Countries

Promoting transparency for better pension outcomes

Select country to see results

Australia.

Australia ranked 4th globally with an average total score of 65.

The first pillar of Australia’s pension system is a means-tested, unfunded age-based pension that provides a basic benefit. The backbone of the country’s pension system is the second pillar, a mandatory defined contribution system with minimum required contributions for all workers which was introduced in 1992. Before the compulsory superannuation system was introduced, defined benefit schemes were the more popular form of occupational pension provision. The environment is competitive as individuals select the superannuation fund for their contributions. There are many superannuation providers which generally fall into two categories: not-for-profit industry funds and retail funds, which are offered to the public by financial services companies.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

Australia.

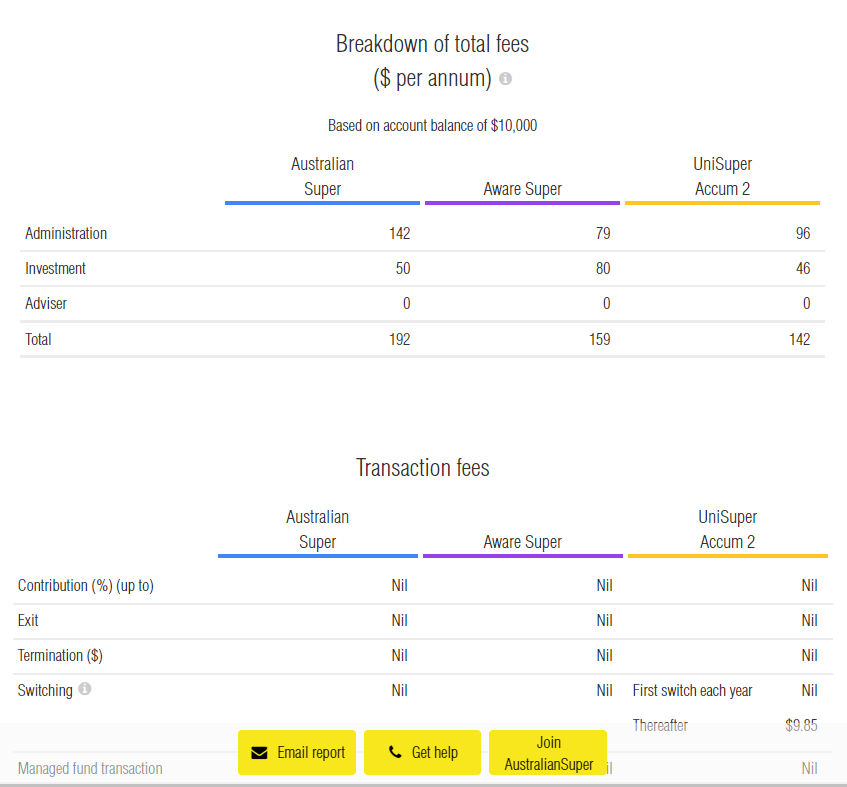

Cost

With an average cost factor score of 67, Australia’s superannuation funds ranked 3rd globally. Individual scores ranged from 58 to 84. Four of the funds offer DC options in a competitive environment, so the questions relating to completeness of external management and transaction costs were all from the perspective of product disclosure statements to members. Some of the Australian funds did a very good job of including all transaction costs (including implicit ones like market impact, buy and sell spreads, etc.) and quantifying and disclosing this to members. Commendable and not typical relative to funds globally.

Governance

The Australian funds did very well on this factor with an average score of 72, second behind Canada. The range of scores was quite narrow: from a low of 65 to a high of 80. Funds scored well in all areas except organisational strategy, which was a surprise since all super funds are fully integrated investment management and member service organisations. Members would benefit from a clearer picture of where their super fund is heading. Where the Australian funds did particularly well was in disclosures on compensation, human resources and organisation, receiving the top grade in this area. Compensation disclosures for both the board and management were especially impressive – all funds received top marks.

