South Africa.

South Africa ranked 7th globally with an average total score of 56.

The South African pension system consists of a means-tested, non-contributory government social security system supplemented by voluntary occupational retirement schemes.

The five South African funds that were reviewed are not a homogenous group. They included two defined benefit plans: GEPF, one of the world’s largest funds and the national electricity utility, Eskom. The other funds are ‘umbrella’ funds, defined contribution providers that compete for employer and individual members. Umbrella funds offer business owners and their employees the opportunity to join a larger established retirement fund while retaining some flexibility in plan design and features.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

South Africa.

Cost

The South African funds ranked 12th globally with a score of 42, a drop from last year’s 9th place position in this factor. Individual fund scores ranged from 36 to 51. In line with last year, total fund cost disclosures and the completeness of external management fees are relative strengths. Asset class level costs and transaction costs were areas of particular weakness relative to the global universe.

Governance

Despite an average score that increased from 62 last year to 68 in this year’s review, South Africa’s rank for governance disclosures remained at 7th place. The range was quite wide: from a low of 49 to a high of 84. Disclosures related to governance structure and mission were very good, as were organisational strategy disclosures. Disclosures for compensation and HR were weaker. For most funds, disclosures related to board competencies and composition as well as organisational strategy are significantly improved compared to last year.

Performance

Despite a small drop in overall score, now 62, the South African funds moved up one place to 7th globally in performance disclosures. Scores showed only a modest range, from a low of 55 to a high of 79; four of the five funds scored between 55 and 59. Total fund performance disclosures were good, asset class level disclosures less so, albeit improved from last year. Apart from risk disclosures, which trailed global peers, disclosures in other areas were largely in line with global averages.

Responsible Investment

Like most countries, the RI disclosures of South African funds improved from last year while their 9th place ranking was maintained. Individual fund scores showed wide variation, from a low of 17 to a high of 67. The South African funds acquitted themselves well in most areas reviewed. The weakest area overall was exclusion. The largest increase was seen in impact investing as a result of one fund that began disclosing in this area reflecting the initiation of investments in sustainable development projects.

Examples

Old Mutual Superfund

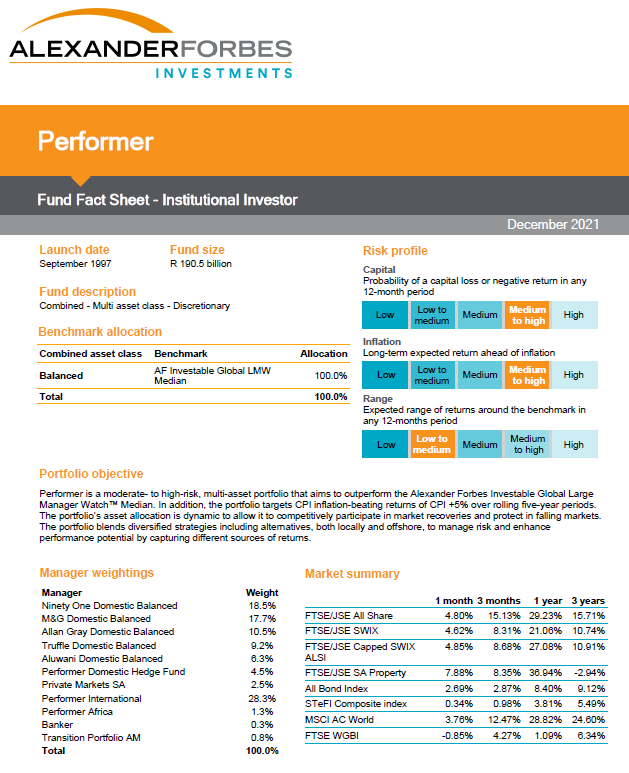

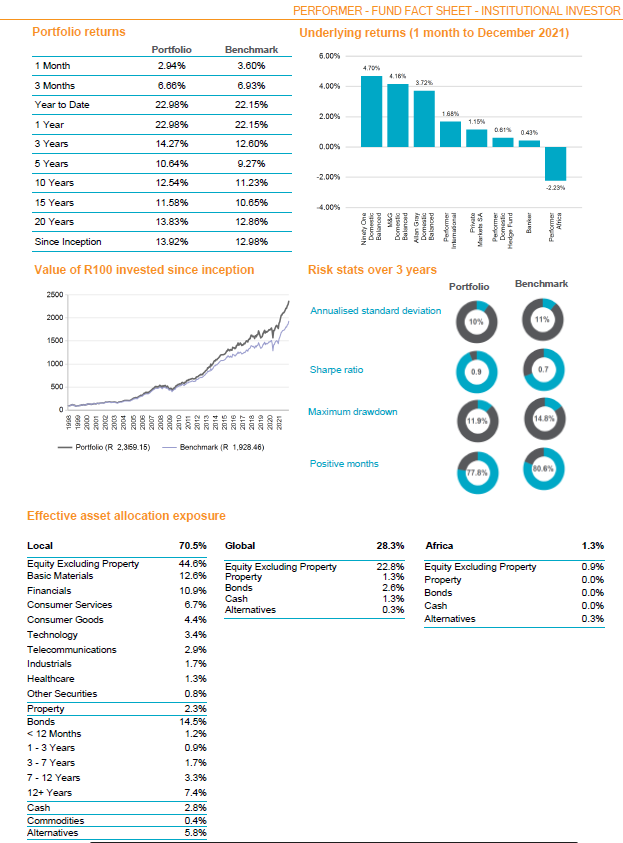

These are excerpts from an information packed three-page fact sheet for a DC investment option available to Old Mutual Superfund plan members. Key disclosures included: fund objective, short to long-term performance, benchmark, risk level, asset allocation and largest holdings.

