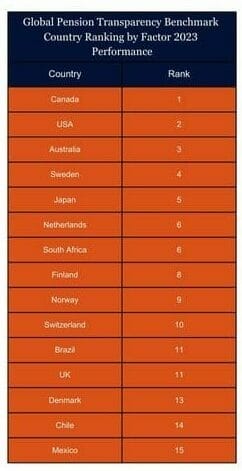

Canada is a standout in the transparency of pension fund reporting, topping the list of countries for the third year in a row, with a score of 83, and eight points clear of the next best country score.

In a benchmarking first, all five assessed Canadian funds feature in the top 10, with an average improvement in this year’s score of eight points, showcasing that improvements can be made even when funds are already demonstrating best practice.

The top five countries were rounded out by The Netherlands, Australia, Sweden and the United Kingdom.

Australia was the single biggest country improver, increasing its country score by 10 points, and making its way into the top three by nudging out Sweden.

CEM Benchmarking product lead for transparency benchmarking Edsart Heuberger said Australia’s country improvements were driven by AustralianSuper’s better performance, and by Australian Retirement Trust, a fund created from the merger of QSuper and Sunsuper, scoring much higher than QSuper alone did last year.

As well as ranking first among the countries reviewed, Canadian funds collectively were the best funds for disclosure around governance and performance. Dutch funds also deserve an honourable mention: collectively they provided the best disclosures on cost and responsible investing.

The past three years has seen gains in transparency across all factors but there is still room for improvement, particularly when it comes to transparency of disclosure around costs.

“Leading countries excel in different areas,” CEM’s Heuberger says.

“Canadians have terrific reporting on governance and investment performance, the Dutch are world-class on costs, and the Nordics excel in responsible investing.

“Generally, funds would gain the most by improving their external investment cost and responsible investing disclosures.”

The GPTB does not account for different regulatory regimes, but it acknowledges that different regulators are driving different disclosure requirements that could impact fund disclosures and comparability.

The GPTB does not account for different regulatory regimes, but it acknowledges that different regulators are driving different disclosure requirements that could impact fund disclosures and comparability.

This is seen particularly in the cost factor, where the top three scores were held by The Netherlands, Canada and Australia. The primary distinguishing factor of these leading funds is the strict regulatory environment that they operate in. (See story on factor scores.)

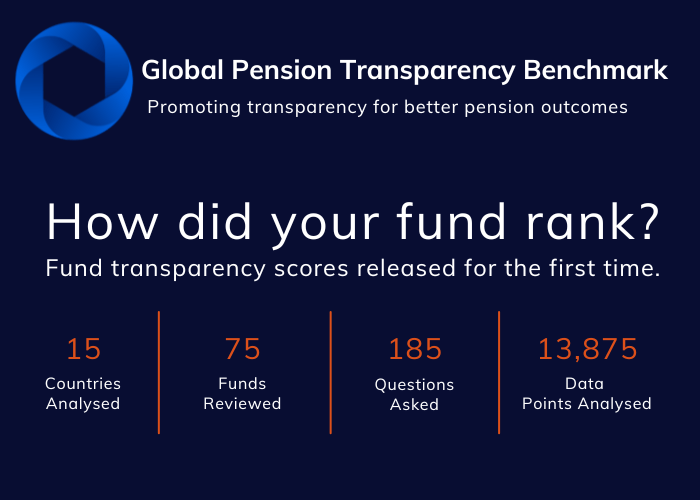

The Global Pension Transparency Benchmark is a collaboration between Top1000funds.com and CEM Benchmarking and a world-first global benchmark measuring the transparency of disclosures of 15 pension systems across the value-generating measures of cost, governance, performance and responsible investments

It ranks countries on public disclosures of key value-generation elements for the five largest pension fund organisations within each country.

The country rankings are now in their third year, with the scores of the 75 underlying funds published for the second time this year.

The GPTB focuses on the transparency and quality of public disclosures with quality relating to the completeness, clarity, information value and comparability of disclosures.

The overall scores and rankings are measured by assessing hundreds of underlying components and analysing more than 13,000 data points.

For all the scores and rankings by country, fund and factor click here