Japan.

Japan ranked 13th globally with an average total score of 39.

The public disclosures of the five largest pension fund organisations in Japan were reviewed. The Japanese organisations include the fund backing the social security system, three organisations that manage funds for public sector workers and one fund that manages pension assets for private sector workers.

Japan’s pension system backbone is the national social security system – National Pension Service. Workplace pensions that supplement the National Pension Service are common for both private and public sector workers and have traditionally been defined benefit in nature. Earlier in this century, defined contribution style arrangements were introduced and those who do not a have a workplace pension may set up an individual defined contribution account with the Pension Fund Association.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

Japan.

Japan is not a country that is known for openness, perhaps it is no surprise then that its total score of 38 was 13th of the 15 countries reviewed. It was only in performance disclosures that the Japanese organisations scored in the top 10 of countries globally. Individual fund scores ranged from a low of 24 to a high of 48.

Cost

With an average cost factor score of 38, the Japanese funds ranked 13th globally. Individual fund scores were fairly uniform, from a low of 30 to a high of only 46. Disclosures were typically good for the reporting of external manager fees, both at the total fund and asset class level. Lower scores were seen in many other areas. For example, transaction costs were not disclosed by any organisation, nor were member service costs.

Governance

Governance was, on a relative basis, the worst scoring factor for the Japanese organisations. This factor received a score of 28, the second lowest of the countries reviewed. Within governance, scores in organisational strategy disclosures were the highest relative to other countries. The Japanese organisations finished 13th in this area albeit with a score of 10. Disclosures related to board competencies and qualifications as well as compensation, HR and organisation were particularly poor, with three funds scoring zero across both components.

Performance

The average performance factor score was 69, which was 8th globally and by far the best factor for the Japanese organisations. Scores were quite varied however, from a low of 47 to a high of 86. Short-term disclosures at both fund and asset class level were quite good, however disclosure for mid and long-term performance was spottier. Disclosure of benchmarks was quite good, in some cases disclosed at the mandate level.

Responsible Investment

Japanese funds scored an average of 20 on responsible investing, 12th of the countries reviewed. Despite the low score, all but one organisation disclosed that they did have an established policy/framework for RI. Most of these funds further disclosed quantitative KPIs that are used to assess progress towards RI goals. Another bright spot was the disclosure of interactions with portfolio companies on RI, at least at a high level; details were lacking in many disclosures. Unfortunately, disclosure on RI governance was completely lacking.

Examples

Several of the Japanese funds showed very detailed performance and value added information at the manager/mandate level, one fund even showed this information for 1, 3 and 5 year periods. These disclosures allow stakeholders to see exactly which managers have successfully beaten their benchmarks and added value, as well as those managers which have not been as successful.

