Finland.

Finland ranked 7th globally with an average total score of 53.

The base of Finland’s pension system is a flat rate government pension called the National Pension which provides up to 20% of the average wage. Supplementing the National Pension are mandatory earnings-related plans provided by employers through several pension insurance companies. The mandatory earnings related plans are funded by contributions from both employees and employers. Voluntary pension plans are not common and are generally only put in place for executives.

One of the funds reviewed is the fund that manages the assets backing the national pension. The other four organisations are pension insurance organisations which manage assets and administer benefits backing the mandatory earnings-related plans.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

Finland.

The Finnish funds scored 7th globally with an average score of 53 and were in the top half of scores in three of the four factors. The range of scores across the organisations was the second largest globally, from a low of 33 to a high of 63, however it should be noted that four of the organisations scored very similarly with a single outlier. The Finns are obviously committed to producing clear, approachable communications that will be understood by their members. Responsible investing disclosures were generally very complete, cost information much less so.

Cost

With an average cost factor score of 28, Finland’s cost factor score ranked 14th globally. Individual scores ranged from 18 to 31. The annual reports provided little in the way of cost disclosure, generally just one line of ‘investment charges’ in the income statement. No additional detail about whether external management costs were included and no transaction cost or asset class details were provided.

Governance

The Finnish funds are mid pack on this factor with an average score of 57, ranking 7th globally. The range of scores were again quite wide, from a low of 38 to a high of 71. Organisations scored very highly in governance structure and mission disclosures with an average score of 90, second overall on this component. There was generally little information on board competencies and qualifications, perhaps due to the multiple layers of governing bodies and their relatively large membership. The weakest area was organisational strategy, disappointing since only one organisation was a dedicated funds management organisation.