Performance

The Australian funds scored well in performance with an average country score of 76 and a global ranking of 4th on the factor. Scores were quite consistent across funds, ranging in a narrow band from 66 to 86. Scores on most performance components were around the top-quartile mark with two outliers. Benchmark disclosures were relatively weak at the asset class level. In contrast, the Australians had the highest average score on disclosures for member service levels. It seems the competitive environment and freedom that individuals enjoy to switch funds drives more emphasis on member service.

Responsible Investing

The Australian funds had an average country score of 46 on RI and ranked 8th globally. Individual fund scores ranged widely from a low of 8 to a high of 70. Areas of relative strength were: active ownership policies, ranked 4th with an average score of 72, and exclusion policies and practices ranked 4th with an average score of 70. Disclosures in other areas were generally mid-range relative to other countries.

Examples

AustralianSuper

Source: AustralianSuper website

First State Super

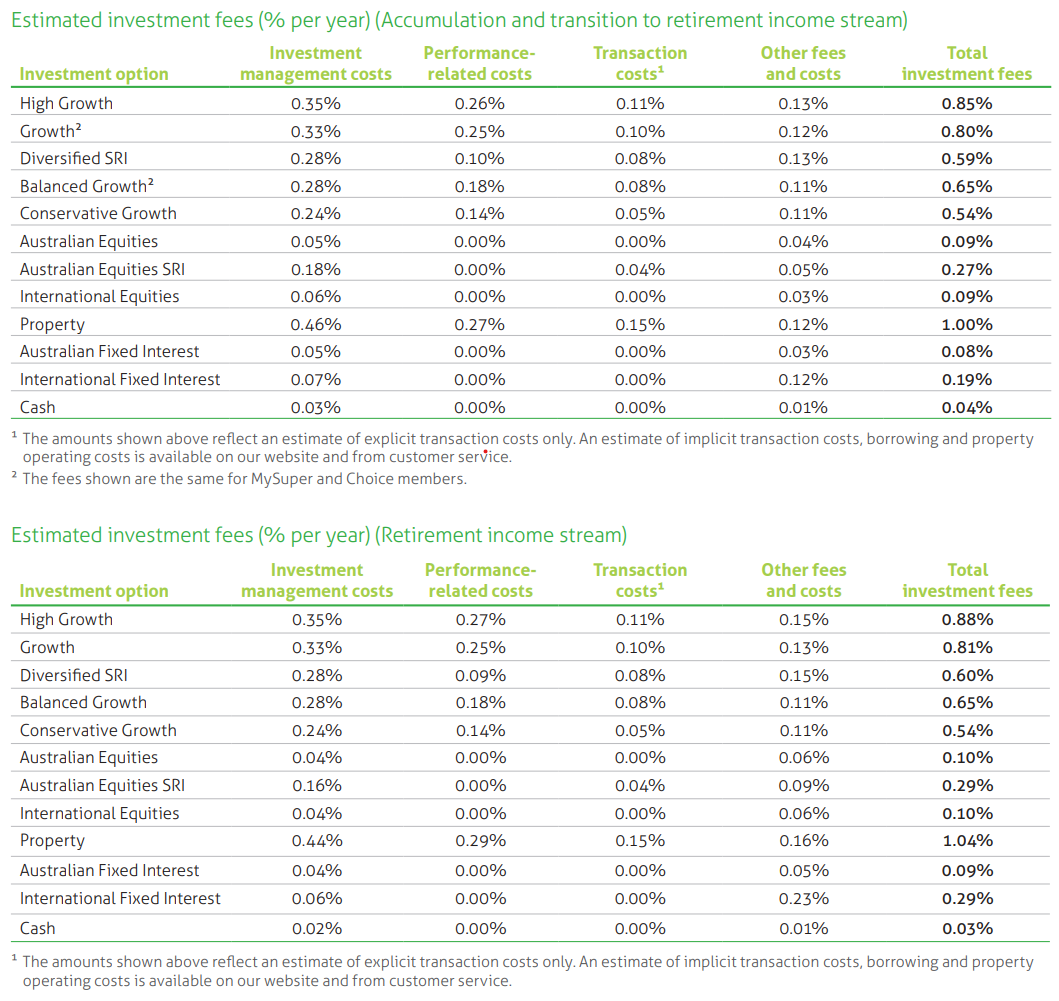

First State Super has a very good breakdown of the estimated investment fees annually by investment option. This annual report was produced in 2019 prior to the merger and name change to AwareSuper.