Government Pension Investment Fund

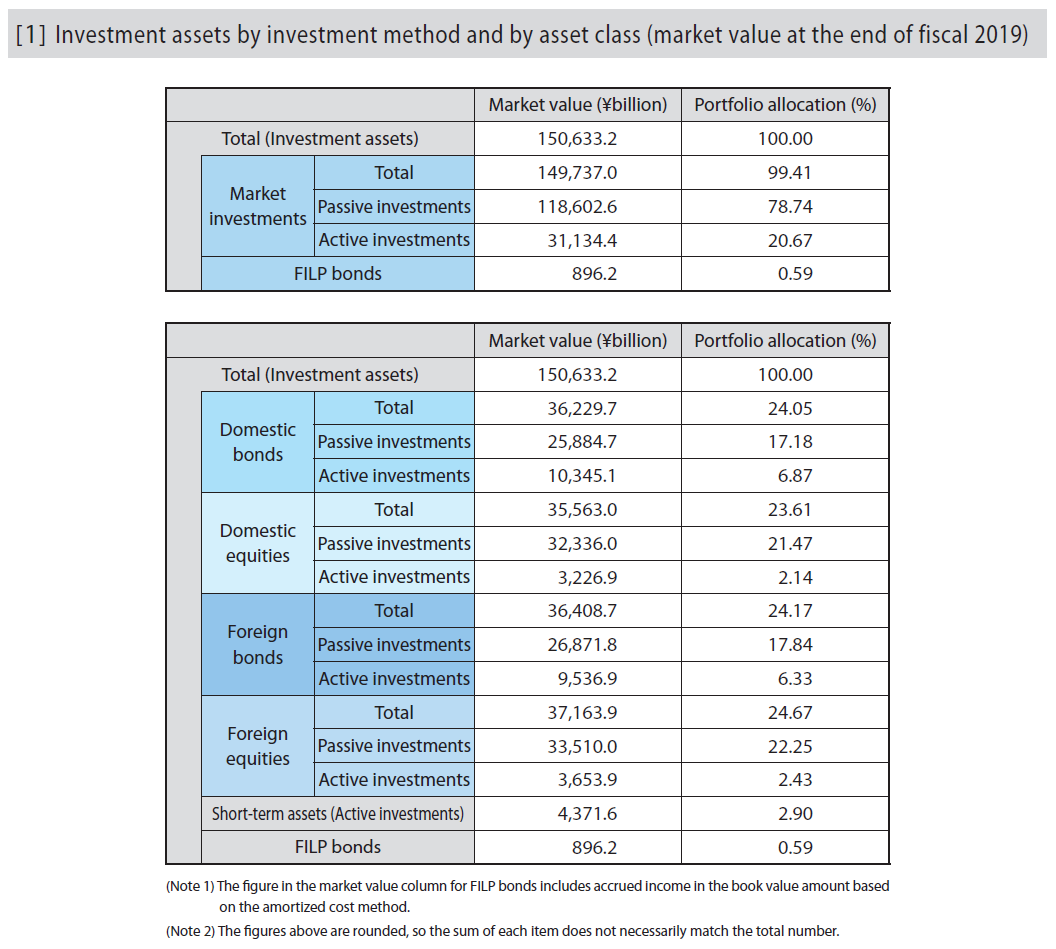

Government Pension Investment Fund (GPIF) provided an excellent breakdown of investments by asset class and implementation style. Disclosures such as this were very rare in any country.

Source: GPIF Annual Report FY 2019 (page 81)

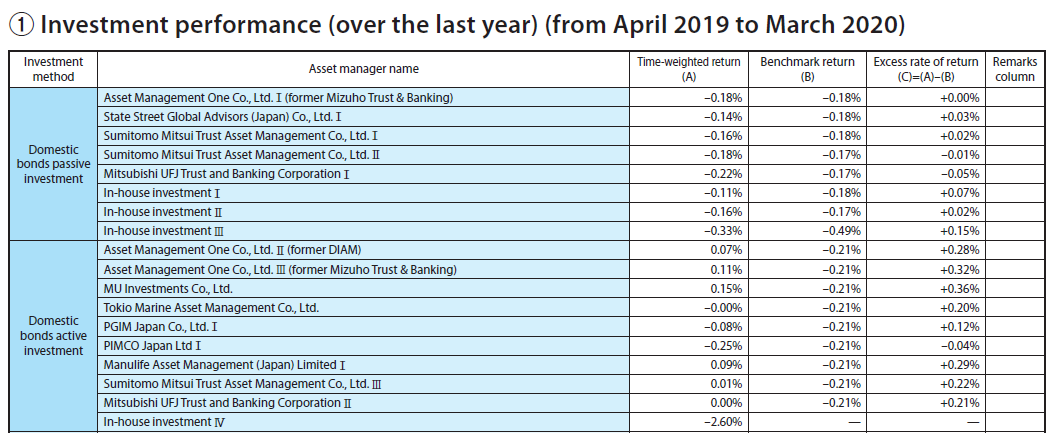

GPIF showed detailed performance against benchmarks for each asset class at a mandate level, split by active/passive implementation. It even disclosed the performance of various internal investment strategies separately. The exhibit below provides information for the fixed income assets as an example.

Source: GPIF Annual Report FY 2019 (page 84)

Overall Results

Japan.

Funds Analysed

Government Pension Investment Fund (GPIF)

GPIF is the largest pension fund in the world and manages assets for Japan’s National Pension Service, the government social security system.

Federation of National Public Service Personnel Mutual Aid Associations (KKR)

KKR manages pension funds for national public service personnel as well as offering pension and other medical and welfare services.

National Federation of Mutual Aid (Shichousonren)

National Federation of Mutual Aid (Shichousonren) manages pension assets for the Mutual Aid Associations for Personnel of Designated Cities, 47 Mutual Aid Associations for Municipal Personnel, and three Mutual Aid Associations for Personnel of Cities.

Pension Fund Association

Pension Fund Association manages assets and administers benefits for corporate pension plans and workers who have left plans, allowing them to aggregate pensions from different employers. The Pension Fund Association also allows private sector employees who do not have a company pension to set up individual defined contribution accounts.

Pension Fund Association for Local Government Officials (Chikyoren)

Chikyoren manages pension assets for the Local Public Service Personnel Mutual Aid Association.