Switzerland.

Switzerland ranked 10th globally with an average total score of 52.

The public disclosures of the largest Swiss pension providers were reviewed. Two public institutions and three of the largest private pension funds were part of the analysis. The public institutions managed assets primarily for public workers or pensioners tied to the Confederation, specific cantons, or communes within Switzerland. The Swiss pension system is founded on three pillars. The first is a state-run pension scheme for seniors, orphans, and surviving spouses. The second pillar consists of pension funds run by investment foundations, which are tied to employers. The third pillar is composed of voluntary private investments. The plans that were a part of this review primarily fall under the second pillar.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

Switzerland.

Swiss funds ranked 10th globally with an average country score of 52. The range of fund scores was quite wide, ranging from a low of 43 to a high of 71. Governance and responsible investing were areas of relative weakness whereas performance and cost factors were areas of relative strength.

Cost

Switzerland’s cost factor score ranked 4th globally with an average cost factor score of 65. Individual scores ranged widely from a low of 40 to a high of 82. The wide range is primarily due to one fund with weak cost disclosures. Most Swiss funds had good cost disclosures across all components, and external manager fees were particularly well done.

Governance

This was the weakest factor for the Swiss funds. The country average score was 42, ranking 13th in the global rankings. The range of scores was particularly wide: from a low of 26 to a high of 78. The two public sector funds, and one in particular, scored much better than the three corporate pension entities which was consistent with what we saw in other countries. Scores related to board competencies and qualifications were especially weak – 3 funds received a score of zero with a fourth scoring only 10.

Performance

Swiss funds also did well on performance with an average country score of 70, which placed them 5th globally. Individual funds scores from a low of 56 to a high of 84. The Swiss funds generally had high scores across performance component measures. Disclosures related to the clarity of return and valued added were especially good and much appreciated: the highest average score was 92 and three funds scored 100. The only area of relative weakness was for asset class returns and value added measures. In general, it was difficult to find asset class specific information for Swiss funds.

Responsible Investment

This was also a weak factor for the Swiss funds. The average country score was 29 and the global rank was 11th. Scores for individual funds ranged from a low of 18 to a high of 49. Both RI governance and framework and reporting components were good for one public fund but lacking in the other four funds. The entire group scored poorly in RI implementation outside of exclusion policies.

Examples

Publica

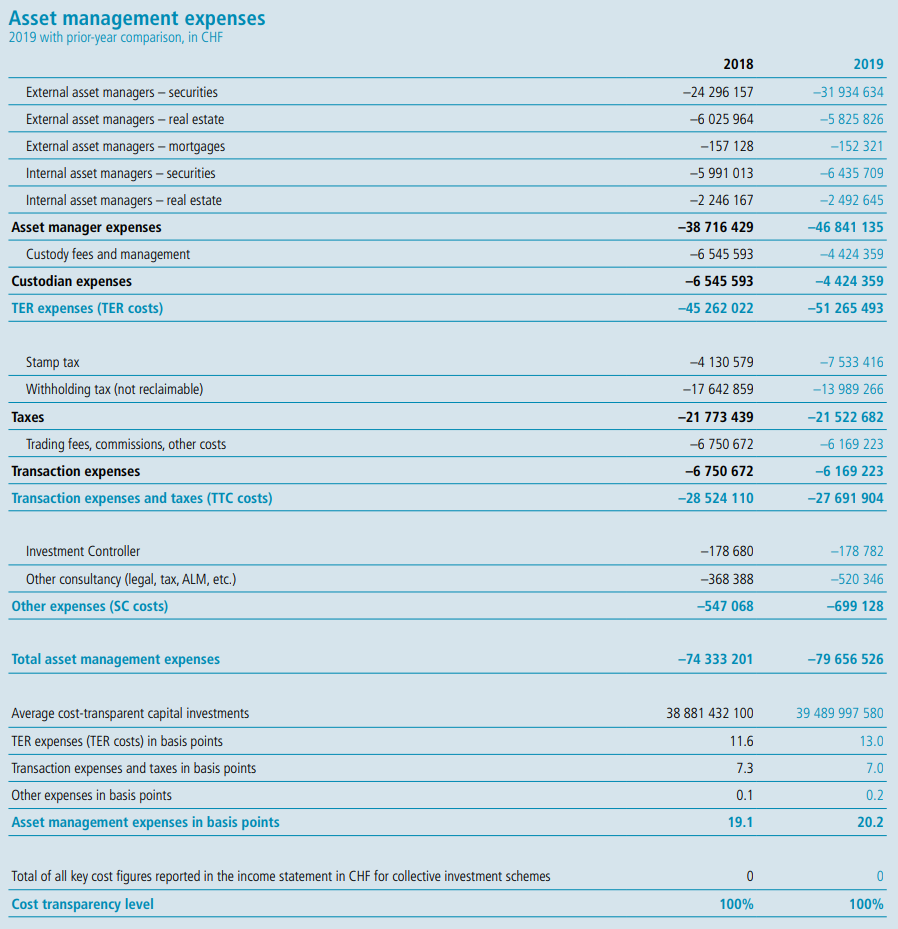

Publica provided a succinct but comprehensive summary of cost disclosures. It was categorised intuitively and had a confirmation of 100% transparency.

