Comprehensive, holistic value disclosures and compelling communication are key benchmarks for pension funds. This has been confirmed by the first year experience working with leading global pension funds for the Global Pension Transparency Benchmark, a collaboration between Top1000funds.com and CEM Benchmarking. In year two, in recognition of this belief and communication excellence, we have decided to award bonus points to funds preparing <IR> Framework integrated annual reports. Mike Heale looks at four examples of pension funds already using the <IR> Framework.

Comprehensive disclosures and compelling communication are a winning combination for pension funds.

Transparency and effective communication are two critically important success factors for pension funds. Together they are a winning combination that help to build trust, improve strategic focus and clarity, enhance stakeholder relationships, increase engagement with plan members and employees and drive better outcomes.

Pension funds have two readily accessible opportunities for improving their transparency and communication quality:

- Utilize the Global Pension Transparency Benchmark

- Adopt the <IR> framework and prepare an Integrated Annual Report

About the Global Pension Transparency Benchmark

The Global Pension Transparency Benchmark (GPTB), a collaboration between Top1000funds.com and CEM Benchmarking, was launched in 2021. The GPTB is a world first for pension fund disclosure, bringing a focus to transparency in a bid to improve pension outcomes for members. The public disclosures of key value generating elements for the five largest pension organisations across 15 countries were reviewed in the inaugural annual assessment.

The GPTB framework examines four high-impact value-driving factors: governance and organisation, performance, costs, and responsible investing, which are scored by assessing almost 200 specific components.

The reviews cover fund websites, annual reports, financial statements, and various other published documents. Disclosures are scored objectively, mainly using yes/no answers related to what is disclosed/not disclosed.

Disclosures related to performance results are scored but the relative outcomes themselves are not scored. Clearly, outcomes are important. However, it is not useful to compare them across funds globally because of differences in plan types, organisational mandates, and regulatory frameworks.

In developing the GPTB framework, we recognised that disclosure quality cannot be completely captured by simple objective questions. Communication quality – clarity, cohesiveness, brevity, plain language, use of infographics – is difficult to measure objectively, but it is vital to ensure that key information is read and understood by stakeholders. Therefore, we decided to highlight communication quality through our selection of best practice examples.

Communication quality ranged widely across funds. Some reviews were frankly painful to do because of poor communication quality, even when disclosures and transparency scores were reasonable. In contrast, the communication quality of some of the material we reviewed was outstanding. We found that the small group of funds that prepared Integrated Annual Reports were among the very best.

About the International Integrated Reporting framework and integrated annual reports

The International Integrated Reporting framework and integrated thinking principles have been developed and are used around the world in over 70 countries. The <IR> Framework and Integrated Thinking Principles are now maintained under the auspices of the Value Reporting Foundation, a global non profit organisation that offers a comprehensive suite of resources designed to help businesses and investors develop a shared understanding of enterprise value—how it is created, preserved, or eroded. The resources—including integrated thinking principles, the Integrated Reporting Framework, and SASB —can be used alone or in combination, depending on business needs.

The main goal of an integrated annual report is to concisely explain to all stakeholders how an organization creates value over time. The value paradigm is holistic. It includes internal value creation factors as well as external environmental and social impacts. The <IR> Framework defines six capitals – financial, manufactured, intellectual, human, social and relationship and natural – as stocks of value that are increased, decreased, or transformed through the activities and outputs of the organization.

The <IR> Framework is now applied by a wide range of organizations – corporations, non-profits as well as pension funds and other asset owners. It takes a principle‑based approach. Here are the seven guiding principles that shape the content and presentation format of an integrated annual report.

Strategic focus and future orientation – insight into strategy and how it is intended to create value in the short, medium, and long term.

Connectivity of information – a holistic view of how internal and external factors interact and impact value creation over time.

Stakeholder relationships – insight into the nature and quality of the relationships with key stakeholders.

Materiality – focus on what really matters.

Conciseness – brevity drives focus on what really matters. The pension fund integrated annual reports featured in this article averaged 88 pages. Some of the annual reports reviewed for the GPTB were over 200 pages.

Reliability and completeness – balanced and accurate presentation of all material matters, both positive and negative.

Consistency and comparability – present information consistently over time and in a format that facilitates comparisons with similar organizations.

Pension fund disclosure examples

In keeping with the adage that a picture is worth a thousand words, below are disclosure examples from four pension funds that prepare integrated annual reports. We have highlighted how these disclosures align with <IR> Framework requirements, principles, and effective communication generally, as well as how they incorporate some of the key disclosure elements specified in the GPTB.

