Norway.

Norway ranked 9th globally with an average total score of 55.

The Norwegian pension system consists of a public pension system, a mandatory occupational system plus personal pension saving provisions. The state pension scheme provides a flat rate basic pension plus an earnings-related supplement that covers all employed and self-employed persons. Occupational pension schemes can be funded through an insurance contract or a pension fund. Historically defined benefit schemes were the dominant form of occupational schemes but new defined contribution schemes are becoming increasingly popular. About 75 percent of private pensions in the Norwegian pension system are funded via insurance contracts. The reviews consisted of two funds supporting the public pension system, two funds managing assets for public employees and the largest corporate pension fund in Norway.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

Norway.

Norway had an average country score of 55, a small improvement from last year. As a result, Norway’s global ranking improved from 11th to 9th. Individual fund scores ranged very widely, from a low of 39 to a high of 75. A similarly wide dispersion of results was recorded for all the factors. The total scores for each of the five funds reviewed improved year-on-year. Governance and cost continued to be the weakest factors however both factors, particularly governance, saw improvements. Responsible investing was an area of relative strength and where Norwegian funds ranked 7th globally.

Cost

Norway maintained its 10th place ranking globally with a score of 44. Individual scores ranged widely, from a low of 19 to a high of 78. This range was even wider than that observed in last year’s review with the highest scoring fund improving its disclosures and the lowest ranking funds regressing slightly. No areas of disclosure stood out. Asset class level disclosures were the only area where the Norwegian funds scored better that the average fund globally. Scores in each other area were below global averages, with most commensurate with their 10th place overall ranking.

Governance

The Norwegian funds ranked 9th in governance disclosures with an average country score of 65, a slight improvement from last year’s ranking. The range of scores was wide, with a low of 35 to a high of 83, but more positively the scores of each of the five funds improved year-on-year. Average scores in each factor also improved from last year. With the exception of one fund, disclosures of compensation, human resource and organisational items was quite strong. Disclosures of governance structure improved the most from last year. Despite improvements, disclosures of board competency and qualification continued to be generally lacking.

