Responsible Investing.

Results Overview

Responsible Investing.

The responsible investing factor was assessed by looking at three criteria

1. Responsible investing framework and reporting

Average country score: 47

Responsible investing framework and reporting was one of the higher scoring components. Sweden really stood out with a score of 92. The scores for the Swedish funds ranged from 80 to 100 (two funds had a score of 100). This type of consistency was not seen among funds in other countries and is not surprising given the legal rules for responsible investing implemented in Sweden. Part of this new legal framework is uniform reporting guidelines that impact the largest funds.

On the other end of the spectrum, Mexico had the lowest score for this component with a score of 7. Some funds in Mexico disclosed they had a responsible investing policy and/or responsible investing was included as part of the mission/values/overall strategy of the fund, but no other disclosures within this component were provided.

- 93% of all funds disclosed that they had an established policy/framework for RI

- 77% of all funds disclosed that they had a climate change policy (either as part of the overall RI policy or as a stand-alone policy)

While most funds disclosed that they had an RI policy/framework, specifics on targets and measuring outcomes were not as robust. This is an area where improvement is possible and necessary: what are the goals and targets and how are they measured and tracked.

- 56% of all funds disclosed their goals/targets for responsible investing

- 49% of all funds disclosed how they have progressed on their responsible investing goals/targets

Questions relating to responsible investing framework and reporting

- Has the fund established a policy/framework for responsible investing?

- Does the fund include a climate change policy (either as part of the overall RI policy or a distinct stand-alone policy)?

- Are responsible investing processes/reports verified by an independent third party?

- Is ESG/sustainability included as part of the mission/values/overall strategy for the fund?

- Are goals/targets for responsible investing disclosed and clearly laid out?

- Does the fund provide how they have progressed on their RI goals/targets (eg. year over year changes/improvements)?

- Are quantitative KPIs included as part of the progress report on RI goals/targets?

- Does the fund comply with the Global Reporting Initiative (GRI) for reporting purposes?

- As part of the climate change goals, does the fund provide data on its portfolio’s carbon footprint?

- Does the fund disclose the climate-related risks and opportunities for investments/(and/or portfolio)?

- If the fund does disclose climate-related risks and opportunities, does the fund follow the recommendations as outlined by the Task Force on Climate-related Financial Disclosures (TCFD)?

2. Responsible investing governance

Average country score: 33

Responsible investing governance was one of the lower scoring components. For RI to be successfully implemented there needs to be oversight and accountability. For this component, marks were provided for disclosures that clearly laid out where the oversight of responsible investing resides and who is accountable for ensuring that RI policies are implemented. There were a few countries where RI was part of the board’s oversight across all funds (Finland, South Africa, Sweden, and the UK).

- 65% of all funds disclosed whether RI is part of board oversight

- 49% of all funds disclosed whether there is a designated role/team to oversee the RI mandate for the fund

- 47% of all funds disclosed how RI is integrated at the executive management level

Questions relating to responsible investing governance

- Does the fund disclose whether responsible investing is part of the board’s oversight?

- Does the fund disclose how responsible investing is integrated at the executive management level (i.e., CEO, CIO, etc.)?

- Has the fund disclosed a designated role/team to oversee the responsible investing mandate for the fund?

- Is responsible investing integrated within each asset class team?

- Does the fund disclose whether responsible investing has an impact or is a component of staff compensation?

- Does the fund disclose whether responsible investing has an impact on the organisation’s scorecard?

- Does the fund disclose whether ESG training or education is provided to its staff?

- Does the fund disclose how it engages with its members on ESG related matters (i.e., survey members on ESG)?

3. Responsible investing implementation

The Responsible investing implementation component was divided into four categories representing the most common strategies.

i. Exclusion

Average country score: 38

Exclusion refers to the strategy of using negative screening or enhanced ESG monitoring as part of the investment process. Exclusion was most common in the Netherlands. Every fund in the Netherlands used exclusion as part of the investment process and disclosed the criteria used for screening and provided a detailed list of excluded investments.