Sentinel Retirement Fund

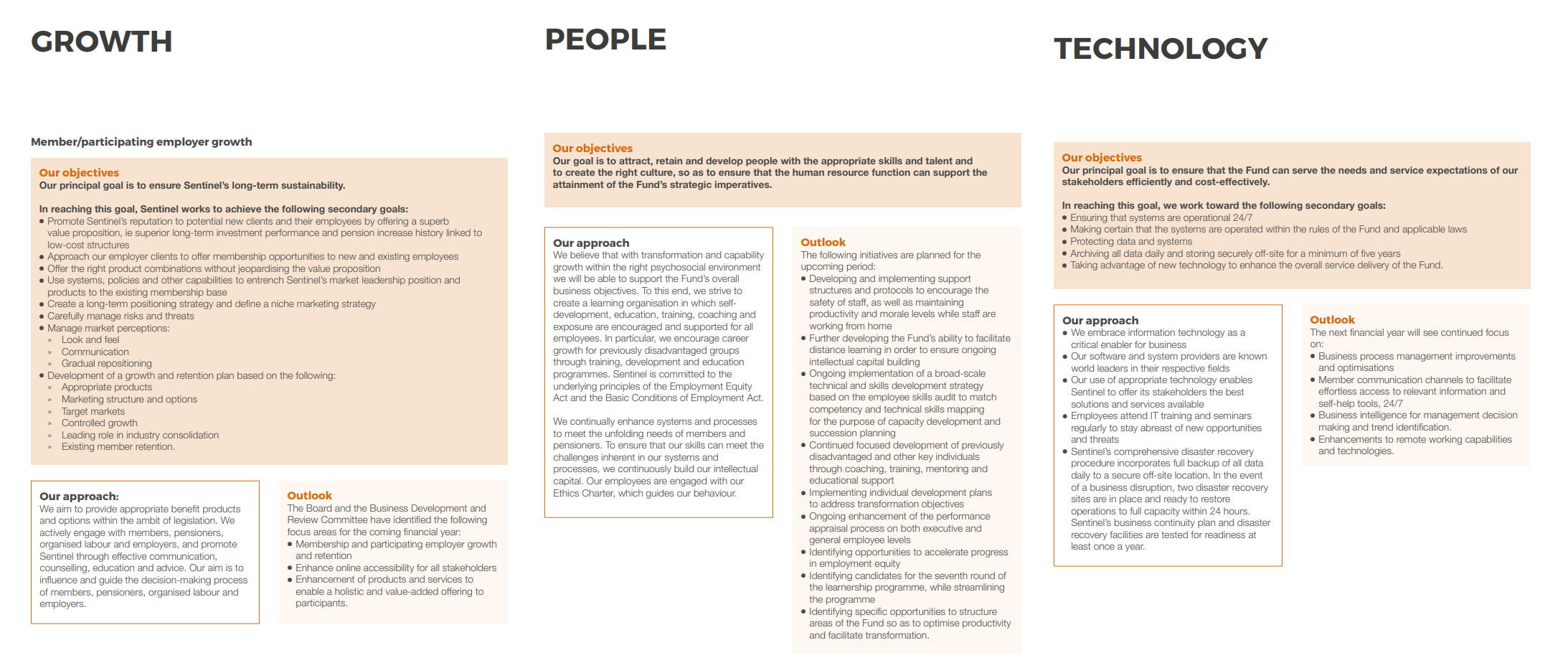

Sentinel Retirement Fund provided good detail on its overall corporate goals including the importance of human capital and technology on its future growth.

Source: Sentinel Retirement Fund Integrated Annual Report 2020, page 88-90

Overall Results

South Africa.

Funds Analysed

Eskom Pension and Provident Fund (EPPF)

EPPF provides investment management and benefit administration services for the defined benefit plan for employees of Eskom, South Africa’s public electrical utility company.

Government Employees Pension Fund (GEPF)

GEPF is a defined benefit fund that manages pensions and related benefits on behalf of government employees in South Africa. GEPF is by far the largest pension fund in South Africa and one of the largest in the world.

Old Mutual SuperFund

Old Mutual SuperFund is South Africa’s first ‘umbrella’ fund, introduced by Old Mutual in 1992. Old Mutual is a large diversified financial services company that operates in 14 African countries.

Sanlam Umbrella Fund

Sanlam Umbrella Fund is a defined contribution fund offered by Sanlam, part of the Sanlam Group, a large, diversified financial services company with operations in 44 emerging and developed market countries.

Sentinel Retirement Fund

Sentinel Retirement Fund was founded in 1946 and originally served the mining industry. It converted to an umbrella pension fund that is now open to all industries and employers in South Africa. Sentinel has a mutual, not-for-profit business model.