The Netherlands.

The Netherlands ranked 2nd globally with an average total score of 69.

The five Dutch funds reviewed were a homogenous group representing various occupational defined benefit pension funds. All are organised as a non-profit with a board representing employees, employers and trade unions where applicable. All outsource asset management and benefit administration services to third party providers (eg APG and PGGM). Historically, the funds and administration service providers were typically one entity but were separated in the early 2000s. This separation gave the pension funds autonomy and the ability to go elsewhere for services.

The Dutch pension system is considered one of the best in the world. Two regulators, the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM) oversee the system. On top of this, there is a very active association, Pensionefederatie, an association of 198 pension funds that promotes the interests of members of pension funds. The annual reports reviewed all followed the disclosure practices recommended by this association.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

The Netherlands.

Cost

Dutch funds continue to be global leaders in cost disclosures, ranked 1st globally with a score of 77. Individual scores were narrowly banded, with a low of 71 and a high of 89. Much of this positive showing is the result of strict cost disclosure recommendations promulgated by the Pensioenefederatie. However, while these guidelines from their regulatory authority drive much of what is disclosed, how it was disclosed was also commendable; independent from the content, the reporting and disclosures were clear and of high communication quality. Transaction cost reporting remains one of the Netherland’s strengths relative to the global universe. Relative to last year, member service and asset class cost disclosures improved, the positive impact of which was offset by lower scores for total fund cost disclosures.

Governance

With an average score of 66 and a global rank of 8th, the same ranking as last year, governance continued to be the weakest factor for Dutch funds. All of the individual fund scores increased year over year and ranged from a low of 54 to a high of 78. Despite very robust governance structures, few Dutch funds disclosed much information on either board member skills and competencies or actual board activities or meeting attendance. Disclosures on compensations, HR and organisation were also quite limited. Organisational strategy was disclosed relatively well with Dutch funds ranking 5th globally.

Performance

Performance disclosures saw little change year over year. While the average score declined slightly to 65, Dutch funds now rank 5th globally, an improvement from last year’s 6th place ranking. Scores were tightly banded with a low of 59 and high of 73. Explanation of results were excellent, as were disclosures of risk practices and funded status. Asset class level disclosures were spotty and disclosures of benchmarks were only observed at one of the five funds.

Responsible Investment

Dutch funds continued their excellent showing in RI disclosures with an average score of 77, good enough to move up to 1st place globally. Individual fund scores again ranged in a narrow band from a low of 62 to a high of 83. Scores in each component measured exceeded global averages. The weakest RI component area was RI governance disclosures. RI implementation was a clear area of strength: disclosures related to exclusion policies, active ownership and impact investing disclosures remain consistently high.

Examples

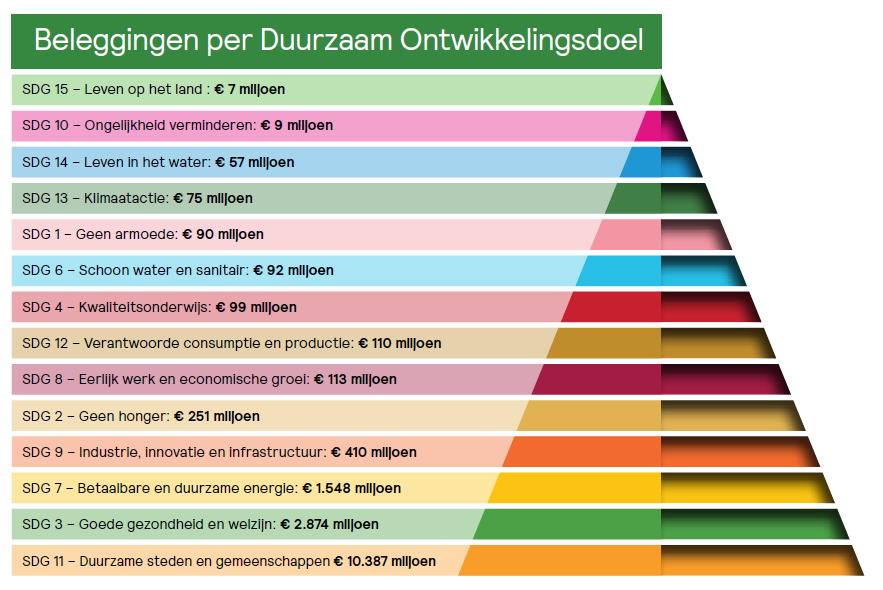

bpfBOUW

In addition to having superlative costs disclosures, the Dutch funds also had extensive responsible investing disclosures, including comprehensive annual reports dedicated to the subject. In the example below, bpfBOUW illustrates its investments made towards UN Sustainable Development Goals and then illustrate how they are meeting SDG7, showing both a breakdown of investments by asset class, but also four specific examples of investments.