- 60% of funds disclosed whether a negative screen or enhanced ESG monitoring was used as part of the investment process

- 43% of funds disclosed the criteria used for negative screening (exclusion policy) or enhanced monitoring

ii. Active ownership

Average country score: 51

Active ownership refers to engaging with and influencing companies to conduct their business in a way that promotes responsible investing and aligns with ESG factors that the fund is focused on. Included in active ownership is active participation in shareholder meetings and exercising voting rights. Compared to the other implementation strategies, active ownership scored the highest. Even some countries that scored poorly in other components of RI or scored poorly overall tended to score higher on active ownership. This may be because funds starting to implement RI typically focus first on public equities and active ownership is a key implementation strategy for this asset class. Canada had the highest average score for active ownership at 99. This was one area that was consistent across funds in Canada. All Canadian funds disclosed an active ownership strategy that outlined engagement activities and all actively participated in shareholder meetings and exercising voting rights. On the other hand, exclusion was one of the lowest scores for Canada with an average score of 19. Clearly, active ownership is the preferred strategy in Canada.

- 63% of all funds disclose an ownership policy that outlines engagement activities with investees

- 59% of all funds disclose a policy for active participation in shareholder meetings and exercising voting rights (either in person or by proxy)

- 59% of all funds provide the number of shareholder meetings participated in and votes cast

iii. Impact investing

Average country score: 37

Impact investing refers to the strategy of investing in opportunities that promote sustainability (eg, renewable energy, green bonds, etc.). Most of the European countries aligned their impact investing with the United Nations Sustainable Development Goals.

- 56% of all funds disclosed that investments were made in companies that promote sustainability

- 45% of all funds provided list or examples of investments made as part of their impact investing program

- 43% of all funds utilise or align with the United Nations Sustainable Development Goals (SDGs)

iv. ESG Integration

Average country score: 26

ESG integration refers to how funds integrate RI across the different asset classes and total portfolio. Funds were scored on disclosing RI policies for external managers, for investment/asset class level frameworks and for disclosing the impact of ESG integration across the fund. ESG integration scored the lowest within the implementation component. The Netherlands scored the highest with an average score of 55 with most funds disclosing their RI policy for external managers and all were Principles for Responsible Investing (PRI) signatories.

- 63% of all funds disclosed they were PRI Signatories

- 43% of all funds disclosed RI policies for external managers (including climate change specifics)

- 33% of all funds disclosed that ESG factors are taken into consideration as part of risk management

Questions relating to responsible investing implementation

Exclusion

- Does the fund use negative screening or enhanced ESG monitoring as part of the investment process?

- Is the criteria used for negative screening (exclusion policy) or enhanced monitoring provided?

- Does the fund implement an exclusion/negative screening/enhanced monitoring for each asset class?

- Does the fund disclose the number of exclusions (eg. 300 investments are excluded)?

- Does the fund provide a detailed list of excluded investments (individually listing investments that are excluded)?

Active ownership

- Does the fund have and disclose an ownership policy that outlines engagement activities with investees?

- Does the fund summarise engagement activities conducted and what the resulting outcome was?

- Does the fund disclose which ESG factors the fund is focused on or prioritising in its engagement efforts?

- Does the fund provide a breakdown of the engagement efforts undertaken categorised by each ESG factor?

- Is the policy for active participation in general shareholder meetings and exercising voting rights (either in person or by proxy) disclosed?

- Does the fund provide examples of their voting record?

- Does the fund provide the number of shareholder meetings and votes cast?

- Does the fund disclose its policy on nominating board of directors?

- Does the fund’s active ownership policy outline requirements for board composition?

- Does the fund’s active ownership policy outline requirements for remuneration/executive pay?

- Does the fund’s active ownership policy have an embedded climate change policy?

- Does the fund’s active ownership policy have an embedded ESG policy?

- Does the fund provide access to their voting records?

Responsible investing implementation – Impact Investing

- Does the fund invest in companies that promote sustainability (eg. microfinance, renewable energy, green bonds, etc.)?

- Do the impact investing strategies utilise or align with the United Nations, Sustainable Development Goals?

- Does the fund provide a list/examples of investments that are part of impact investing?

- Does the fund disclose its goals for impact investing for the investments discussed?

- Does the fund disclose the results of impact investing (what was achieved) for the investments discussed?

- Does the fund disclose the dollar value (or % of assets) that impact investments accounted for?

- Does the fund implement impact investing across all relevant asset classes?

Responsible Investing Implementation – ESG Integration

- Does the fund disclose if it is a PRI signatory (participate in the United Nations Principle for Responsible Investing)?

- If the fund does disclose it is a PRI signatory, does the fund provide its annual PRI assessment report (including the summary scorecard)?

- Does the fund disclose its policy for responsible investing for external managers (including specifics such as climate change)?

- Does the fund disclose whether or not external managers are required to be PRI signatories?

- Does the fund disclose/include the impact of ESG factors on risk management?

- Does the fund use an investment level framework SASB (Sustainability Accounting Standards Board) to help identify material ESG issues/risks for an investment?

- Does the fund disclose how responsible investing is integrated into the investment process for each asset class?

- Does the fund use a third party to assess the ESG performance or compliance of private assets or investments (i.e., GRESB, etc)?

- Does the fund disclose the goal/mandate for ESG integration across the portfolio ($ or % of portfolio)?

- Does the fund disclose how they are progressing on integrating ESG ($ or % of portfolio changes year over year)?

To view all questions to each component, visit the Methodology page here.

Average country score

Highest score

Responsible investment questions asked

Overall Results

Responsible Investing.

Overall Ranking

1.Sweden

2.The Netherlands

3.Denmark

4.Canada

5.Finland

6.Norway

7.United Kingdom

8.Australia

9.South Africa

10.United States

11.Switzerland

12.Japan

13.Brazil

14.Chile

15.Mexico

“We are made wise not by the recollection of our past, but by the responsibility for our future.”

George Bernard Shaw

Responsible Investing.

Funds were scored based on 54 questions across three major components. The average country score was 41 out of 100, the lowest average score compared to the other three GPTB factors (performance, cost and governance). Responsible investing (RI) also had the greatest dispersion among average country scores as different countries are obviously at different stages of implementing responsible investing and providing disclosures. The average country scores ranged from 2 to 73.

Sweden led the way, with an average country score of 73, closely followed by the Netherlands with an average country score of 71. The countries with the highest average RI score tended to also have higher scores in implementation, particularly active ownership, and impact investing.

The Nordic countries – Sweden, Denmark, Finland, and Norway – did very well on RI as a region, with all countries ranked in the top six.

1. Responsible investing framework and reporting (30% of responsible investing factor score)

The starting point is to assess whether disclosures lay out how RI is part of the overall strategy for the fund. This includes the goals and targets for RI and whether disclosures include the progress made towards these goals and targets. The verification of RI disclosures by independent third parties and alignment with emerging global standards for RI reporting (GRI – Global Reporting Initiative and TCFD – Task Force on Climate-related Financial Disclosures) was also considered.

2. Responsible investing governance (15% of responsible investing factor score)

For RI to be successful there needs to be accountability. The responsibilities for oversight and implementation need to be clearly laid out. Important considerations in evaluating disclosures around governance include whether RI is part of the board’s oversight and how it is integrated within the organisation including executive management oversight and whether there is a dedicated role or team.

3. Responsible investing implementation (55% of responsible investing factor score)

Evaluation of implementation disclosures covers the key policies that funds use to implement RI. Funds are scored on whether actual activities and specific metrics are provided. Funds do not necessarily have to employ all these implementation strategies. However, transparency around not employing specific policies is considered. The key implementation policies included in the assessment are:

- Exclusion

Disclosure of screening and monitoring criteria used to assess eligibility of investments. For instance, some funds exclude tobacco companies and list excluded investments. - Active investing

Disclosures around ownership policies that outline how funds engage with investees to bring about change that aligns with RI investing policies, values, and goals. For instance, funds are scored on whether disclosures around voting records, engagement statistics, etc. are provided. - Impact investing

Disclosures on how funds invest to promote sustainability. Assessments include whether key focus areas or goals are provided, metrics such as % of portfolio impacted, and examples of investments (i.e., investing in renewable energy to reduce carbon footprint). - ESG integration

Disclosures related to the various ways responsible investing is implemented across the portfolio, including whether RI is part of the criteria for evaluating external managers and if it is included in risk management processes.

Best Practices

What – A separate section or supplemental report related to the policies, targets, engagement efforts, and outcomes to determine the status of responsible investing (RI).

Why – Funds with a supplementary responsible investing report or a separate section in their annual report typically have much better RI disclosures than those that do not. European countries – Sweden, the Netherlands, Denmark, and Finland – earned the four highest scores on the RI factor. Two things stood out 1. funds in these countries generally have more highly developed responsible investing efforts 2. excellent disclosures communicated via supplemental RI reports or dedicated annual report sections.

Providing separate sections or standalone RI reporting allows funds to clearly communicate their RI strategy and progress as well as to highlight the specific RI themes they are focused on (e.g., renewable investments, water management, human rights, etc.). It also helps stakeholders to quickly and easily assess whether a fund takes RI seriously and what is being done.

How – RI policies, activity, and outcomes should be disclosed in a clear manner in the responsible investing section of annual reports or in supplementary reports. These disclosures should include:

- A clear description or table showing achievements in the past year and goals for the coming year along with quantifiable metrics

- Information on how responsible investing is implemented for each asset class

- Clear philosophy on exclusion policy, criteria, and activity

- List of engagement efforts taken, including metrics around shareholder meetings and a detailed list of voting activity

Best practice examples:

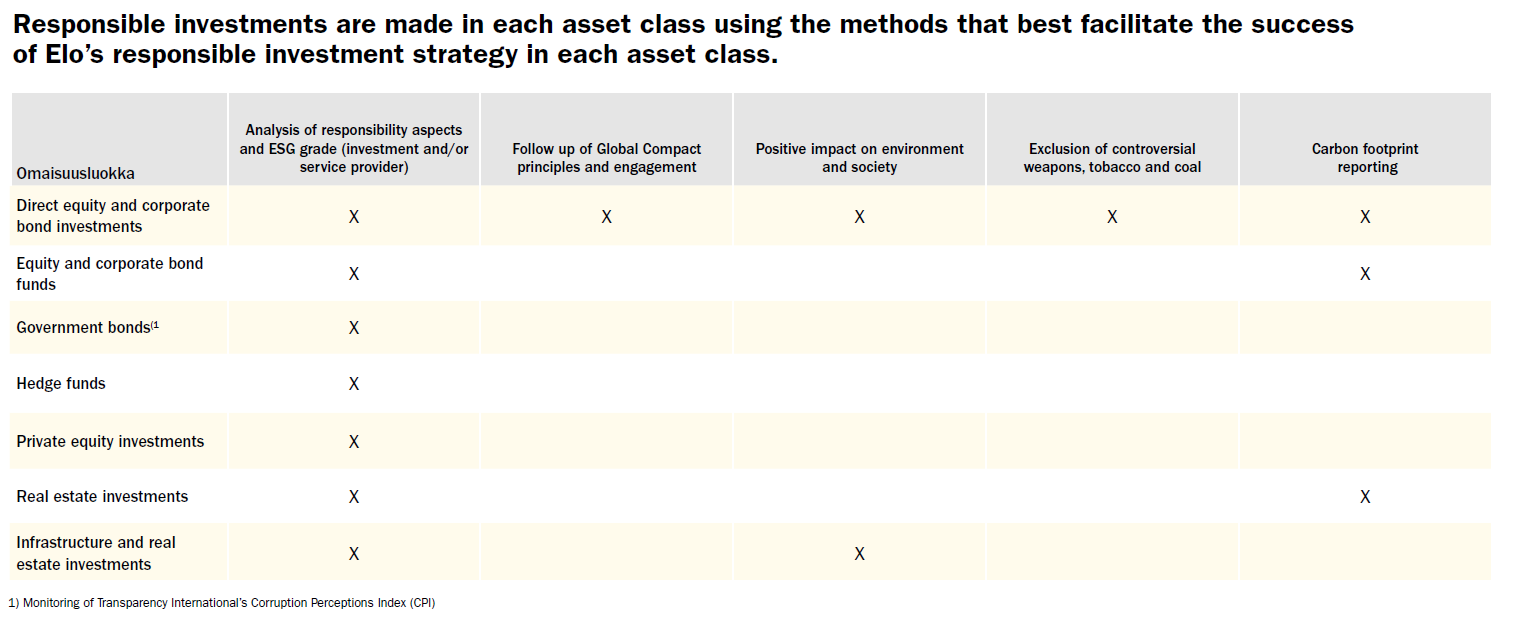

Elo

The example below is from Finnish Fund Elo’s 2019 annual and responsibility report. Elo’s responsible investing initiatives were incorporated into its annual report and Elo provided RI details by focusing on: investing, climate, customers, personnel, and operating methods. The use of visuals and graphics highlighted areas of focus, their investment themes across different asset classes and disclosed details on carbon emission reporting.

Source: Elo’s Annual and Responsibility Report 2019 (page 19)

