The world in which pension organizations operate is undoubtedly becoming more complex. Not only have organizations needed to adapt to low interest rates and changes in capital markets since the financial crisis, but also the need to navigate within the framework of climate change and sustainability. That is before we even consider the impact of the COVID-19 pandemic.

Pension organizations must continuously adapt to these changing conditions to be successful over long time horizons. Stakeholders are right to be concerned about an organization’s ability to innovate and succeed long-term. These concerns can be addressed through transparent communication.

Reviewing the disclosures of 75 global pension organizations for the Global Pension Transparency Benchmark (GPTB) found that only 36 per cent of organizations made public disclosures regarding their organizational strategy that went beyond disclosures of economic and market conditions and the impact on the performance of their investments. Clearly there is room for improvement in communicating key corporate activities to stakeholders. This article explores some of the ways that funds may go about doing so.

About the Global Pension Transparency Benchmark

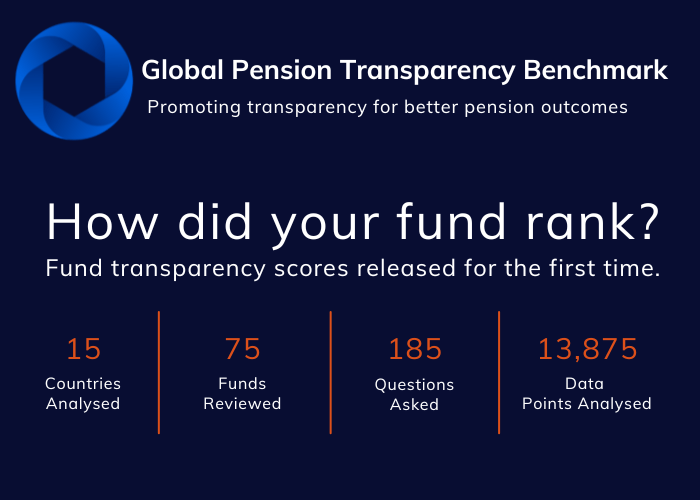

The Global Pension Transparency Benchmark (GPTB), a collaboration between Top1000funds.com and CEM Benchmarking, was launched in 2021. The GPTB is a world first for pension fund disclosure, bringing a focus to transparency in a bid to improve pension outcomes for members. The public disclosures of key value generating elements for the five largest pension organisations across 15 countries were reviewed in the inaugural annual assessment.

The GPTB framework examines four high-impact value-driving factors: governance and organisation, performance, costs, and responsible investing, which are scored by assessing almost 200 specific components.

The reviews cover fund websites, annual reports, financial statements, and various other published documents. Disclosures are scored objectively, mainly using yes/no answers related to what is disclosed/not disclosed.

Disclosures related to performance results are scored but the relative outcomes themselves are not scored. Clearly, outcomes are important. However, it is not useful to compare them across funds globally because of differences in plan types, organisational mandates, and regulatory frameworks.

In developing the GPTB framework, we recognised that disclosure quality cannot be completely captured by simple objective questions. Communication quality – clarity, cohesiveness, brevity, plain language, use of infographics – is difficult to measure objectively, but it is vital to ensure that key information is read and understood by stakeholders. Therefore, we decided to highlight communication quality through our selection of best practice examples.

Communication quality ranged widely across funds. Some reviews were frankly painful to do because of poor communication quality, even when disclosures and transparency scores were reasonable. In contrast, the communication quality of some of the material we reviewed was outstanding. We found that the small group of funds that prepared Integrated Annual Reports were among the very best.

Disclosing organizational strategy: Moving beyond investment performance

Organizations are generally quite forthcoming about their fund performance and how it was impacted by external economic factors. The review of funds for the GPTB revealed that:

- 95 per cent of organizations reviewed provided commentary on economic and market conditions; and

- close to two thirds of organizations provided forward looking statements on how they saw economic and market conditions impacting their fund in the future.

Although undoubtedly important, how a pension organization navigates economic and market conditions is only one piece of the puzzle.

Pension organizations, especially large globally focused pension organization, are better viewed as corporate entities who must effectively manage more than just their stock of financial capital to be successful over long time horizons. The Integrated Reporting, or <IR> framework provides a guide as to what pension organizations should be disclosing to stakeholders and defines the following capitals:

Financial capital – The pool of funds that is available to the organization for use in the provision of pensions and available to generate returns to meet future obligations. Pension organizations currently focus most or all of the disclosures on this capital.

Manufactured capital –In the context of pension organizations, this capital represents the buildings and more importantly the IT infrastructure and systems used to create value. Organizations must ensure that its IT systems are fit for purpose of managing risks and that such systems innovate as new risks emerge or gain in importance. This capital also encompasses the operation of satellite offices to enhance value creation in foreign assets.

Intellectual capital – Not only must organizations ensure adequate physical infrastructure, but they must also ensure that proprietary economic, risk and reporting models remain relevant and reflect both current realities and anticipated changes.

Human Capital – Pension organizations must ensure that they possess the requisite human capital to enact their investment strategy. This is especially pertinent when organizations choose to insource investment management, risk and other functions.

Social and relationship capital – This category of capital would include not just disclosure and communications to stakeholders but also how the organization navigates the political realities in both their home jurisdiction as well as globally. By virtue of their size and importance in the provision of pensions on a national level, pension organizations will often have to work with both governments and NGOs to ensure that they are able to create value both for their direct stakeholders and society as a whole.

Natural capital – Similar to social and relationship capital there are two lenses with which to view this capital. First from the lens of the organization’s own natural footprint. Although often viewed as relatively minor, communication in this regard can help foster better social and relationship capital. More important is how funds deal with natural capital through their stewardship and active ownership endeavours, ensuring that financial capital continues to generate value over the long-term.

How leading organizations are communicating corporate strategy

The example below from Canada’s PSP Investment Board shows that effective disclosures on corporate strategy don’t have to be long and complex. In a single page they effectively distill the major items of their organizational strategy, covering topics such as:

- The management of their human capital through discussion of development and retention of staff; and

- The growth of their stock of intellectual and manufactured capital by increasing their global footprint and investment in new systems to increase operational efficiency.

Michael Reid is vice president, relationship management at CEM Benchmarking.