South Africa.

South Africa ranked 8th globally with an average total score of 53.

The five South African funds that were reviewed are not a homogenous group. They included two defined benefit plans: GEPF, one of the world’s largest funds and the national electricity utility, Eskom. The other funds are ‘umbrella’ funds, defined contribution providers that compete for employer and individual members. Umbrella funds offer business owners and their employees the opportunity to join a larger established retirement fund while retaining some flexibility in plan design and features.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

South Africa.

South African funds scored in the top-half overall of the countries that were reviewed. It ranked 8th globally with an average total score of 53. By factor it ranked: 9th for cost; 6th in governance; 11th for performance; and 9th in responsible investing. Scores on the four factors ranged quite widely across the funds. There were gaps and minimal disclosures in some areas. One thing all funds had in common was their communication quality. Their websites and published reports were well organised and packed with important information for stakeholders.

Cost

With an average cost factor score of 46, the South African funds ranked 9th globally. Individual fund scores ranged widely, from 34 to 63. Disclosures were typically good at the total fund level and for the completeness of reporting on external manager fees. Lower scores in other areas were generally due to lack of specific details. For example, transaction costs were often stated as ‘included’ but the amount was not disclosed.

Governance

This was a strong factor for South African funds which averaged 60 along with a global ranking of 6th. The range was quite wide: from a low of 43 to a high of 77. Disclosures related to governance structure and mission were very good, followed by board competencies and composition. Disclosures for compensation and organisational strategy were typically weaker.

Performance

With an average score of 66, South African funds ranked 11th globally. Individual fund scores ranged widely, from a low of 56 to a high of 80. Areas of strength were: total fund returns and value added; asset mix and portfolio composition; and, risk. Weaker areas included asset class returns and value added as well as clarity on the basis of reported returns.

Responsible Investment

South African funds had an average score of 40 and raked 9th globally. Individual fund scores ranged widely, from a low of 8 to a high of 57. RI component scores also varied widely across the funds. The weakest area overall was governance. For implementation, active ownership disclosures were generally good. In contrast, exclusion policy, impact investing and ESG scores were typically quite low.