Source: First State Super Annual Report 2019 (page 16)

Overall Results

Australia.

Funds Analysed

AustralianSuper

AustralianSuper is the largest Australian superannuation and pension fund, with approximately one in every 10 Australian workers as members. It is a not-for-profit industry superannuation fund.

Aware Super

Aware Super is a not-for-profit industry fund with a new name but a history going back to 1992. It is Australia’s second largest fund, with $130 billion under management following the merger between First State Super and VicSuper.

Future Fund

Future Fund is an independently managed sovereign wealth fund established in 2006 to meet unfunded public sector superannuation liabilities.

QSuper

QSuper is an Australian superannuation fund based in Brisbane, Queensland. The fund was established in 1912 through an Act of Parliament. It is a not-for-profit fund, with around 585,000 members and $113 billion.

UniSuper

UniSuper is a not-for-profit superannuation fund with origins as a provider of superannuation for employees of Australia’s higher education and research sector.

Insights

Why transparency is a strategic initiative for Norway’s SWF

Norway’s giant sovereign wealth fund took out the top spot in this year’s Global Pension...

Global Pension Transparency Benchmark makes process improvements

The Global Pension Transparency Benchmark, a collaboration between Top1000funds.com and CEM...

Benchmark proves scrutiny on disclosure drives transparency improvements

Now in its fourth iteration, the Global Pension Transparency Benchmark shows that ongoing scrutiny...

Canadian funds shine in transparency benchmark

For the fourth year running, Canada is number one in the country rankings of the Global Pension Transparency Benchmark, according to the 2024...

Perfect score sees Norway take out top spot on transparency

Norway’s sovereign wealth fund, Government Pension Fund Global, has topped the list of the most transparent funds according to the Global Pension...

Asset owners proving trust goes hand-in-hand with transparency

Transparency is key to building trust according to executives at Norges Bank and the United Nations Staff Pension Fund. They discussed the benefits,...

Why Norges Bank leads the world in transparency

Norges Bank has taken the top spot again in the Global Pension Transparency Benchmark. But perhaps even more extraordinary than the consistency and...

Please note, your details will be shared with both CEM and Top1000funds.com. Your data will never be shared with any other organisations or third parties.

CEM Benchmarking is an independent provider of cost and performance benchmarking information for pension funds and other institutional asset owners worldwide. It believes ‘what gets measured gets managed’ and is deeply committed to helping clients run cost-effective operations that generate value for their stakeholders. With vast industry knowledge and a robust database spanning 28 years and $10+ trillion in AUM, CEM helps more than half of the world’s top 300 pension schemes understand and manage their costs and performance. CEM also facilitates better pension outcomes by sharing cutting edge research derived from its proprietary databases.

Top1000funds.com is the market leading news and analysis site for the world’s largest institutional investors. It focuses on leading the global investment industry to continuous improvement through case studies of best practice in governance and decision making, portfolio construction and efficient portfolio management, fees and costs, and sustainable investing. The publication pushes the industry to question whether status quo processes and behaviours to tackle risks and opportunities will be sufficient in the future, and actively campaigns for diversity, sustainability, transparency, innovation and better alignment of fees in the investment industry. Top1000funds.com is read by investment professionals in more than 40 countries.

Categories

Links

© 2021 Conexus Financial. Top1000funds.com. Please read our Terms and Conditions, Privacy Policy and Terms of use.