Denmark.

Denmark ranked 5th globally with an average total score of 59.

The public disclosures of the largest Danish pension providers were reviewed. The country’s primary public pension system consists of a basic pension and a pension supplement, paid to the most financially disadvantaged. Alongside this, the combination of ATP Lifelong Pension and other mandatory occupational pension schemes cover about 90% of the employed workforce.

Almost all plans in Denmark are of the defined contribution type, in part driven by the prevalence of industry-wide collective labour market agreements. The collective bargaining agreements often mandate both employee and employer participation in supplementary schemes, so while technically voluntary, participation is effectively compulsory. The occupational pension pillar is chiefly funded by employees paying into these schemes. The occupational schemes themselves are offered by a variety of providers who compete for the same customers.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

Denmark.

Danish funds scored well overall, ranking 5th globally with an average overall score of 59. The rankings by factor are dispersed: 3rd in responsible investing, 4th in governance, 8th in cost, and 12th in performance. The websites contain many modern design elements and were generally organised intuitively. As evidenced by their high ranking in responsible investing, corporate responsibility and ESG figures are front-and-centre or only a click away on many of the websites. Performance and cost disclosures were somewhat lacking compared to global peers.

Cost

With an average cost factor score of 51, Denmark’s funds ranked 8th globally. Individual fund results ranged in a narrow band, from a low of 41 to a high of 59. There was great disclosure of high-level KPIs but little in the way of detailed cost disclosures, particularly for asset class and transaction costs.

Governance

The Danish funds did quite well on this factor with an average score of 63, which was a global rank of fourth. The range of scores was very wide: from a low of 47 to a high of 91. Funds scored well in all areas except organisational strategy. More a story of consistently decent scores than excellence in any specific area. The Danes received the 4th highest grade for disclosures on compensation, human resources, and organisational disclosures. Of particular note were disclosures on organisational headcount, compensation, and diversity programs.

Performance

This was the weakest factor for the Danish funds, with an average country score of 61 and a global ranking of 12th. Individual fund scores ranged scored from a low of 51 to a high of 70. Disclosures for total fund and asset class returns as well as benchmarks were often lacking or minimal. Disclosures and scores were relatively higher for risk management policies and practices as well as explanation of results.

Responsible Investment

This was a very strong factor for the Danish funds. The average score was 61 and their global rank was 3rd. Scores ranged widely, from a low of 46 to a high of 74. RI framework and reporting was an area of strength with an average score of 68 and a global rank of 3rd. RI implementation scores were also strong especially disclosures related to exclusion policies, active ownership and impact investing. In contrast, RI governance scores were lower for most funds.

Examples

ATP Group

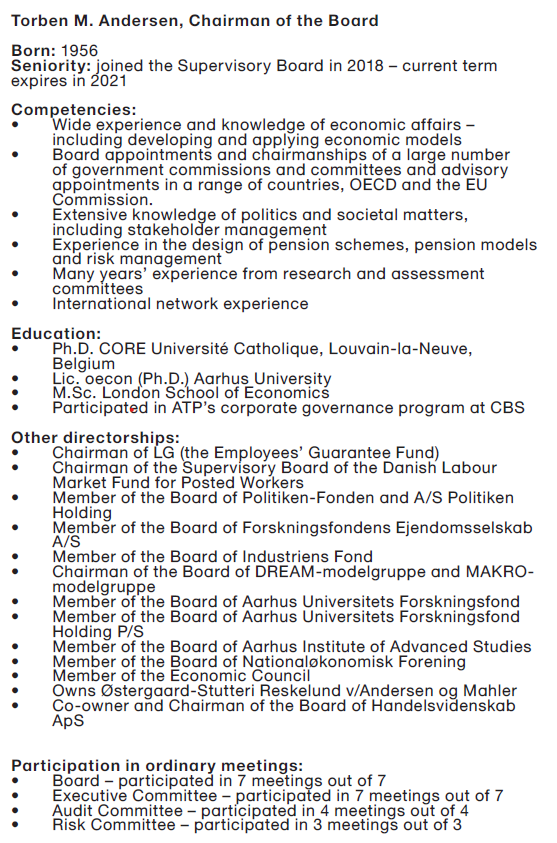

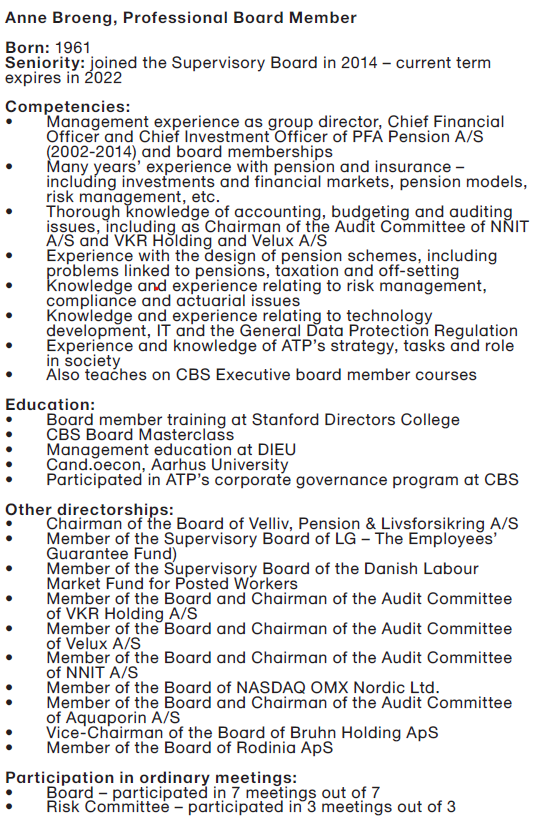

ATP was extremely thorough in its disclosure of the relevant competencies of board members. Not only was relevant experience listed, but relevant proficiencies were provided in plain English.

ATP provide an extensive list of relative competencies for board members.

Source: The ATP Group Annual Report 2019 (page 137-140)

Pension Danmark

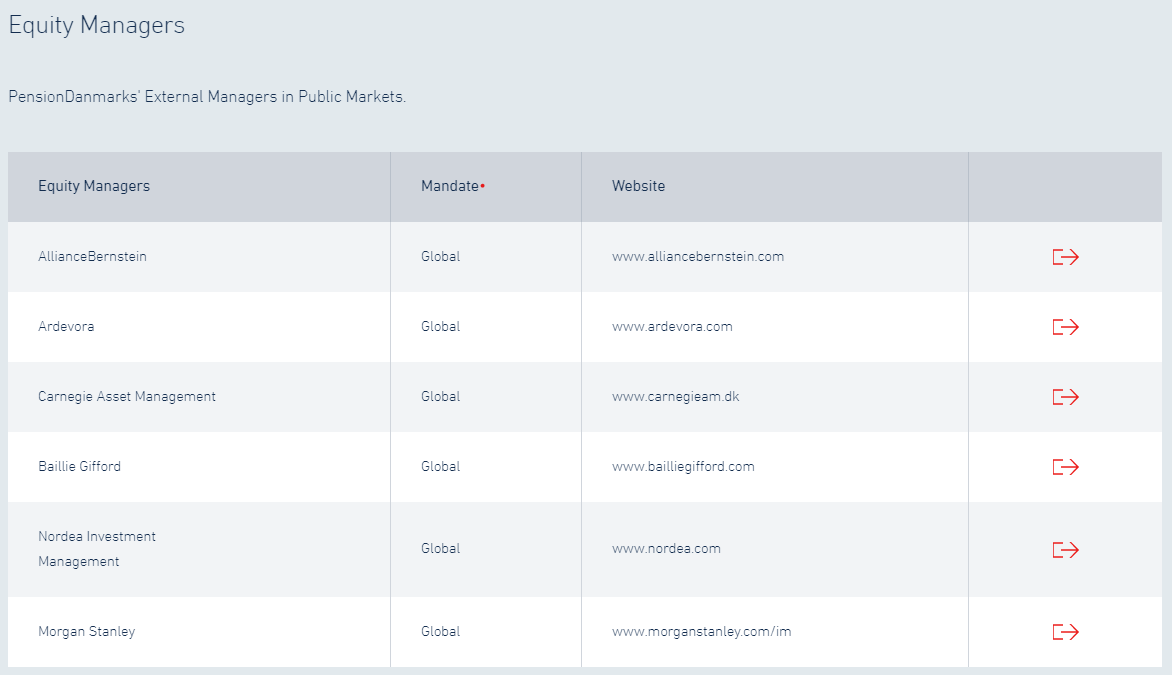

Pension Danmark also provided good transparency on their equity managers, along with a complete list of all their holdings.

Source: PensionDanmark website

Overall Results

Denmark.

Funds Analysed

ATP Group

ATP Group is Denmark’s largest pension and processing company with 5.2 million members and pension assets exceeding DKK900 billion. It provides lifelong pensions to Danish citizens.

Industriens

Industriens manages a compulsory labour market pension scheme with approximately 400,000 members from approximately 8,000 companies. It is a defined contribution scheme with assets of approximately DKK200 billion. Profits are returned to the members.

Pension Danmark

Pension Danmark is a member-owned labor market pension fund with DKK260 billion under management. It serves approximately 750,000 members from 23,400 companies.

PFA Pension

PFA Pension is Denmark’s largest commercial pension, insurance, and healthcare products company. It manages pension assets of more than DKK680 billion for more than 1.3 million members.

Sampension

Sampension is a customer-owned pension company with assets of close to DKK300 billion and around 300,000 customers. It manages industry-wide pension schemes for white collar employees in Danish municipalities and central government.