Examples

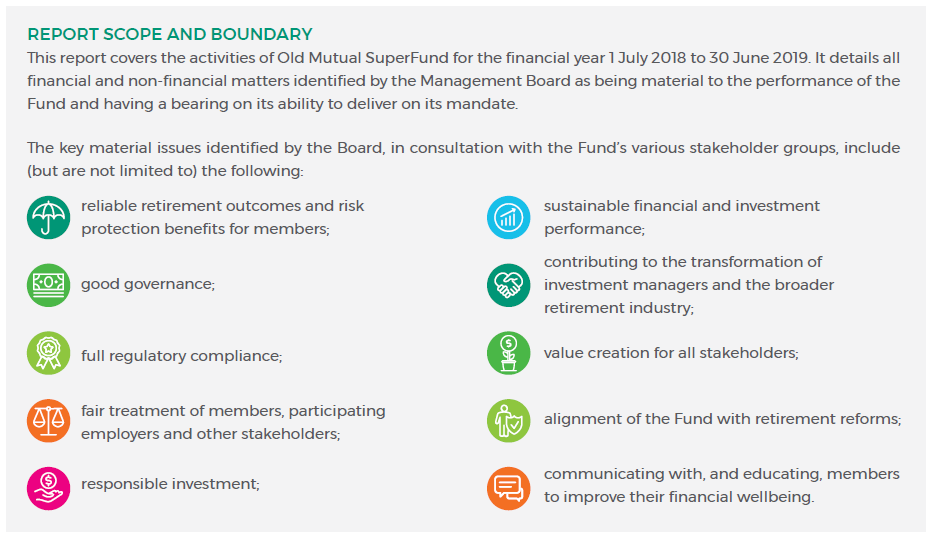

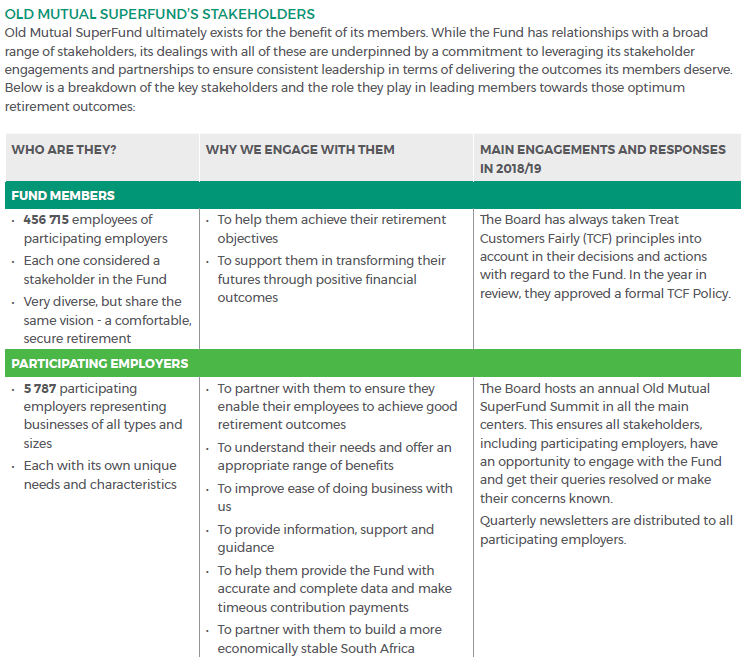

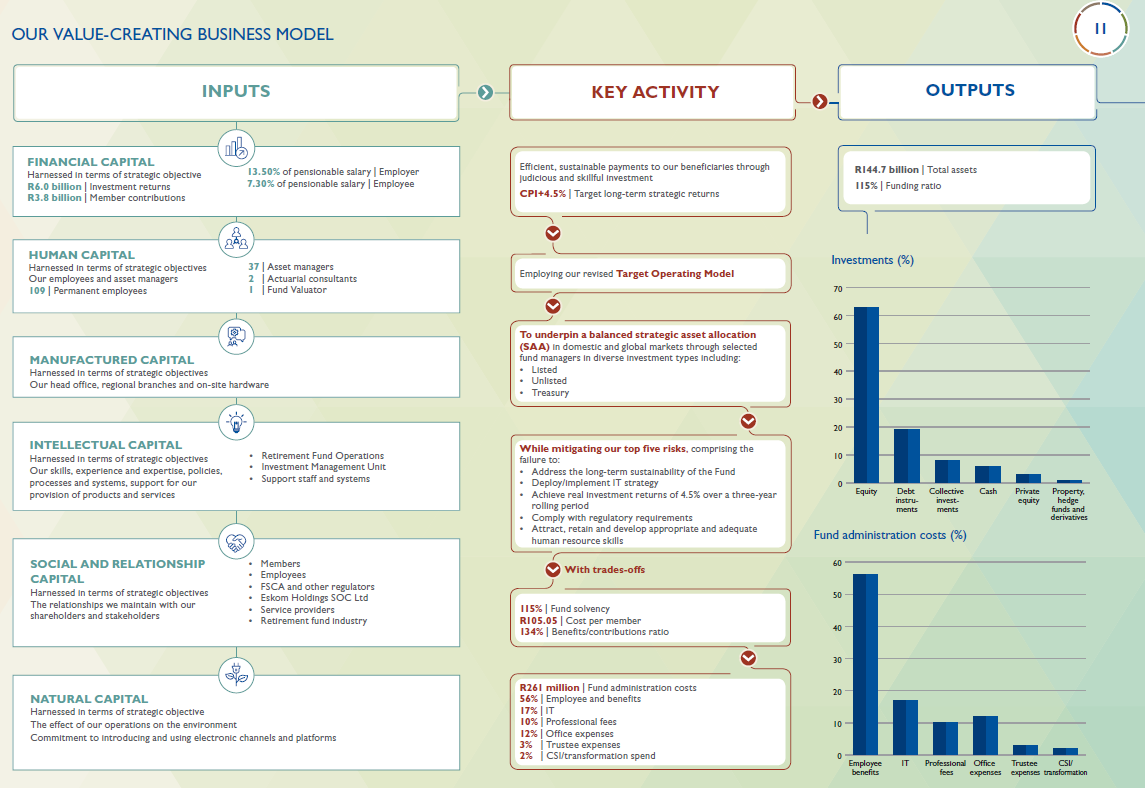

Annual reports for all of the South African funds are well organised, cohesive and packed with important information for stakeholders. Infographics, summaries, pictures, charts, etc., are used effectively to add impact and keep readers engaged. Three of the funds – Eskom PPF, Old Mutual Superfund and Sentinel Retirement Fund – prepare integrated annual reports, that incorporate reporting standards developed by the Integrated Reporting Council (IIRC). The IR reporting framework is highlighly recommended for its structured and holistic focus on value creation and outcomes for all stakeholder. Here are selected excerpts from the integrated annual reports for these three funds.

