Japan.

Japan ranked 14th globally with an average total score of 39.

The public disclosures of the five largest pension fund organisations in Japan were reviewed. The Japanese organisations include the fund backing the social security system, three organisations that manage funds for public sector workers and one fund that manages pension assets for private sector workers.

Japan’s pension system backbone is the national social security system – National Pension Service. Workplace pensions that supplement the National Pension Service are common for both private and public sector workers and have traditionally been defined benefit in nature. Earlier in this century, defined contribution style arrangements were introduced and those who do not a have a workplace pension may set up an individual defined contribution account with the Pension Fund Association.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

Japan.

The overall ranking of the Japanese funds dropped from 13th in last year’s review to 14th. This betrays the fact that we saw improved disclosures in three of the four components and three of the five funds. Disclosures on fund performance, while still the strongest area for the Japanese funds saw a decline in completeness relative to last year.

Cost

The Japanese funds continued to rank 13th globally with an average score of 36. Individual scores ranged from a low of 26 to a high of 54. Disclosures of external management fees was the area in which the Japanese funds received their highest score, albeit still below the global average. Last year we observed no disclosures for either member service costs or transaction costs. One fund disclosed transactions costs in our most recent review.

Governance

We observed improvements in all areas of governance disclosures from last year’s review. Unfortunately, given the low starting point, the average score of 46 continued to be the second lowest of the countries reviewed. Despite improvements, disclosures related to compensation, HR and organisation were particularly poor, with two funds scoring zero in this section. We were heartened to see the improved results, although further improvements will be required for the Japanese funds to improve their overall ranking.

Performance

Performance continued to be the area in which the disclosures of Japanese funds were most complete. Unfortunately, disclosures this year were less comprehensive overall and Japan’s rank dropped four spots to 11th with a score of 56. One positive was that return and benchmark disclosures were clear. Disclosure of benchmarks in particular were good, in some cases disclosed at the mandate level.

Responsible Investment

Japanese funds scored an average of 23 on responsible investing with a global rank of 12, a slight improvement in score but the same ranking. There was wide disparity in the fund scores, from a low of nil to a high of 67. Two funds made disclosures related to RI governance where none did last year. Disclosure of active ownership policies were the strongest component, however given the overall low score, all components scored below the global average. Disclosures relating to impact investing were particularly low with 4 out of the 5 funds scoring nil.

Example

Several of the Japanese funds showed very detailed performance and value added information at the manager/mandate level, one fund even showed this information for 1, 3 and 5 year periods. These disclosures allow stakeholders to see exactly which managers have successfully beaten their benchmarks and added value, as well as those managers which have not been as successful.

