Mexico.

Mexico ranked 15th globally with an average total score of 25.

The public disclosures of the five largest private pension fund managers, known as Afores, were reviewed. Mexico reformed its pension system in 1997 and instituted a fully funded, private and mandatory defined contribution system. The reform was modeled after the pension reforms in Chile in the early 1980s. Afores are responsible for managing individual accounts and investing contributions. They are chartered by the Mexican government and compete for individual accounts.

Afore investment programs are dictated by regulation. As of 2019, the Afores must offer 10 ‘Siefore’ generational funds. The Siefores are structured like target date funds: the contributions of each member are assigned to the Siefore associated with their date of birth and remain there throughout their working life. Regulations stipulate investment limits that cover investments in various asset classes and investment vehicles. Contributions are currently set at 6.5% of wages.

Afores set the administration fees they charge members, but the fee must be the same percentage of salary for all their members. These fees are known as commission and they are applied to contributions into the funds. Commissions are intended to cover all Afore costs and generate a profit margin.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

Mexico.

Mexican Afores scored in the bottom quartile of countries overall and on all four factors. It ranked 15th globally with an average total score of 25. By factor they ranked: 15th in governance; 14th for performance; 15th for cost; and 15th in responsible investing. Afore websites were focused on interacting with their members and generating new business and were typically attractive. However, disclosures for many of the transparency elements in the benchmark were very often completely missing or minimal, both on websites and in public documents like annual reports. All of the Afores are part of larger commercial organisations. Only the disclosures that were specific to the Afores themselves were scored, the disclosures of the parent companies were not scored. It is possible that Afore members have access to more detailed information on their secured member portals.

Cost

With an average cost factor score of 23, the Mexican Afores ranked 15th globally. Individual scores ranged in narrow band, from a low of 19 to high of 26. Much of the cost information found related to total costs and was sourced from CONSAR, the Mexican regulator’s website. More detailed cost disclosures by the Afores directly, were generally minimal or non-existent.

Governance

The Afores had an average score of 17 and a global ranking of 15th. Results ranged from a low of 0 to a high of 42. Some of the Afores had good disclosures for governance structure and mission but others had poor results. Disclosures related to on board competencies and qualifications, compensation and organisational strategy were often non-existent or minimal at best.

Performance

With an average score of 55, Mexican Afores ranked 14th globally. Scores ranged widely across the various components. There was uniformly good reporting on investment option returns and value added. Much of this reporting was found on the CONSAR website. In contrast, scores were very low for asset class performance, explanation of results, and benchmark disclosures.

Responsible Investment

This was also a very weak factor for the Mexican Afores. The average score was 2 and their global rank was 15th. Scores were uniformly low for all RI components. Disclosures were usually non-existent, or minimal at best.

Examples

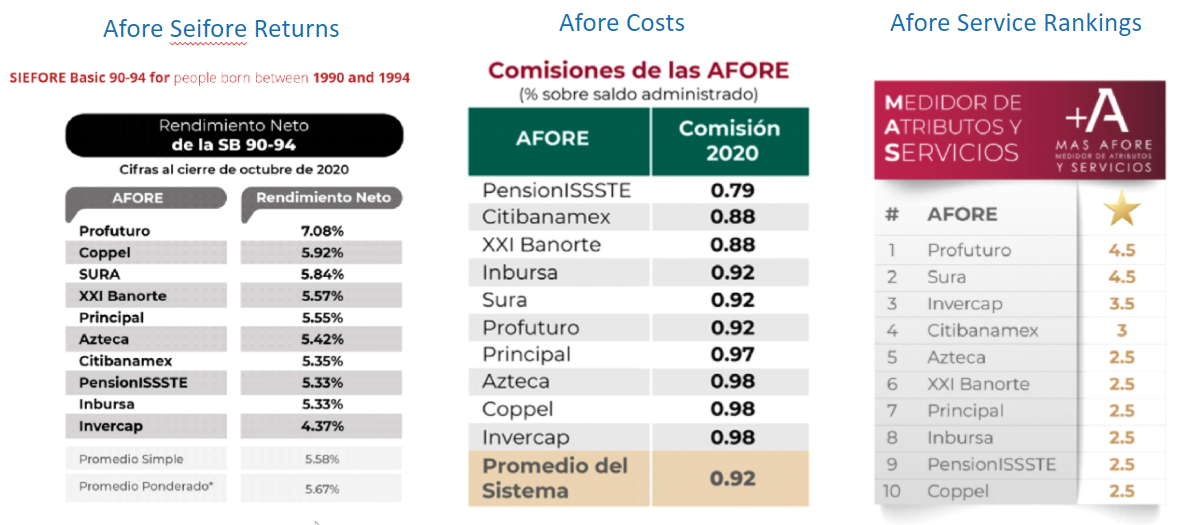

All of the Afore websites provided links to CONSAR (the National Commission of the Retirement Savings System), the Mexican pension regulator. CONSAR’s website featured standardised comparisons of the Afores on key metrics including: Siefore returns, Afore total costs, and Afore service level rankings. These disclosures were included in the scoring because the Afores cited these disclosures and provided links to CONSAR’s website. Providing standardised comparisons across the Afores is a positive in a mandatory, competitive system where individuals must select their pension provider.

CONSAR

CONSARs website includes standardised comparative information on key Afore performance metrics to help workers make better decisions for placing their savings.

Key Mexican Afore comparative metrics on the CONSAR website

Source: Consar website

Overall Results

Mexico.

Funds Analysed

Banorte

Banorte is the largest Mexican Afore by assets under management. It is domestically owned and is part of Grupo Financiero Banorte, a large Mexican banking and financial services company.

Citibanamex

Citibanamex is the second largest Mexican Afore by assets under management and it is part of the Banamex Financial Group, a large Mexican financial services company, which is a Citigroup subsidiary. Citigroup is a large American multinational investment bank and financial services company.

Principal Afore

Principal Afore is part of the Principal Financial Group, a large global financial services company headquartered in the United States.

Profuturo

Profuturo is the fourth largest Mexican Afore by assets under management. It is part of Grupo Bal, a large Mexican conglomerate that participates in financial services and several other industry sectors.

Sura

Sura is the fourth largest Mexican Afore by assets under management. It is part of Grupo SURA, a Colombian company that offers pension fund management and other financial services in Mexico and several other Latin American countries.