The Netherlands.

The Netherlands ranked 2nd globally with an average total score of 70.

The five Dutch funds reviewed were a homogenous group representing various occupational defined benefit pension funds. All are organised as a non-profit with a board representing employees, employers and trade unions where applicable. All outsource asset management and benefit administration services to third party providers (eg APG and PGGM). The funds and service providers were typically one entity at one point, but were separated in the early 2000s. This separation gave the pension funds autonomy and the ability to go elsewhere for services.

The Dutch pension system is considered one of the best in the world. Two regulators, the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM) oversee the system. On top of this, there is a very active association, Pensionefederatie, an association of 198 pension funds that promotes the interests of members of pension funds. The annual reports reviewed all followed the disclosure practices recommended by this association.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

The Netherlands.

Dutch funds ranked 2nd globally with an average country score of 70. By factor they ranked: 1st for cost; 8th in governance; 6th for performance; and 2nd in responsible investing. Dutch funds took the top four highest individual fund cost factor scores. The Netherlands is known for its ‘consensus’ driven approach to civic and social issues and this was reflected generally in scores. The range of individual fund scores was perhaps the lowest of any country.

Cost

With an average country cost score of 83, the Dutch funds ranked 1st globally. Individual fund scores were all good and ranged from a low of 71 to a high of 88. Collectively, they all scored extremely well for completeness of external management fees, as they all follow the Pensionefederatie recommendation of ‘looking through’ multi-layered investment structures. Most funds follow the same practice for transaction costs and they also include more estimates for market impact, which was not common in other countries. The weakest cost factor area was asset class disclosure.

In 2011, the Pensioenefederatie published recommendations on how to improve transparency and reporting of pension fund costs. The Dutch funds reviewed all followed these recommendations. This ensures comparability, consistency and completeness of cost reporting and explains why Dutch funds were the top scoring funds for cost disclosures.

Governance

With an average score of 56 and a global rank of 8th, this was the weakest factor for Dutch funds. Individual fund scores ranged from a low of 43 to a high of 69. The Dutch received the second highest score in organisational strategy disclosures with a mark of 53 with both reviews and forward-looking statements around corporate goals being disclosed by most organisations. Despite very robust governance structures, few Dutch funds disclosed much information on either board member skills and competencies or actual board activities and meeting attendance.

Performance

With an average country score of 69, Dutch funds ranked 6th globally on the performance factor. Individual fund scores ranged in a narrow band from a low of 62 to a high of 74. Areas of strength were: funded status/solvency, risk management policies and practices as well as asset mix and portfolio composition disclosures. Weaker areas included asset class returns and benchmark disclosures and quality.

Responsible Investment

Dutch funds had an average score of 71 earning it a 2nd place rank globally. Individual fund scores ranged in a narrow band from a low of 58 to a high of 79. The weakest RI component area overall was governance. RI implementation was a clear area of strength: disclosures related to exclusion policies, active ownership and impact investing disclosures were consistently high.