Government Pension Investment Fund

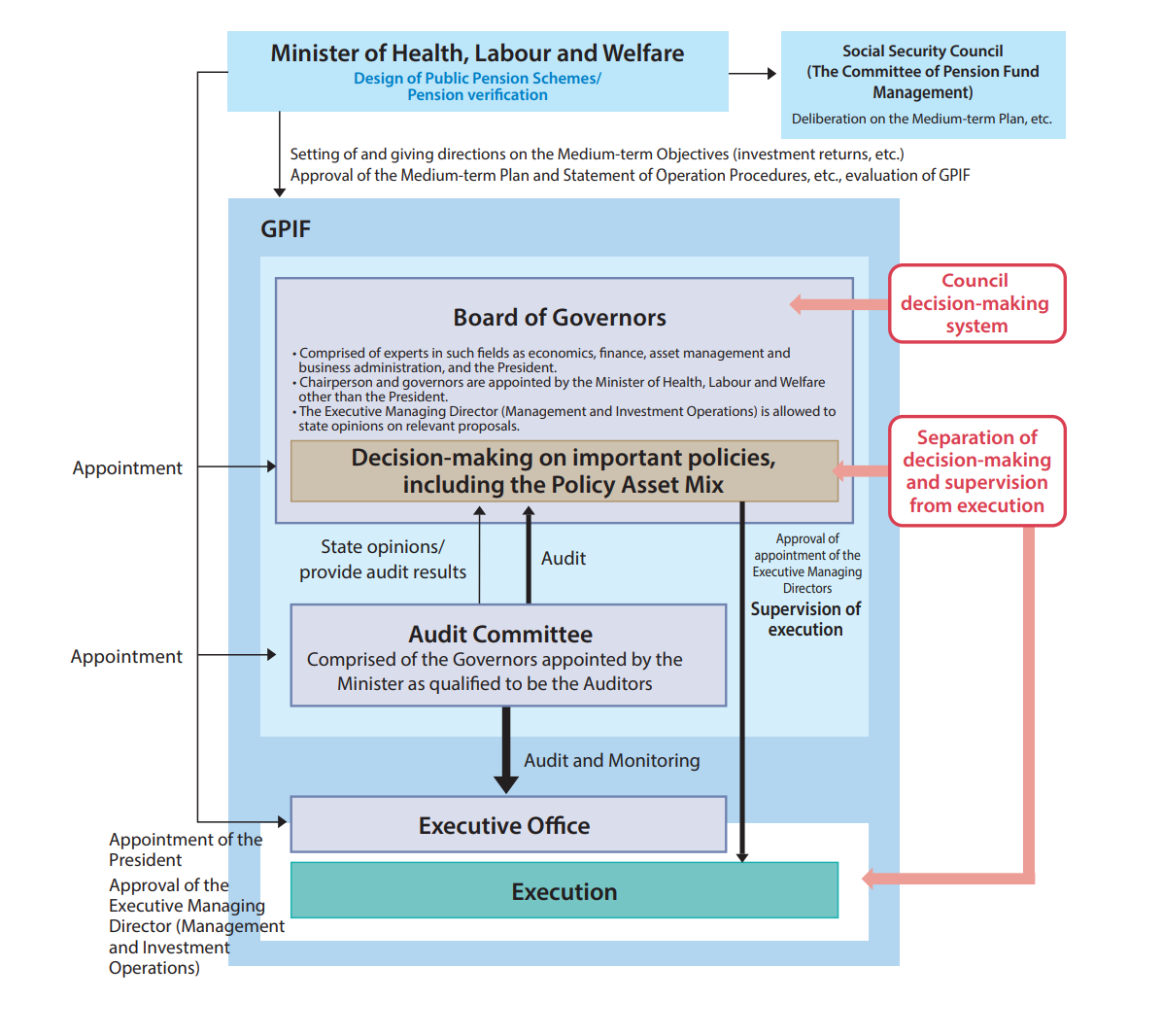

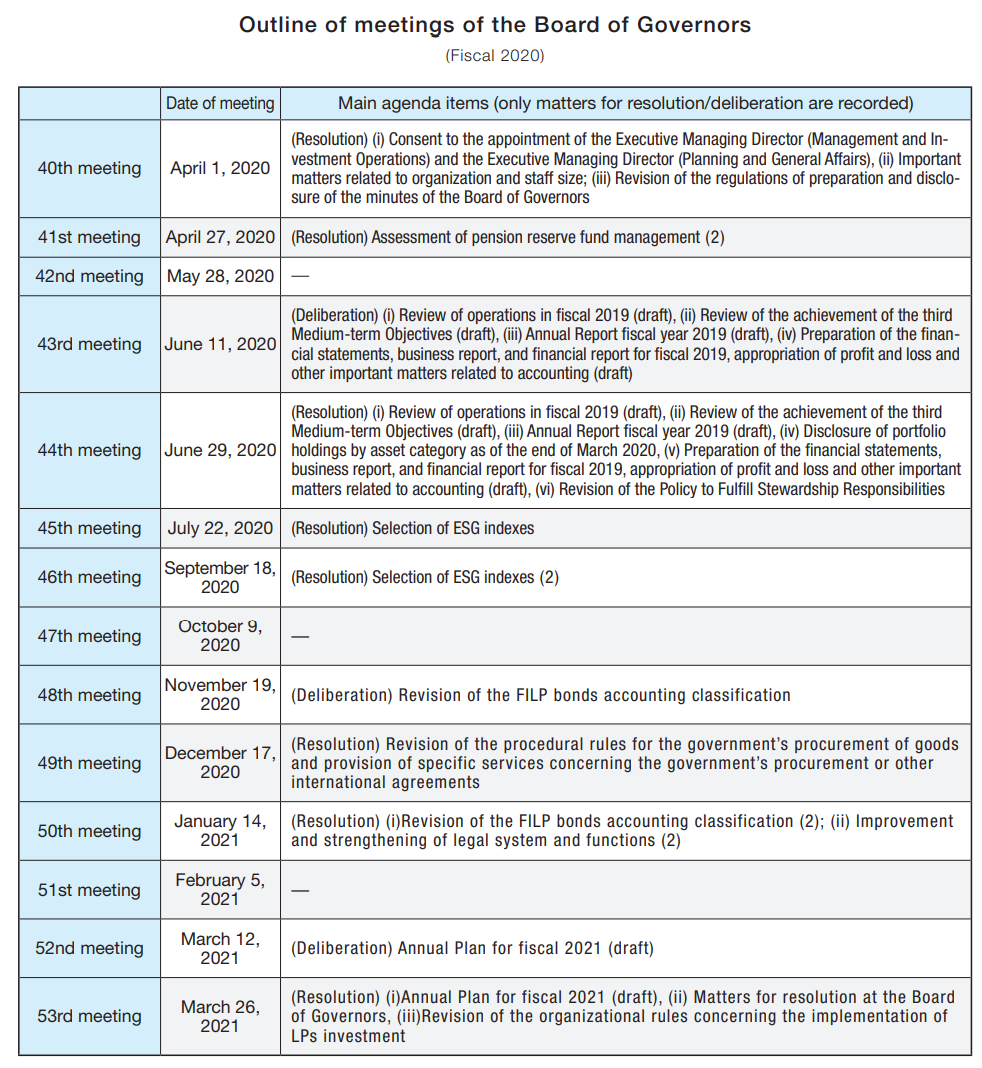

GPIF did a great job of graphically illustrating its overall governance structure and related flow of decision making and execution. Additionally, the provided a brief overview of important items that were discussed during meetings of the Board of Governors.

Source: GPIF Annual Report, FY 2020, Pg 87

Source: GPIF Annual Report, FY 2020, Pg 88

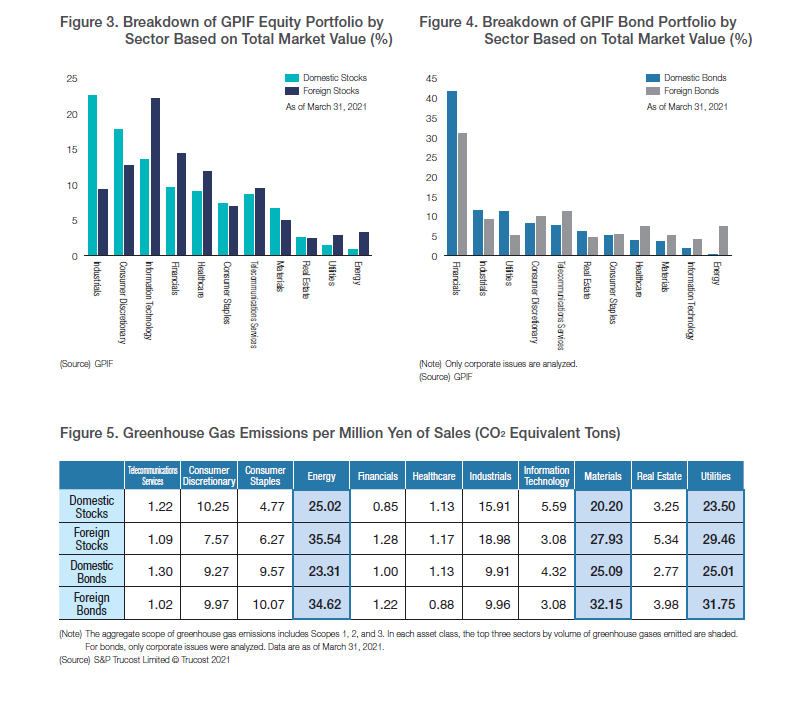

GPIF produces a comprehensive ESG report with great quantitative analysis of its portfolio and related ESG impacts. The example below allows readers to see the sector breakdown of its equity and fixed income holdings along with data on the carbon footprint by sector and asset class.

Source: GPIF ESG Report 2020, Pg 52

Overall Results

Japan.

Funds Analysed

Government Pension Investment Fund (GPIF)

GPIF is the largest pension fund in the world and manages assets for Japan’s National Pension Service, the government social security system.

Federation of National Public Service Personnel Mutual Aid Associations (KKR)

KKR manages pension funds for national public service personnel as well as offering pension and other medical and welfare services.

National Federation of Mutual Aid (Shichousonren)

National Federation of Mutual Aid (Shichousonren) manages pension assets for the Mutual Aid Associations for Personnel of Designated Cities, 47 Mutual Aid Associations for Municipal Personnel, and three Mutual Aid Associations for Personnel of Cities.

Pension Fund Association

Pension Fund Association manages assets and administers benefits for corporate pension plans and workers who have left plans, allowing them to aggregate pensions from different employers. The Pension Fund Association also allows private sector employees who do not have a company pension to set up individual defined contribution accounts.

Pension Fund Association for Local Government Officials (Chikyoren)

Chikyoren manages pension assets for the Local Public Service Personnel Mutual Aid Association.