Eskom Pension and Provident Fund

Eskom Pension and Provident Fund example of integrated annual report.

Example of Eskom’s focus on value creation and outcomes for stakeholders:

Example of Eskom’s focus on value creation and outcomes for stakeholders (continued):

Source: Eskom Pension and Provident Fund Integrated Annual Report 2019 (page 11 and 12)

Sentinel Retirement Fund

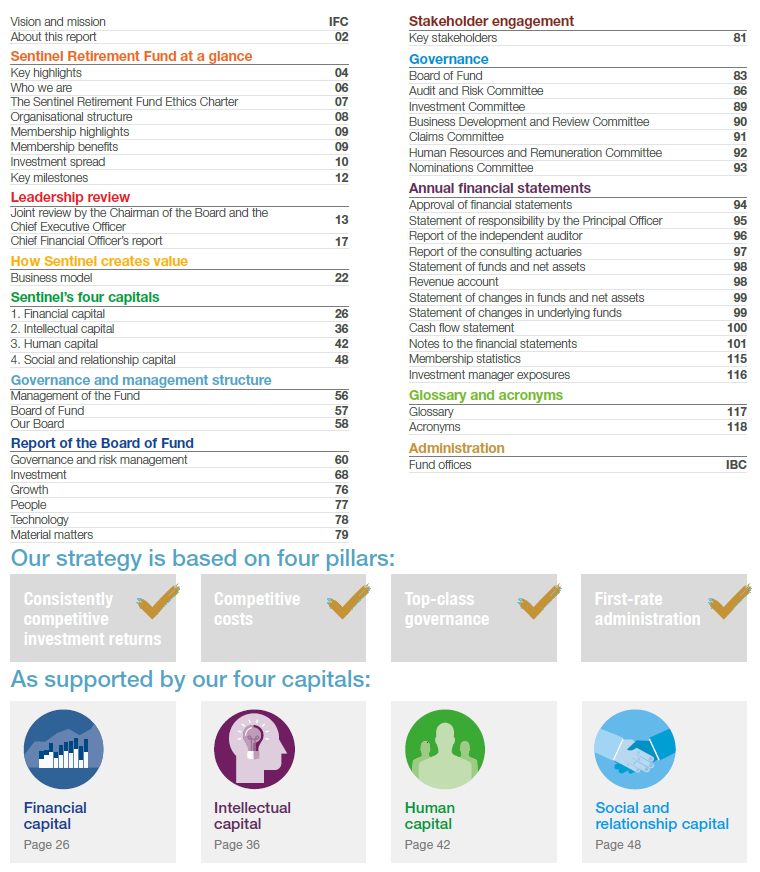

Example of Sentinel Retirement Fund Integrated Annual Report:

Source: Sentinel Retirement Fund Integrated Annual Report 2019 (table of contents)

Old Mutual Superfund

Overall Results

South Africa.

Funds Analysed

Eskom Pension and Provident Fund (EPPF)

EPPF provides investment management and benefit administration services for the defined benefit plan for employees of Eskom, South Africa’s public electrical utility company.

Government Employees Pension Fund (GEPF)

GEPF is a defined benefit fund that manages pensions and related benefits on behalf of government employees in South Africa. GEPF is by far the largest pension fund in South Africa and one of the largest in the world.

Old Mutual SuperFund

Old Mutual SuperFund is South Africa’s first ‘umbrella’ fund, introduced by Old Mutual in 1992. Old Mutual is a large diversified financial services company that operates in 14 African countries.

Sanlam Umbrella Fund

Sanlam Umbrella Fund is a defined contribution fund offered by Sanlam, part of the Sanlam Group, a large, diversified financial services company with operations in 44 emerging and developed market countries.

Sentinel Retirement Fund

Sentinel Retirement Fund was founded in 1946 and originally served the mining industry. It converted to an umbrella pension fund that is now open to all industries and employers in South Africa. Sentinel has a mutual, not-for-profit business model.