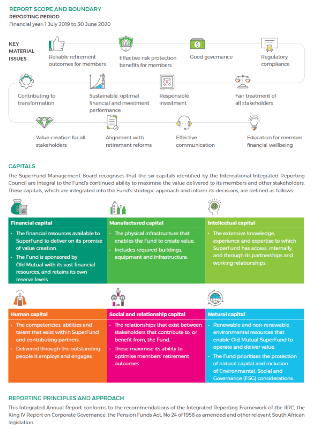

Old Mutual SuperFund Integrated Annual Report 2020

Old Mutual, a South African fund, provides a clear, plain language one page summary of its integrated annual report that includes:

- Report scope, principles, and approach

- Key material issues covered in the report

- The six capitals and how they apply to Old Mutual and its stakeholders

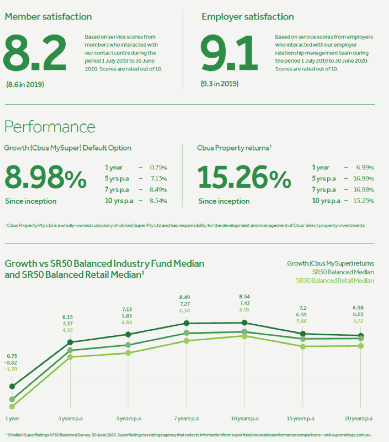

Cbus Annual Integrated Report 2020

A concise and impactful report means presenting high-level summary information and not drowning the reader in detail. Best practice is to direct the reader to other sources for additional detail, as Cbus, an Australian pension fund, has done here and throughout its report.

Elements scored in the GPTB framework that are referenced on this page:

- Governance

- Responsible Investing

- GRI and TCFD integration

- Financial and performance information

- Independent external assurances over the report

Another excerpt from the Cbus integrated report provides a one-page summary of key performance results. What we liked:

- Member and Employer satisfaction scores for current and past year

- Investment performance across multiple time periods: from current year to 20 years

- Relative performance context is provided via comparisons to comparable industry ‘benchmarks’.

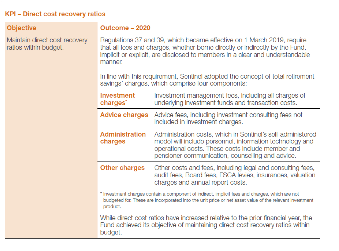

Sentinel Retirement Fund Integrated Annual Report 2020

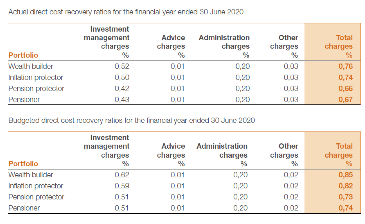

Sentinel, another South African pension fund, included cost reporting in its integrated report that scored highly in the GPTB framework:

- Plain language description and inclusion of key cost components

- Discussion of costs outside the financial statements

- Presentation basis and comparability

- Trend analysis

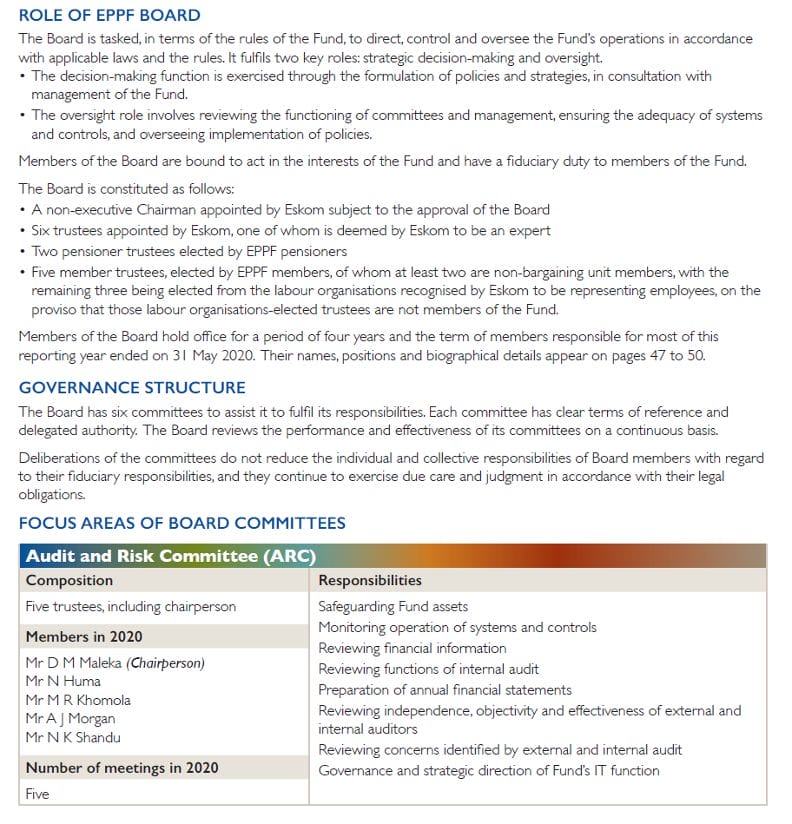

Eskom Pension and Provident Fund 2020 Integrated Report

Eskom, yet another South African fund utilizing an integrated report, included a Governance section that scored highly in the GPTB framework. Here is an excerpt. We especially liked their clear and concise reporting on:

- Role and structure of the Board

- Committee structure and responsibilities

- Board and committee member bios including relevant qualifications and experience

- Meetings held and attendance records

The GPTB and communication quality

Work is now under way on the second iteration of the Global Pension Transparency Benchmark, which will launch in early 2022. Our year one experience and interactions with leading global pension funds has confirmed our belief that comprehensive, holistic value disclosures and compelling communication are key benchmarks for pension funds. In year two, we have decided to award bonus points to funds preparing <IR> Framework integrated annual reports, to recognise their communication excellence.

To learn more about the pension funds and integrated annual reports featured in this article, visit these websites: