United Kingdom.

The United Kingdom ranked 6th globally with an average total score of 58.

The UK has a very mature pension industry underpinned by a national pension scheme which is paid from National Insurance Contributions – a payroll tax. This national pension scheme is supplemented by both occupational and individual pensions. Defined benefit schemes were once popular among private sector employers, but virtually all have closed and many are now frozen. A robust insurance market has developed offering employers many options for reducing or eliminating their legacy defined benefit liabilities. Defined contribution plans are now the norm for private sector workers while most public sector workers still largely accrue defined benefits.

Pensions for the public sector are largely provided through a series of nationwide occupation-based pension schemes. These schemes are unfunded. As a result four of the five funds reviewed were private sector pension schemes. The other organisation is the government fund set up to protect private sector defined benefit members in the event of insolvency.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

United Kingdom.

The UK scored 6th globally and was in the top half of scores in three of the four factors. The range of scores across the organisations was fairly narrow, from a low of 50 to a high of 65. That the UK scored as well as it did when three of the five funds scored were corporate pension funds is testament to the robust governance and disclosure standards of corporate pension schemes in the UK. The UK funds had good disclosures in many areas without excelling in any specific topic.

Cost

With an average cost factor score of 56, the UK funds ranked 7th globally. Individual fund scores were quite dispersed, two funds scored lower than 45 and two funds scored over 70. Similar to performance, asset class level cost disclosures were lacking. Conversely, the UK funds had one of the better scores in disclosures of transaction costs.

Governance

The UK funds did very well on this factor with an average score of 63, ranking them 5th globally, their highest ranking of the four factors. The range of scores was quite wide: from a low of 48 to a high of 86. The three corporate funds scored an average of 52. Fortunate for them that UK regulations require funds to produce an “Annual Report and Account” for members, including information on governance structures. Without their high scores in this component, the corporate funds would have scored quite poorly overall. Disclosure on board competencies and qualification were quite good, earning the third highest score globally with one fund receiving the only perfect score in this area.

Performance

The average performance factor score was 66 and the range in scores was fairly narrow, from a low of 61 to a high of 76. The UK’s ranking of 10th globally, the country’s lowest relative score, is perhaps a bit misleading. The UK funds scored quite well in most areas with the exception of asset class level performance disclosures, which were almost entirely absent. Had the UK funds achieved the global average score of 35 in this area (they scored 4), it would have been enough to move them up to fifth. Disclosure and quality of benchmarks was an area in which the UK funds excelled.

Responsible Investment

The UK funds scored an average of 47 on responsible investing, 7th globally. The range in scores was quite high, from a low of 24 to a high of 63. Relative scores were best for RI governance (2nd globally) and ESG integration (3rd globally). These were the two lowest scoring components within the RI factor and the positive results were reflective of decent overall disclosures without being exceptional in any particular area.

Examples

Although not much to look at, the Annual Report and Accounts that pension schemes in the UK are required to produce do contain a lot of good information on a wide range of issues. More complete in many ways than the Comprehensive Annual Financial Reports that US public sector systems are required to produce, they are much more condensed and user friendly. Were it not for these documents, the UK’s global rank would have undoubtedly been much lower. It is unknown what other jurisdictions require this level of disclosure for corporate pension plans.

