Finland.

Finland ranked 8th globally with an average total score of 55.

The base of Finland’s pension system consists of a flat rate government pension called the national pension which provides up to 20 per cent of the average wage. Supplementing the national pension are mandatory earnings-related plans provided by employers through several pension insurance companies. The mandatory earnings related plans are funded by contributions from both employees and employers. Voluntary pension plans are not common and are generally only put in place for executives.

One of the funds reviewed is the fund that manages the assets backing the national pension (VER). The other four organisations are pension insurance organisations which manage assets and administer benefits backing the mandatory earnings-related plans.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

Finland.

Cost

Finland ranked 14th globally in cost disclosures, with an average factor score of 27, maintaining last year’s ranking however improving slightly in score. None of the Finnish funds performed well and individual scores were close to each other, with a low of 21 and a high of 43. There were slight improvements in what is disclosed regarding reported external management fees and accounting methodologies. Disclosures of member service costs declined but continued to be the only area where the Finns scored better than the global average. Transaction cost disclosures continued to be nonexistent.

Governance

Scores within each area reviewed increased year-on-year resulting in the Finns ranking 6th in governance disclosures, up from 7th in last year’s review. Organisations scored very highly in governance structure and mission disclosures with an average score of 96, ranking 2nd overall in this area; three funds scored a perfect 100. There was generally little information on board competencies and qualifications, perhaps due to the multiple layers of governing bodies and the relatively large number of individuals in each layer. The organisational strategy disclosures improved considerably relative to last year, with the Finns now ranking 3rd in this area.

Performance

The performance disclosures of the Finnish funds continued to be solid if unspectacular. Despite a slight drop in the average fund score to 62, their relative position moved up one place to 6th among the countries reviewed. Disclosures of fund solvency, member service and overall explanations of results continued to be areas of strength. Despite improvements, asset class level disclosures were still lacking, as were disclosures of benchmarks.

Responsible Investment

The Finnish funds continued to score well on this factor, improving their score from 59 to 67. Due to the fact RI disclosures improved in many countries, this increase in score was not enough to improve their 5th place ranking. The range of scores was again exceptionally wide from a low of 14 to a high of 88. Three funds scored very well and were among the top five scoring funds in the world. Improvements in scores were found across all areas but improvements in active ownership and ESG integration disclosures stood out.

Examples

The annual reports and other documents produced by the Finnish organisations were generally very readable, succinct and well organised with effective use of graphics. Four of the five funds comply with the Global Reporting Initiative which makes finding information, particularly around responsible investing, quite easy.