Performance

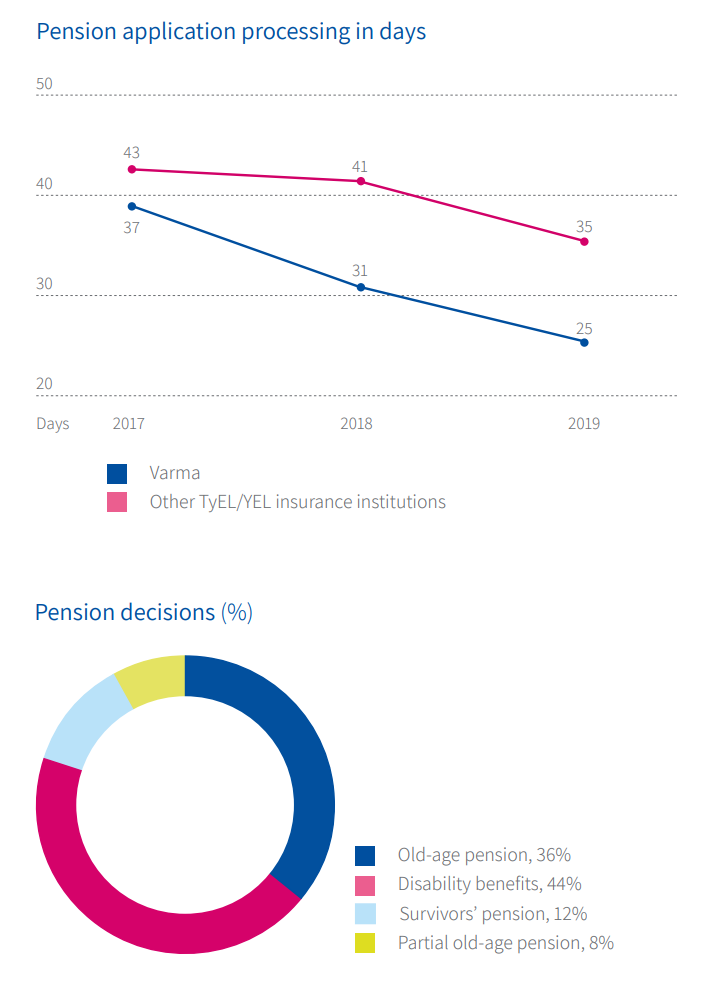

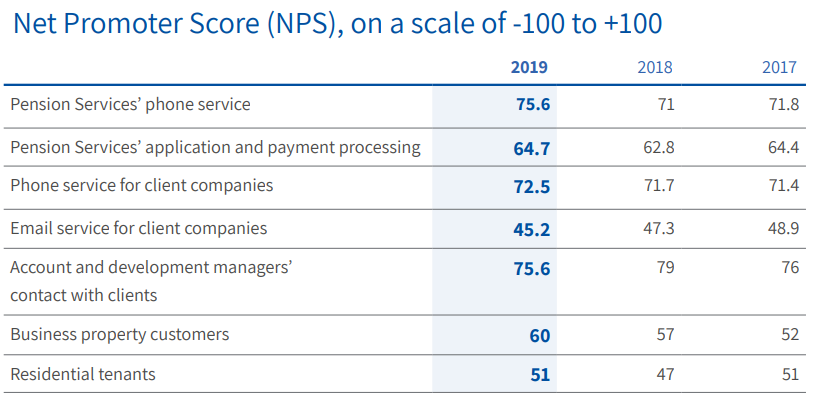

The average performance factor score was 69, ranking it 7th globally. The range in scores was fairly narrow, a low of 64 to a high of 77. Total fund return disclosures were very good, but value add disclosures as well as asset class level performance disclosures were almost completely lacking. Risk and member service disclosures were notable high points.

Responsible Investment

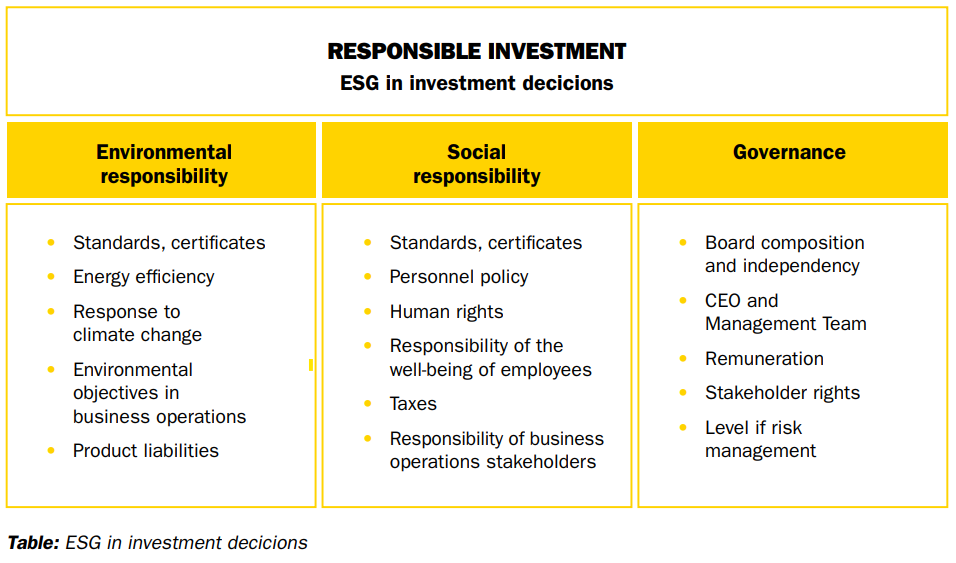

The Finnish funds scored very well on this factor finishing 5th globally with a score of 58. The range of scores was exceptionally wide from a low of 13 to a high of 81, with three funds scoring quite highly. The Finns were particularly good at providing information on RI frameworks and reporting as well as RI governance. Disclosures on exclusions and negative screening were also common.

Examples

The annual reports and other documents produced by the Finnish organisations were generally very readable, succinct and well organised with effective use of graphics. Four of the five funds comply with the Global Reporting Initiative which makes finding information, particularly around responsible investing, quite easy.

Varma

Most of the Finnish organisations are responsible for both asset management and member service. Varma did a great job of illustrating its commitment to member service. Net promotor scores are commonly used in consumer facing industries, but are only recently emerging as a tool for pension service organisations to measure customer satisfaction.

Source: Varma 2019 Annual and Sustainability Report (page 29 and page 28)

Elo

Elo’s 2019 Principles of Responsible Investing Report had some very good exhibits showing a commitment to ESG and RI, as well as the framework.

Overall Results

Finland.

Funds Analysed

Elo

Elo is a large pension insurance company which provides services to both employers and individuals.

Ilmarinen

Ilmarinen is a mutual pension insurance company owned by its members and offers pension services to both employers and the self-employed.

Keva

Keva is Finland’s largest pension provider and administers the pensions of Local Government, State, Evangelical Lutheran Church and Keva employees.

Varma

Varma is a mutual pension insurance company owned by its members and offers pension services to both employers and the self-employed.

VER

VER is the state pension fund of Finland and manages the assets backing the base government pension.