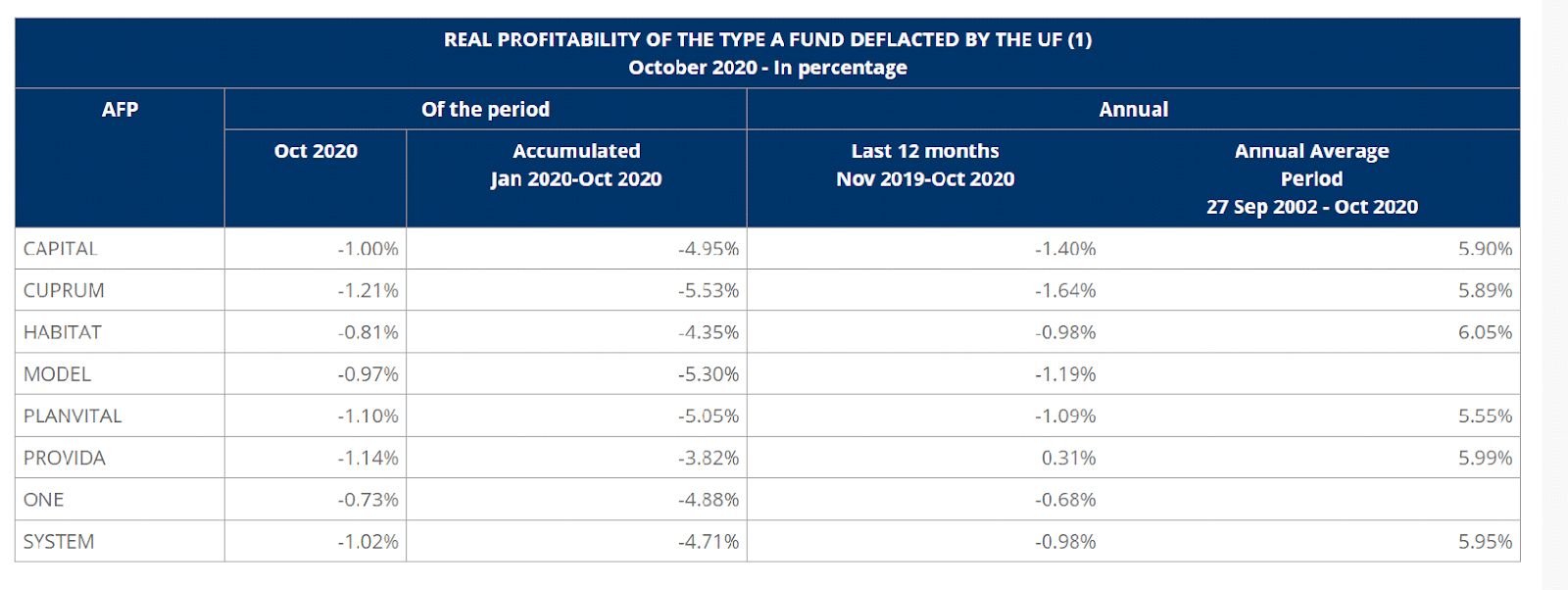

With an average score of 59, Chilean AFPs ranked 13th globally. Scores ranged widely across the various components. There were uniformly good disclosures for reporting on investment option returns and value added, and for the clarity of these disclosures. Much of this reporting was found on the regulator’s website. In contrast, scores were very low for asset class performance and benchmark disclosures.

Responsible Investment

This was a very weak factor for the Chilean AFPs. The average score was 6 and their global rank was 14th. Scores were uniformly low for all RI components. Disclosures were usually non-existent, or minimal at best.

Example

AFP

All of the AFP websites provided links to the Superintendencia de Pensiones, the Chilean pension regulator. The regulator’s website featured standardised comparisons of the AFPs and funds for key metrics: holdings by asset class and investment type, costs, and performance. These disclosures were included in the scoring because the AFPs cited these disclosures and provided links to the regulator’s website. Providing standardised comparisons across the AFPs is a good idea in a mandatory, competitive system where individuals must select their pension provider.

Standardised comparisons for AFP performance and costs

Source: Superintendencia de Pensiones, the Chilean pension regulator’s website

Source: Superintendencia de Pensiones, the Chilean pension regulator’s website

Overall Results

Chile.

Funds Analysed

Capital

Capital is an AFP that is part of Grupo SURA, a Colombian company that offers pension fund management and other financial services in Chile and several other Latin American countries.

Cuprum

Cuprum is an AFP with more than 35 years of history in the Chilean pension system and its inception is tied to the copper mining sector. Cuprum is now part of the Principal Financial Group, a large global financial services company headquartered in the United States.

Habitat

Habitat is the second largest Chilean AFP by assets under management. It also owns pension fund management companies in Peru and Colombia. In 2016, Prudential Financial, a large US global financial services company purchased an interest in Habitat.

Modelo

Modelo is a relatively new domestically owned AFP. It commenced operations in 2010 and has grown quickly.

Provida

Provida was founded in 1981 and is the largest Chilean AFP by assets under management. Provida is now part of MetLife, a large US global financial services company.