United States.

The United States ranked 10th globally with an average total score of 54.

The public disclosures of the five largest pension fund organisations were reviewed. All organisations reviewed manage funds backing the pension entitlements of public sector workers. The United States has a large, mature and fragmented pension market. Many states as well as some counties and municipalities have one or more plans for their public sector employees. Private sector pensions are provided by employers or employer/employee associations. On a federal level, social security provides retirement and other benefits, paid by a combination of payroll taxes and a reserve fund.

Historically, defined benefit plans were the predominant type of retirement plan for both public and private sector workers. Since the turn of the century there has been a concerted move away from defined benefit structures to cash balance and pure defined contribution structures among private sector employers. Pension arrangements for public sector employees are still commonly defined benefit plans, although the last 10 years has seen hybrid defined benefit/defined contribution designs become more common.

Pension arrangements in the United States are highly regulated. Private sector arrangements are governed by ERISA whereas public sector pensions follow regulations determined by the respective state legislative bodies. In addition to these regulations, pension plans must also abide by tax regulations. In fact, it is sections of the US tax code that give rise to the names of many defined contribution arrangements in the US such as 401(k), 403(b), and 457 plans.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

United States.

Disclosures of American public pension funds are heavily influenced by GASB standards and the disclosures required as part of their Annual Comprehensive Financial Reports (ACFR’s). The higher scoring funds supplement information in their ACFR’s through their websites. Like the ACFR’s though the information could be better organised. American systems scored first overall in performance disclosures but did less well in other areas, 10th in responsible investing, 11th for cost, and 11th for governance disclosures. Their overall score was 54, an improvement over last year and now equal to the global average. The range of scores was from a joint low of 35 to a high of 72.

Cost

American funds ranked 11th with an average score of 43. Individual scores varied significantly, with a low of 4 to a high of 68. The average score has improved slightly compared to last year, led by two funds who have revamped their disclosures and provided more fulsome discussion of costs. However, the standardized financial reports from the US funds generally did not provide much salient cost information. Total fund cost disclosures and transaction cost disclosures remain a weakness relative to the global universe.

Governance

The American funds scored poorly on governance disclosures with an average score of 54. Scores were up slightly year over year, and their position in the global ranking improved one placing to 11th. The range of scores was wide: from a low of 35 to a high of 71. While two funds made improvements to their disclosures in the area of compensation, HR and organisation, this area continued to be an issue. The US funds were reticent to disclose actual compensation for board and management. The US was one of three countries where no disclosures were made of individual board member compensation and similarly, one of five countries with no disclosure of management compensation. Even for higher scoring funds, it was often necessary to refer to several documents and/or web pages to find all relevant information.

Performance

The American organisations held on to their first place ranking in this factor. The average score increased slightly to 84 and the disclosures of three of the funds were more complete than last year. The top three fund scores in cost belonged to US funds. While there was a lot of information disclosed across all components, it was not always done in the most cohesive and convenient manner. Unfortunately, it was often necessary to refer to several documents and/or web pages to find all relevant information.

Responsible Investment

This continued to be a weak factor for the American organisations. The global rank of 10th was maintained with an average score of 43. There was a wide disparity in the scores, from a low of nil to a quite respectable 71. Disclosure of active ownership policies was the highest scoring area, both nominally and relatively, having seen the highest increase in score year on year. Consistent with last year, disclosure of exclusion policies remained the weakest for US funds with all but one fund silent in this regard.

Example

The performance disclosures required under GASB as part of the CAFRs resulted in a wealth of performance information being disclosed. We would have liked the information to be have been better organised. It is unfortunate that more governance, cost and responsible investing disclosures are not required by the GASB.