Universities Superannuation Scheme

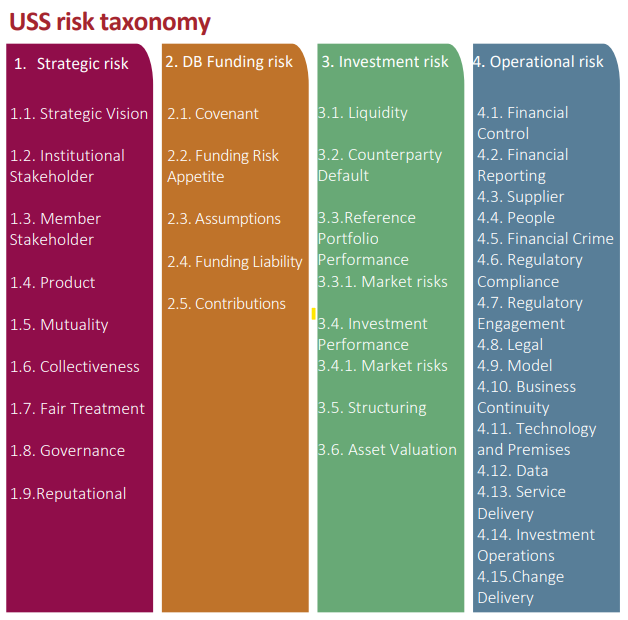

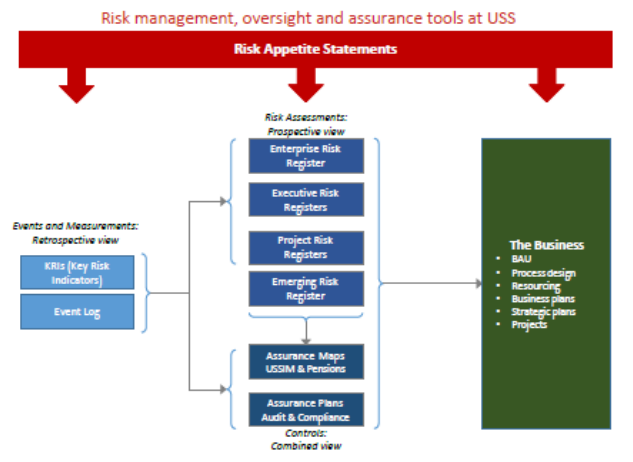

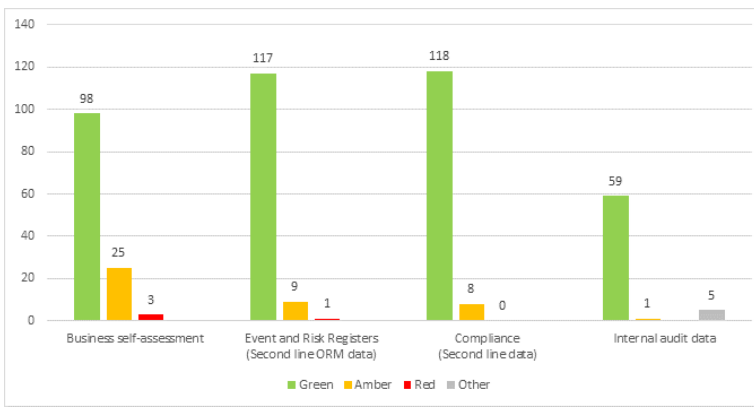

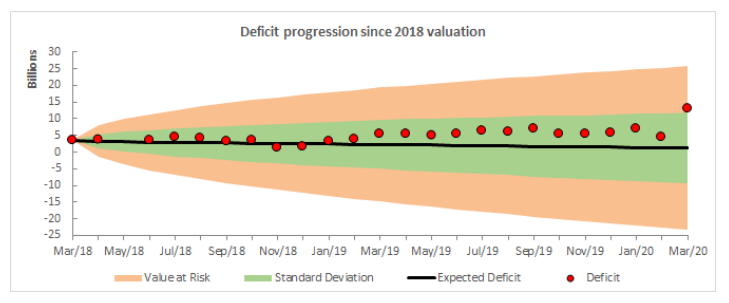

Universities Superannuation Scheme (USS) produced an eight page risk management supplement which succinctly discloses how the scheme views and manages risk.

Overall Results

United Kingdom.

Funds Analysed

BT Pension Scheme

BT Pension Scheme is the UK’s largest corporate defined benefit pension scheme with assets of about £40 billion ($60 billion). The scheme closed to new members in 2001 but remains responsible for securing the long-term financial wellbeing of approximately 320,000 current and future pensioners.

Lloyds Bank Pension Scheme

Lloyds Bank Pension Scheme No. 1 is a pension scheme for employees of Lloyds banking group which has both a closed defined benefit provision and defined contribution provision.

NatWest Group Pension Fund

NatWest Group Pension Fund (formerly the Royal Bank of Scotland Group Pension Fund) is the defined benefit pension fund for employees of NatWest Group.

Pension Protection Fund

Pension Protection Fund is a statutory fund which holds assets to be used to protect members of defined benefit plans if their pension fund becomes insolvent.

Universities Superannuation Scheme

Universities Superannuation Scheme is the largest private sector pension fund in the UK and is the principal pension scheme for universities and higher education institutions in the UK.