Source: Publica Annual Report 2019 (page 70)

BVK

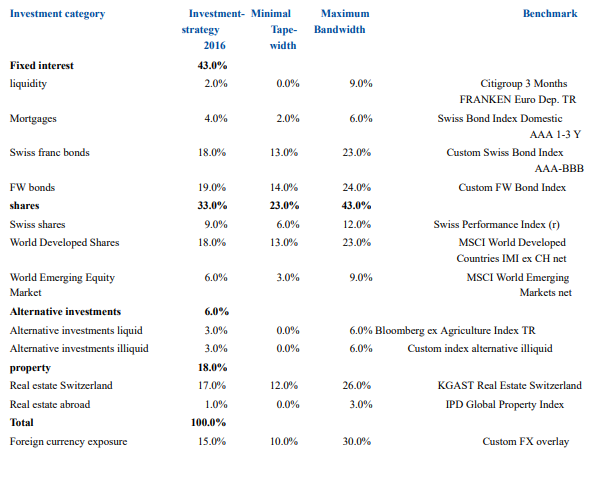

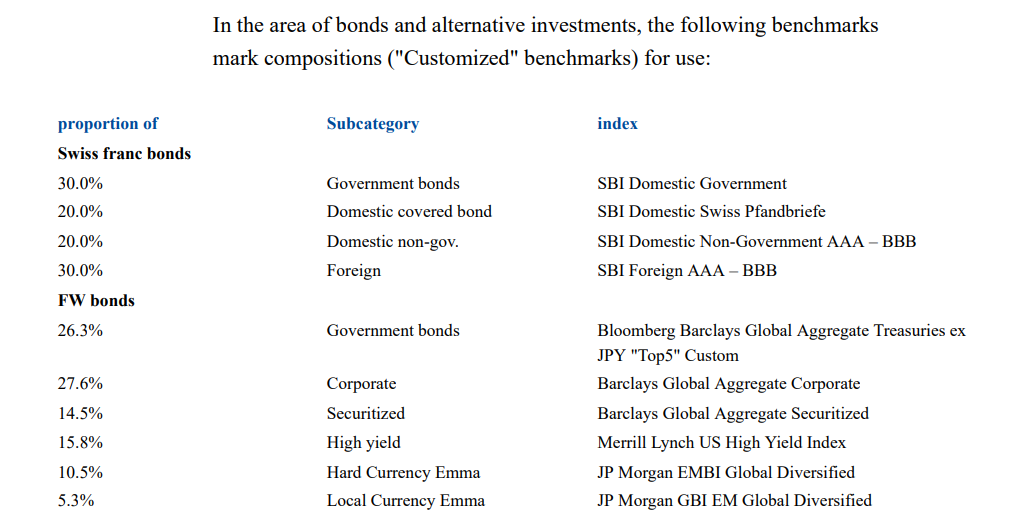

BVK provided clear and comprehensive asset class benchmark disclosures, including custom blended benchmarks where applicable.

Source: BVK Annual Report 2019 (page 34-35)

Overall Results

Switzerland.

Funds Analysed

BVK

BVK is the pension fund for employees of various entities of the canton of Zurich. BVK covers more than 124,000 members 450 affiliated employers and has pension assets of 35 billion Swiss francs.

Compenswiss

Compenswiss is an independent public institution that manages and administers the Swiss Federal social security funds.

Migros

Migros is Switzerland’s largest retail company, supermarket chain, and employer. It manages the pensions of over 80,000 members, representing assets of almost 26 billion Swiss francs.

PUBLICA

PUBLICA is an independent pension institution that is comprised of 13 open and seven closed pension plans, managed on behalf of public entities in the Swiss Confederation. PUBLICA covers more than 100,000 members and has total assets of 41 billion Swiss francs.

SBB

SBB is Switzerland’s national railway company. The pension fund manages the assets of 55,000 members, representing total holdings of almost 19 billion Swiss francs.