CalPERS

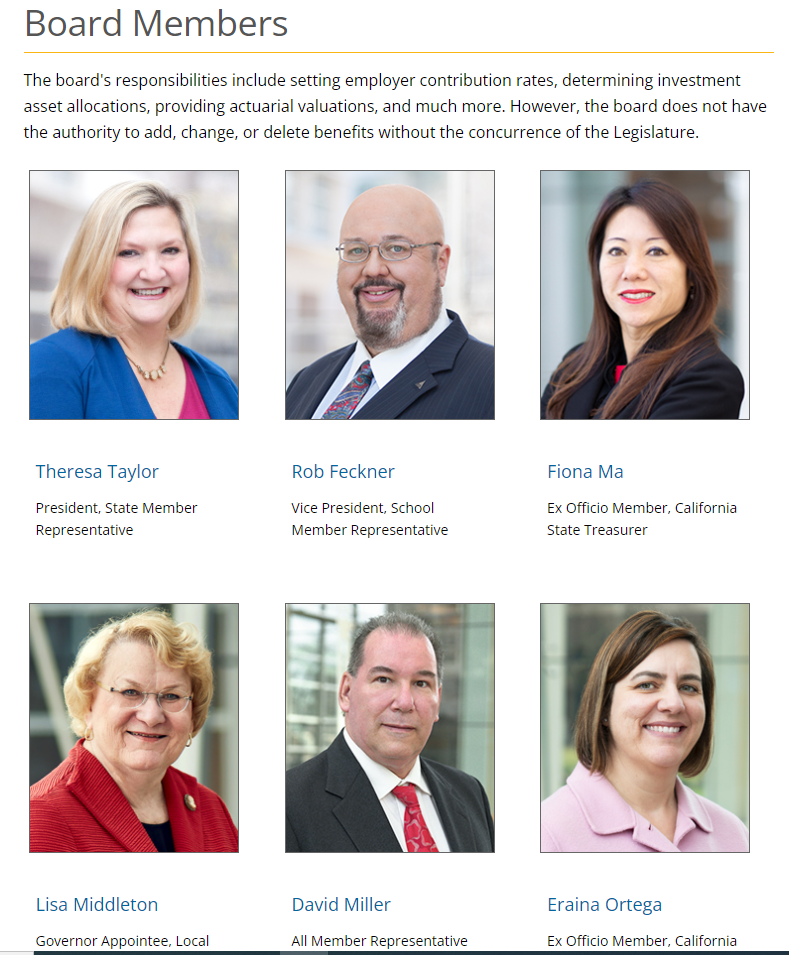

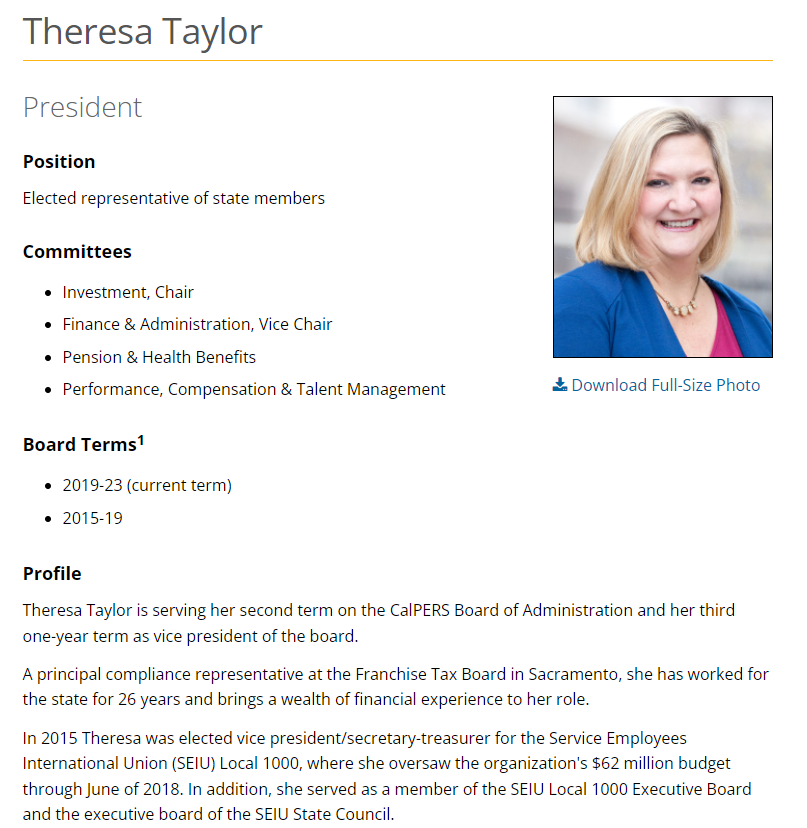

CalPERS’ website provides easy access to information on its board members on its website. By clicking on each member, interested parties can view the experience and qualification of each board member. The member’s term/how they are appointed is a nice touch.

Source: https://www.calpers.ca.gov/page/about/board/board-members