Norway.

Norway ranked 11th globally with an average total score of 51.

The Norwegian pension system consists of a public pension system, a mandatory occupational system plus personal pension saving provisions. The state pension scheme provides a satisfactory flat rate basic pension plus an earnings-related supplement that covers all employed and self-employed persons. Occupational pension schemes can be funded through an insurance contract or a pension fund. Historically defined benefit schemes were the dominant form of occupational schemes but new defined contribution schemes are becoming increasingly popular. About 75% of private pensions in the Norwegian pension system are funded via insurance contracts.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

Norway.

Norway had an average country score of 51 and placed 11th globally and lower than the other European countries reviewed. Individual fund scores ranged very widely, from a low of 34 to a high of 73. A similarly wide dispersion of results was recorded for all of the factors. The two factors that were weakest were governance and cost. In contrast, responsible investing was an area of relative strength and where Norwegian funds ranked 6th globally.

Cost

With an average country score of 42, Norway ranked 10th globally on the cost factor score. Individual fund scores again ranged widely: from a low of 18 to a high of 64. Some of this dispersion related to what public documents were available. In some cases, disclosures were part of parent company annual reporting, and specific pension fund disclosures were minimal. Disclosures were much better where a separate annual report for the pension fund was published. In general, cost disclosure was generally limited to one line in the financial statements with some additional notes. Funds that included DC schemes scored better because they provided fund fact sheets that included more details related to external manager fees and transaction costs.

Governance

The Norwegian funds finished 10th on this factor with an average country score of 48. The range of scores was wide: from a low of 22 to a high of 64. The public sector organisations generally scored much better than the corporate pension entities. With the exception of one corporate pension entity, disclosures of compensation, human resource and, organisational items was quite strong. Board competency and qualification disclosures were generally lacking as were disclosures on organisation strategy.

Performance

The Norwegian funds had an average country score of 67 which was a global ranking of 9th. Individual fund scores ranged widely, from a high of 93 to a low of 46. It was a bifurcated distribution: two funds scored above 90 and three funds scored lower than 55. The two 90+ funds had good scores on most components and especially outstanding results for disclosures related to total fund returns and value added, asset class returns and value added as well as for asset mix and portfolio composition. In general the other three funds did not score particularly well on components other than their risk disclosures which were quite good.

Responsible Investment

Norway performed quite well in this factor with an average score of 47 and a global ranking of 6th. The pattern continued: individual fund RI scores ranged widely, from a low of only six to a very good score of 79. Two individual fund results were dragged down by weaker scores from the other three. These two funds had high scores on most RI components. Conversely, the other three funds typically had weaker disclosures for all RI components.

Example

The Pension Fund Global

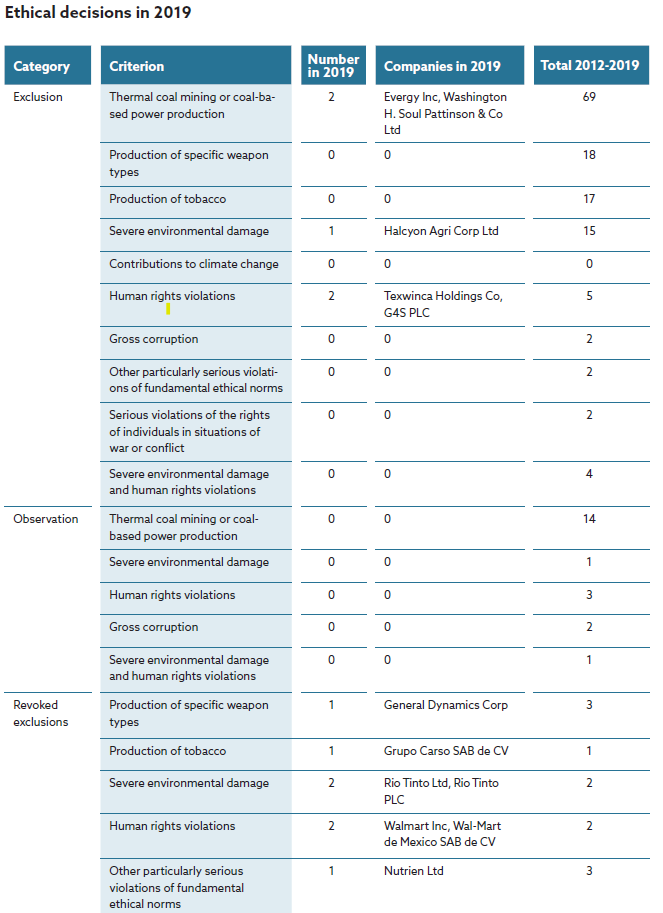

The Pension Fund Global had a very clean and concise table showing all exclusions as well as revoked exclusions for the year, and total, since 2012.

Source: Norges Bank Investment Management Sustainability Report (page 87)

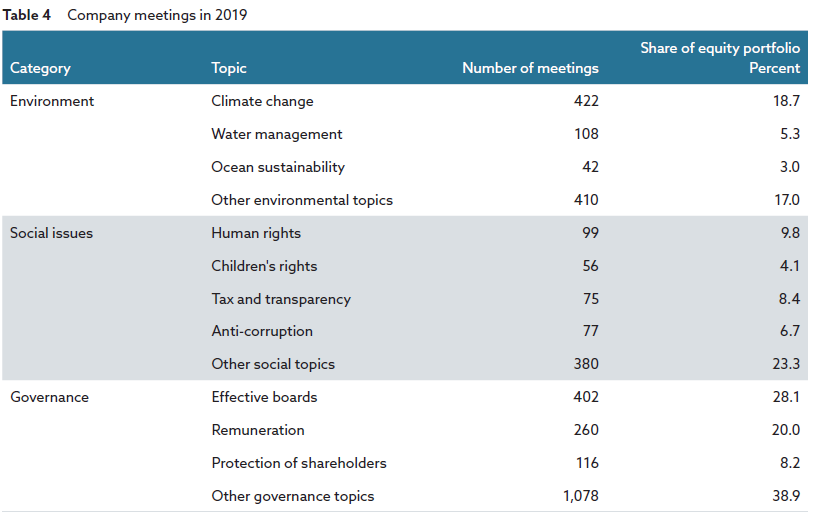

The Pension Fund Global provides a great breakdown of the engagement efforts undertaken categorised by each ESG factor.

Source: Norges Bank Investment Management Sustainability Report (page 43)

Overall Results

Norway.

Funds Analysed

Equinor Pension Fund

Equinor Pension Fund is a pension fund covering employees of Equinor, the largest energy company in Norway that also has operations in 30 countries. Equinor was known as Statoil until 2018.

Government Pension Fund Global

Government Pension Fund Global: This global investment fund derives its financial backing from the oil industry and is managed by Norges Bank Investment Management (NBIM), part of the Norwegian Central Bank on the behalf of the Ministry of Finance. It is the largest pension fund in Europe.

Government Pension Fund Domestic

Government Pension Fund Domestic: This fund was established by the National Insurance Act in 1967 under the name National Insurance Scheme Fund. It is managed by Folketrygdfondet and can only invest domestically.

KLP

KLP is a mutual insurance company, established in 1949, responsible for the management of municipal and county pensions and insurance issues.

Oslo Pension Fund (OPF)

Oslo Pension Fund (OPF) provides pension and insurance management services for employees of the City of Oslo and several other public organisations under its jurisdiction.