Examples

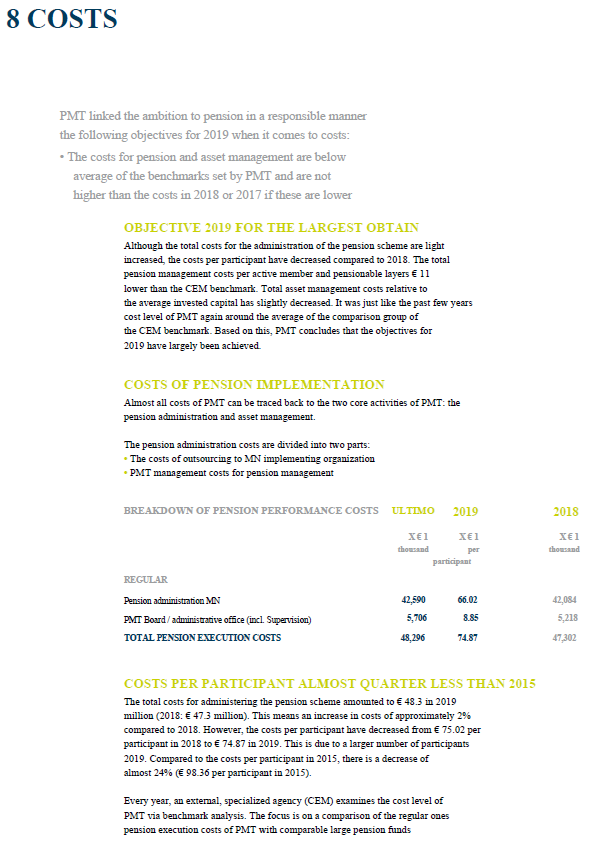

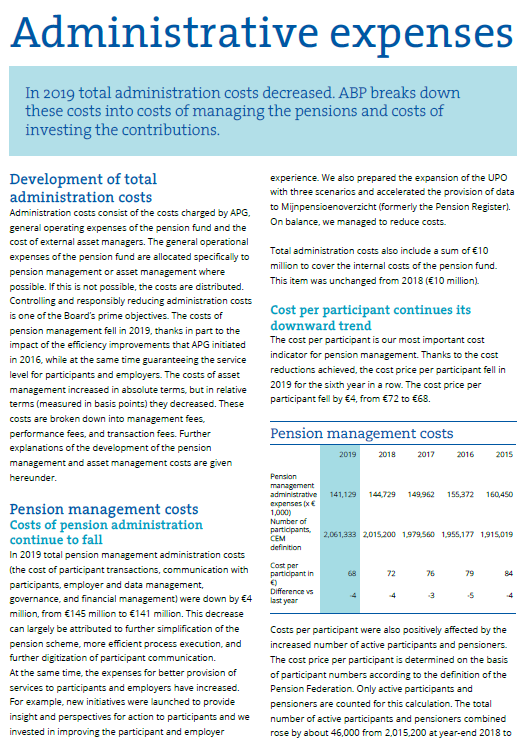

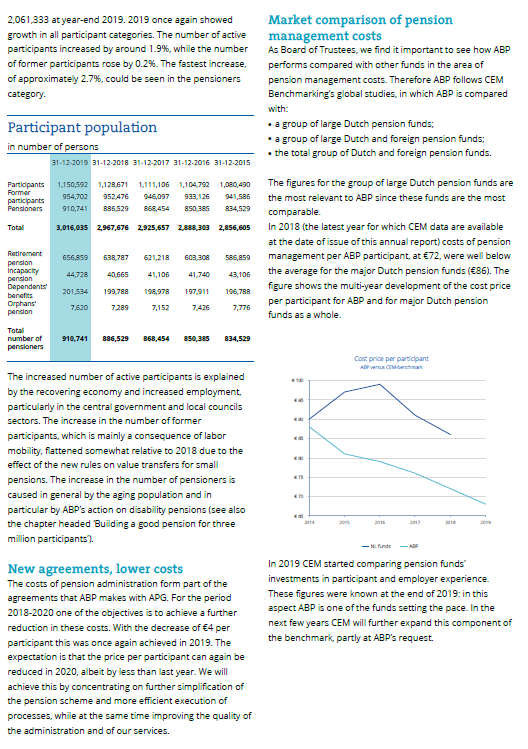

All the Dutch annual reports reviewed had an extensive cost section with pages devoted to a discussion of costs. Items covered included: cost performance, such as actual versus benchmark cost and cost trends. Costs were also reported along with operational context such as costs per participant for administration and costs as a percentage of assets for transaction and asset management costs. Costs are not just numbers in the income statement or footnotes in a schedule. It is appropriate that the Pensionefederatie website refers to Dutch funds having ‘permanent attention to cost control’.

Costs

Every Dutch annual report has an entire section devoted to costs. Costs is not just a footnote or a few schedules in Dutch annual reports. Transaction costs which are more commonly afforded a footnote in most annual reports get an entire page.

For example, PMT Annual Report section on costs.

Source: PMT Annual Report (translated) (page 60)

In ABP’s annual report, the annual report cost section starts on page 49 and ends on page 58.

Source: ABP Annual Report 2019 (pages 48 and 57)