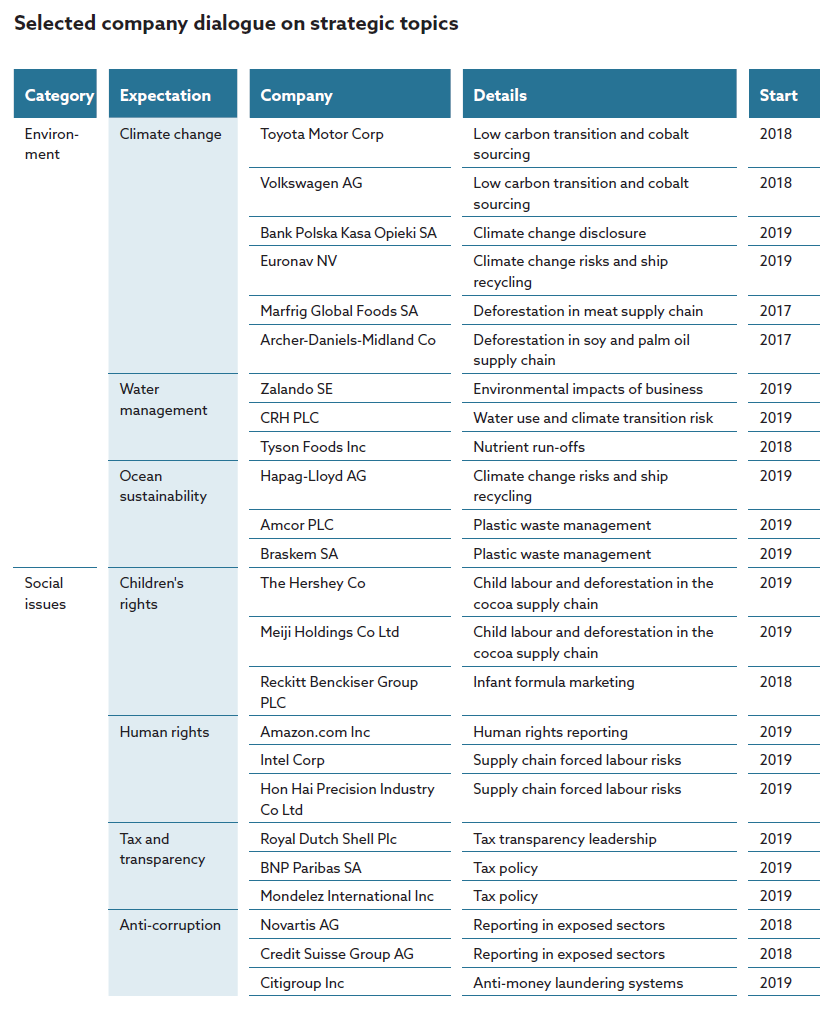

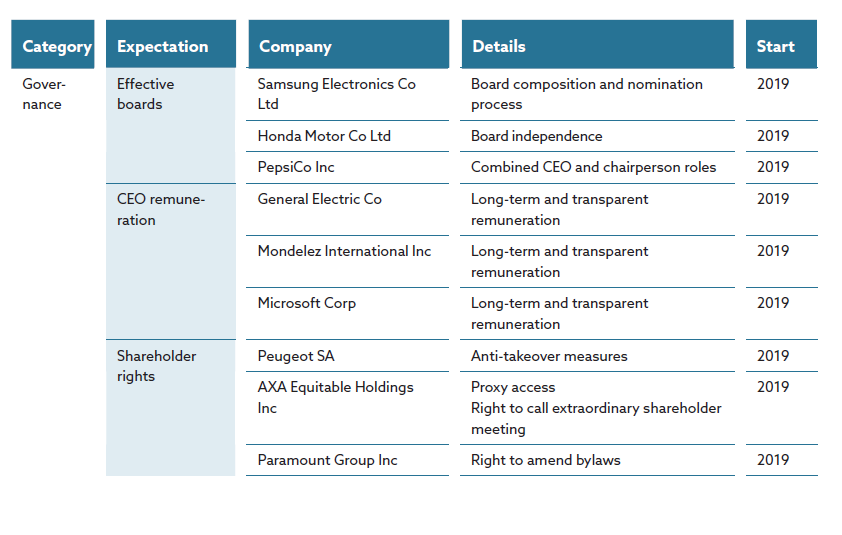

Norwegian Government Pension Fund

The example below is from the Norwegian Government Pension Fund Global responsible investing report. This is from the report’s dialogue section which highlights the fund’s engagement activities with its largest investees. The table is clear, and included break outs by category, company name, themes, and start date of dialogue.

Source: Norwegian Government Pension Fund Global Responsible Investing Report 2019 (page 52 and 53)