Source: bfpBOUW 2020 Responsible Investing Report, pg. 49

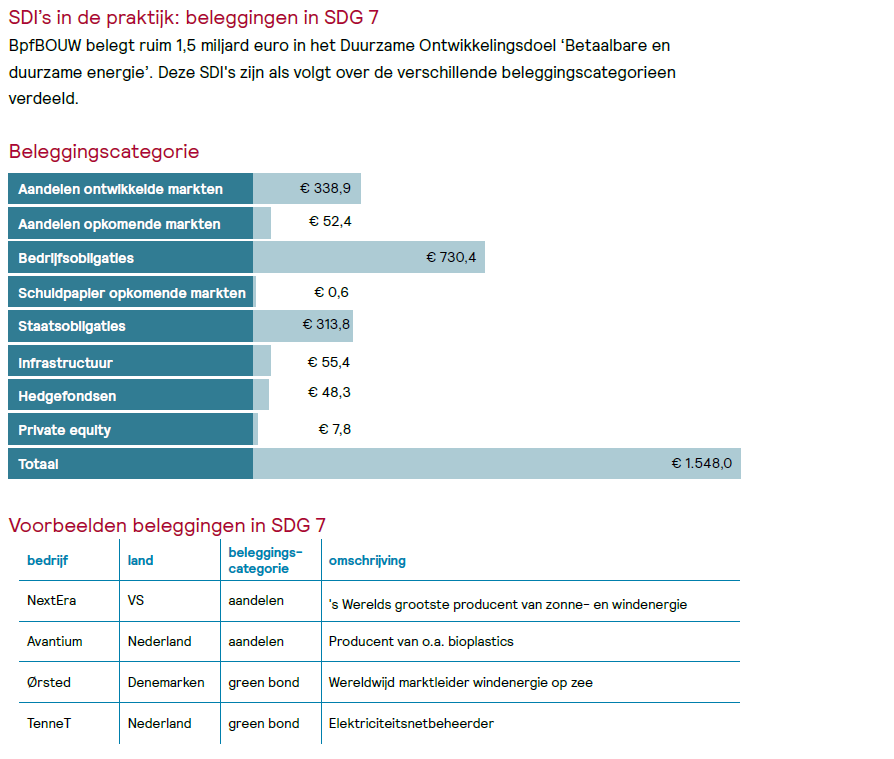

PGGM

PGGM also disclosed its efforts toward the UN Sustainable Development Goals. The exhibit below compares their goal to actual investments and then provides quantified results and impacts.

Source: https://www.pggminvestments.nl/generating-value-for-stakeholders-and-society

Overall Results

The Netherlands.

Funds Analysed

Stichting Pensioenfonds ABP

Stichting Pensioenfonds ABP (“National Civil Pension Fund”), frequently referred to as ABP, is the pension fund for government and education employees. It is the largest pension fund in the Netherlands, with assets of €465 billion, and among the five largest in the world. It serves about three million members. ABP’s benefit administration and asset management operations are outsourced to APG.

Pensioenfonds Zorg en Welzijn (PFZW)

PFZW is the pension fund for the healthcare and welfare sector. It is the second largest pension fund in the Netherlands with AUM of €266 billion and over two million members. PFZW’s benefit administration and asset management operations are outsourced to PGGM.

Pensioenfonds Metaal & Techniek (PMT)

PMT is the pension fund for the metal and technical sectors. PMT is the country’s third largest pension fund covering 34,300 employers and 1.4 million plan participants. Benefit administration and asset management operations are outsourced to MN.

Stichting Bedrijfstakpensioenfonds voor de Bouwnijverheid (BOUW )

BOUW is the pension fund for the building and construction industry. BOUW serves as the collective pension fund the 780,000 plan participants of 13,100 companies. BOUW’s benefit administration and asset management operations are outsourced to APG and Bouwinvest.

Pensioenfonds Metalektro (PME)

PME is the pension fund for the metal and technology industry, covering a range of industries including , shipping, automotive, and semiconductor manufacturers. In total, more than 1,390 employers and 626,000 participants are covered by PME. Benefit administration and asset management operations are outsourced to MN.