Performance

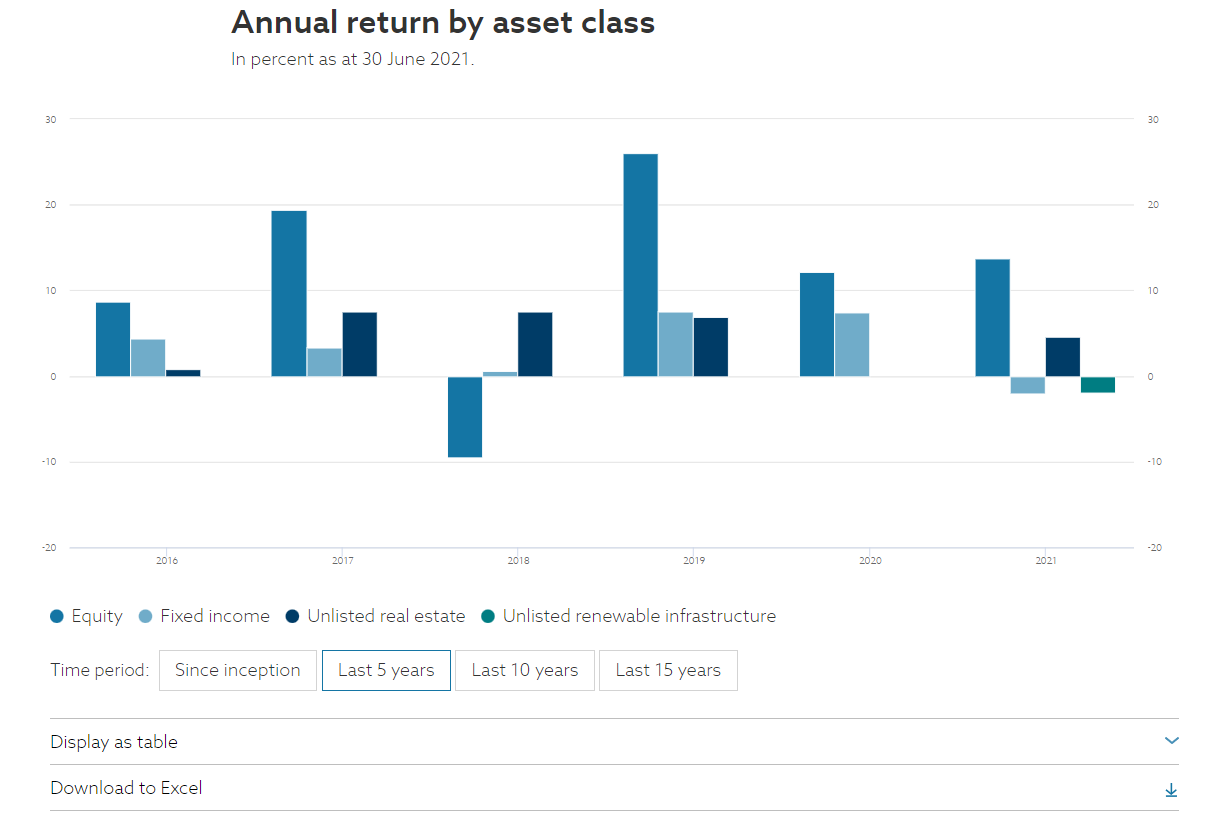

Disclosures of performance by the Norwegian funds continued to be a mixed bag. Their global ranking stayed 9th overall, but the average score declined slightly to 58. The range of scores was fairly wide with the highest scoring fund receiving a score of 82, the lowest scoring fund 34. Asset class level disclosures were the only area of relative strength. Risk disclosures, a high point in last year’s review were less fulsome this year.

Responsible Investment

Norway improved on its score slightly this year, moving from a 56 to a 59. This placed them near the middle of the pack once again with a global ranking of 7th. Similar to other factors, there was a wide range in scores from a low of 38 to a high of 79. Scores for the Norwegian funds exceeded global averages in most components reviewed. Most of the improvement in scoring was due to the increased disclosure on impact investing. Disclosures on ESG integration and impact investing continued to lag other global funds.

Examples

NBIM

NBIM is the asset manager for the Norway Government Pension Fund Global. The NBIM website has an outstanding interactive dashboard that shows how web tools can be used to provide enhanced performance disclosures. Total fund and asset class returns from current to long-term are provided along with click throughs to additional information such as: costs, inflation rates, net real returns, and a range of risk and risk adjusted return metrics. The metrics are also downloadable to accommodate those who want to do their own analysis with the data.

Expectations

Norway’s Domestic Fund produces an “Expectations” report that clearly outlines its framework for dealing with portfolio companies and the expectations it holds for such companies across many areas including anti-corruption measures, Board and executive remuneration, human and workers’ rights, and climate issues. This example outlines expectations on climate issues

Overall Results

Norway.

Funds Analysed

Equinor Pension Fund

Equinor Pension Fund is a pension fund covering employees of Equinor, the largest energy company in Norway that also has operations in 30 countries. Equinor was known as Statoil until 2018.

Government Pension Fund Global

Government Pension Fund Global: This global investment fund derives its financial backing from the oil industry and is managed by Norges Bank Investment Management (NBIM), part of the Norwegian Central Bank on the behalf of the Ministry of Finance. It is the largest pension fund in Europe.

Government Pension Fund Domestic

Government Pension Fund Domestic: This fund was established by the National Insurance Act in 1967 under the name National Insurance Scheme Fund. It is managed by Folketrygdfondet and can only invest domestically.

KLP

KLP is a mutual insurance company, established in 1949, responsible for the management of municipal and county pensions and insurance issues.

Oslo Pension Fund (OPF)

Oslo Pension Fund (OPF) provides pension and insurance management services for employees of the City of Oslo and several other public organisations under its jurisdiction.