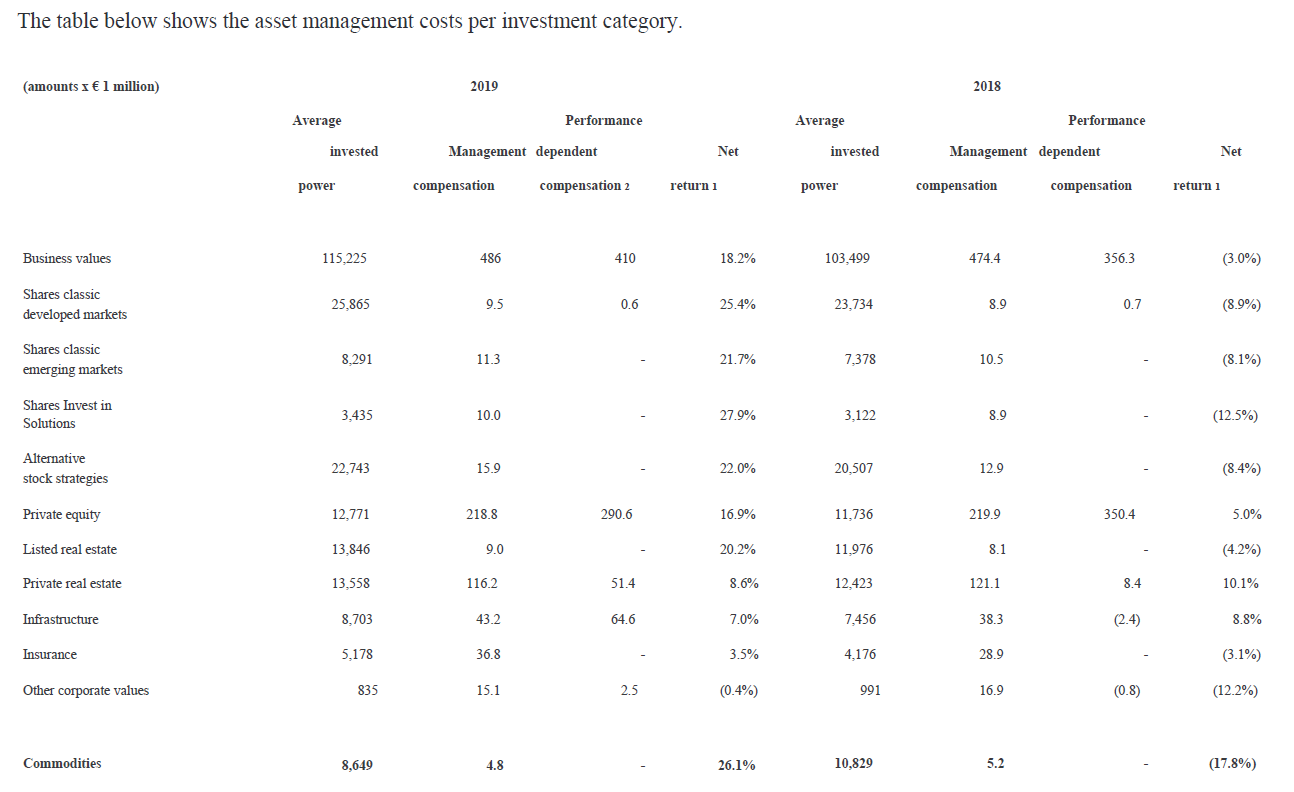

PFZW, like other Dutch funds, reconciles the financial statement costs to the ‘true’ asset management and transaction costs by estimating indirect costs.

Source: PFZW Annual Report (translated) (page 40)

Overall Results

The Netherlands.

Funds Analysed

Stichting Pensioenfonds ABP

Stichting Pensioenfonds ABP (“National Civil Pension Fund”), frequently referred to as ABP, is the pension fund for government and education employees. It is the largest pension fund in the Netherlands, with assets of €465 billion, and among the five largest in the world. It serves about three million members. ABP’s benefit administration and asset management operations are outsourced to APG.

Pensioenfonds Zorg en Welzijn (PFZW)

PFZW is the pension fund for the healthcare and welfare sector. It is the second largest pension fund in the Netherlands with AUM of €266 billion and over two million members. PFZW’s benefit administration and asset management operations are outsourced to PGGM.

Pensioenfonds Metaal & Techniek (PMT)

PMT is the pension fund for the metal and technical sectors. PMT is the country’s third largest pension fund covering 34,300 employers and 1.4 million plan participants. Benefit administration and asset management operations are outsourced to MN.

Stichting Bedrijfstakpensioenfonds voor de Bouwnijverheid (BOUW )

BOUW is the pension fund for the building and construction industry. BOUW serves as the collective pension fund the 780,000 plan participants of 13,100 companies. BOUW’s benefit administration and asset management operations are outsourced to APG and Bouwinvest.

Pensioenfonds Metalektro (PME)

PME is the pension fund for the metal and technology industry, covering a range of industries including , shipping, automotive, and semiconductor manufacturers. In total, more than 1,390 employers and 626,000 participants are covered by PME. Benefit administration and asset management operations are outsourced to MN.