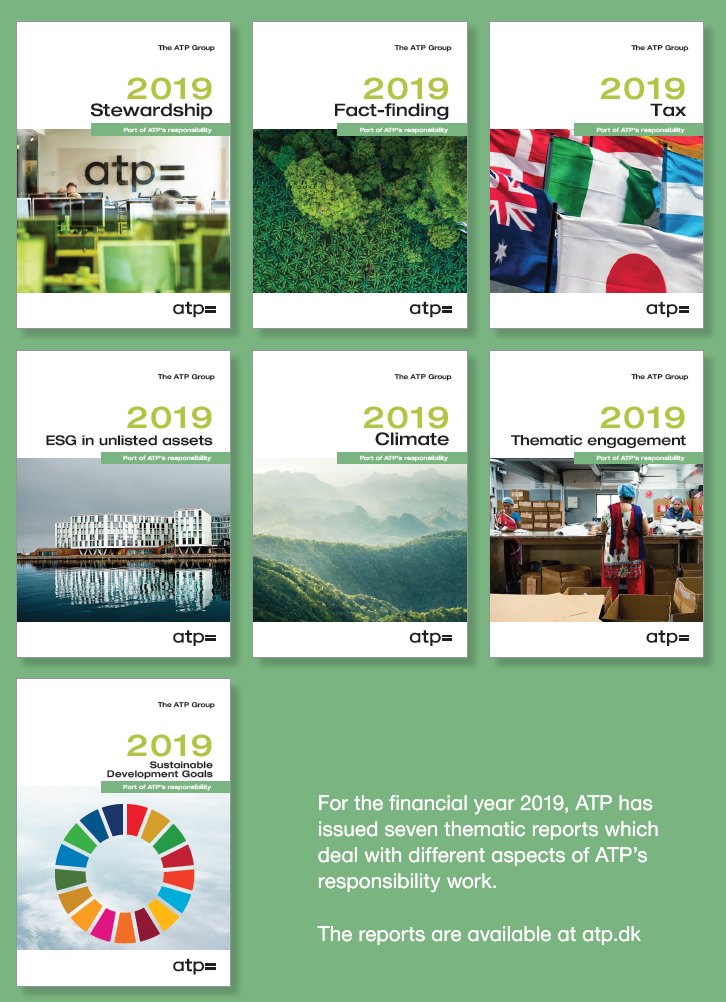

ATP

The example below is from Danish Fund ATP. Many funds across the globe had a separate responsible investing report. ATP was one of the few that published individual annual reports across the different responsible investing themes the fund is focused on. The reports provided the processes and activities across each focus area in one easy to access place.

Source: ATP Responsible Investing Report 2019 (page 5)