Varma

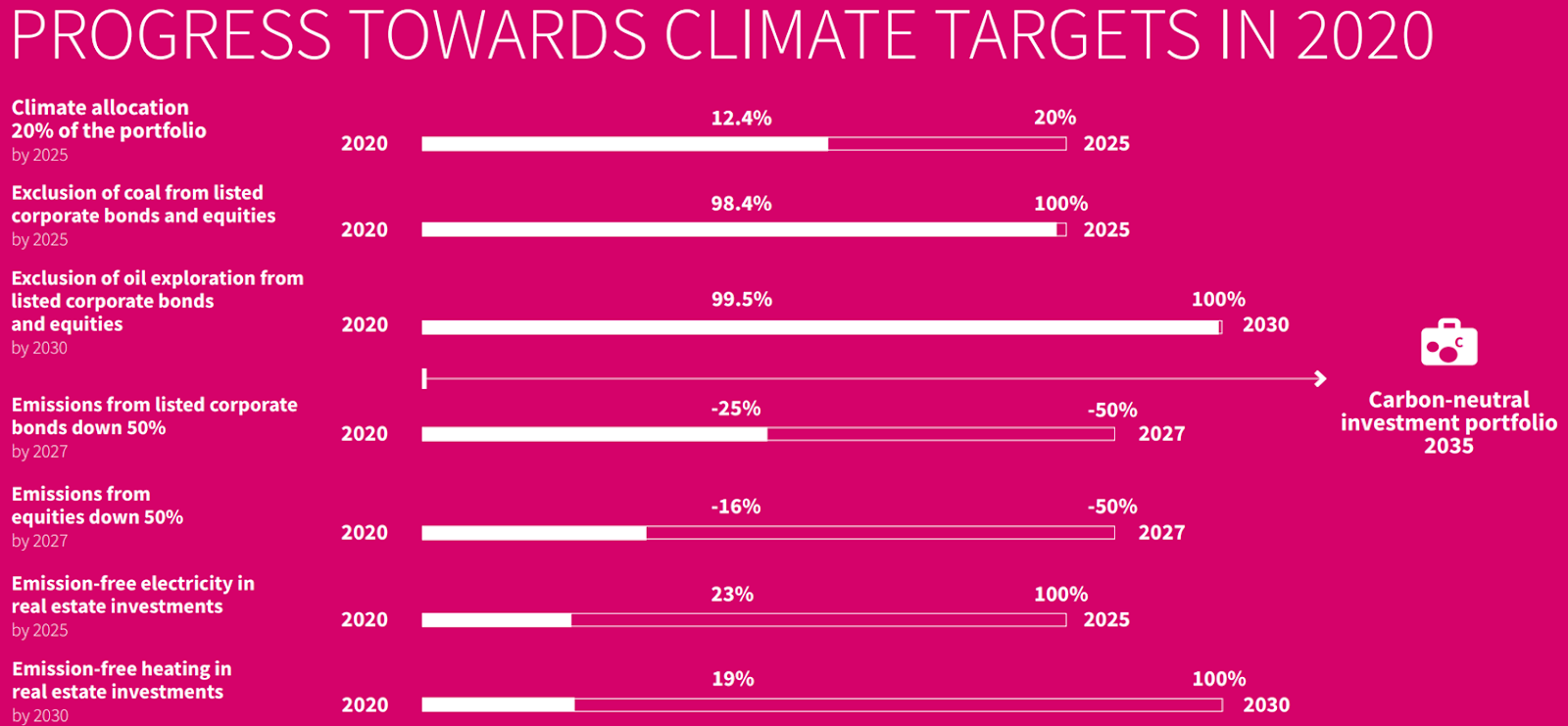

There were more quantitative disclosures around ESG initiatives and Varma’s was one of the better ones. They effectively communicated their progress towards future goals in several areas in a very readable and understandable exhibit.

Source: Varma 2020 Annual and Sustainability Report, pg. 65.

Elo

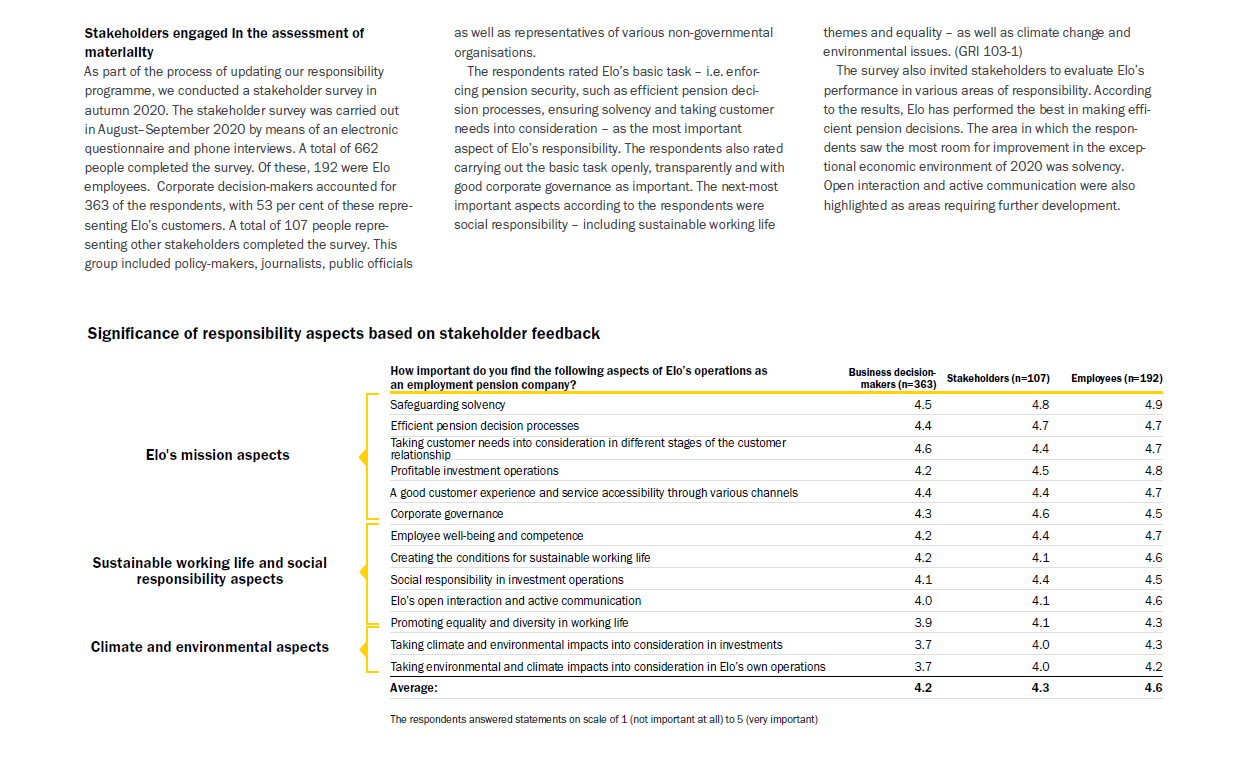

Finland’s ELO surveyed stakeholders at various levels on their views of the importance of various corporate initiatives. Playing back these results in the annual report as part of an overall discussion of their responsibility program demonstrates a commitment to engagement and transparency.

Source: ELO 2020 Annual and Responsibility Report, pg. 9

Overall Results

Finland.

Funds Analysed

Elo

Elo is a large pension insurance company which provides services to both employers and individuals.

Ilmarinen

Ilmarinen is a mutual pension insurance company owned by its members and offers pension services to both employers and the self-employed.

Keva

Keva is Finland’s largest pension provider and administers the pensions of Local Government, State, Evangelical Lutheran Church and Keva employees.

Varma

Varma is a mutual pension insurance company owned by its members and offers pension services to both employers and the self-employed.

VER

VER is the state pension fund of Finland and manages the assets backing the base government pension.