Countries

Promoting transparency for better pension outcomes

Select country to see results

Australia.

Australia ranked 4th globally with an average total score of 65.

The first pillar of Australia’s pension system is a means-tested, unfunded age-based pension that provides a basic benefit. The backbone of the country’s pension system is the second pillar, a mandatory defined contribution system with minimum required contributions for all workers which was introduced in 1992. Before the compulsory superannuation system was introduced, defined benefit schemes were the more popular form of occupational pension provision. The environment is competitive as individuals select the superannuation fund for their contributions. There are many superannuation providers which generally fall into two categories: not-for-profit industry funds and retail funds, which are offered to the public by financial services companies.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

Australia.

Cost

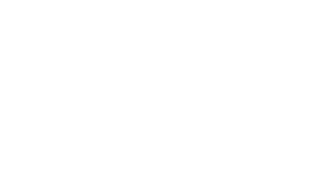

With an average cost factor score of 67, Australia’s superannuation funds ranked 3rd globally. Individual scores ranged from 58 to 84. Four of the funds offer DC options in a competitive environment, so the questions relating to completeness of external management and transaction costs were all from the perspective of product disclosure statements to members. Some of the Australian funds did a very good job of including all transaction costs (including implicit ones like market impact, buy and sell spreads, etc.) and quantifying and disclosing this to members. Commendable and not typical relative to funds globally.

Governance

The Australian funds did very well on this factor with an average score of 72, second behind Canada. The range of scores was quite narrow: from a low of 65 to a high of 80. Funds scored well in all areas except organisational strategy, which was a surprise since all super funds are fully integrated investment management and member service organisations. Members would benefit from a clearer picture of where their super fund is heading. Where the Australian funds did particularly well was in disclosures on compensation, human resources and organisation, receiving the top grade in this area. Compensation disclosures for both the board and management were especially impressive – all funds received top marks.

Performance

The Australian funds scored well in performance with an average country score of 76 and a global ranking of 4th on the factor. Scores were quite consistent across funds, ranging in a narrow band from 66 to 86. Scores on most performance components were around the top-quartile mark with two outliers. Benchmark disclosures were relatively weak at the asset class level. In contrast, the Australians had the highest average score on disclosures for member service levels. It seems the competitive environment and freedom that individuals enjoy to switch funds drives more emphasis on member service.

Responsible Investing

The Australian funds had an average country score of 46 on RI and ranked 8th globally. Individual fund scores ranged widely from a low of 8 to a high of 70. Areas of relative strength were: active ownership policies, ranked 4th with an average score of 72, and exclusion policies and practices ranked 4th with an average score of 70. Disclosures in other areas were generally mid-range relative to other countries.

Examples

AustralianSuper

Source: AustralianSuper website

Source: AustralianSuper websiteFirst State Super

First State Super has a very good breakdown of the estimated investment fees annually by investment option. This annual report was produced in 2019 prior to the merger and name change to AwareSuper.

Source: First State Super Annual Report 2019 (page 16)

Overall Results

Australia.

Funds Analysed

AustralianSuper

AustralianSuper is the largest Australian superannuation and pension fund, with approximately one in every 10 Australian workers as members. It is a not-for-profit industry superannuation fund.

Aware Super

Aware Super is a not-for-profit industry fund with a new name but a history going back to 1992. It is Australia’s second largest fund, with $130 billion under management following the merger between First State Super and VicSuper.

Future Fund

Future Fund is an independently managed sovereign wealth fund established in 2006 to meet unfunded public sector superannuation liabilities.

QSuper

QSuper is an Australian superannuation fund based in Brisbane, Queensland. The fund was established in 1912 through an Act of Parliament. It is a not-for-profit fund, with around 585,000 members and $113 billion.

UniSuper

UniSuper is a not-for-profit superannuation fund with origins as a provider of superannuation for employees of Australia’s higher education and research sector.

Brazil.

Brazil ranked 12th globally with an average total score of 43.

In Brazil, the first pillar consists of two schemes. The RGPS is a mandatory, pay-as-you-go-financed scheme, and it covers the private-sector workforce. The RPPS includes multiple pension schemes at different governmental levels covering public sector employees. In general, these pension plans are financed on a pay-as-you-go basis with the employee paying a percentage of their salary.

Employer sponsored pensions have a long history in Brazil and the country has the oldest system in Latin America. Two pension vehicles exist that can be used to finance private pension benefits. Closed private pension entities are non-profit organisations that can be established on a single-employer or multi-employer basis and by labor unions. Authorised financial institutions also provide pensions through open private pension entities. The closed approach is typically chosen by large employers whereas the open approach is mostly chosen by small and medium-sized employers and offered to their employees. Closed funds, sponsored mainly by large private companies, traditionally provided defined benefit pensions. Like many other countries, some of these DB plans are now closed and DC plans are on the rise.

Overall Factor Ranking

Cost

Governance

Performance

Responsible Investment

Brazil.

Brazil ranked 12th globally overall with an overall average country score of 43. The range of overall scores across funds was fairly narrow: from 34 to 52. Brazil scored in the bottom quartile of countries on three factors: governance and organisation, performance and responsible investing. In contrast, cost disclosures were relatively good and Brazil ranked in the top half of country scores.

Cost

With an average cost factor score of 57, Brazil’s ranked in the top-half with a global ranking of 6th. Individual scores ranged from 38 to 70. Detailed cost information was typically provided for ‘administrative costs’ which included investment management costs to varying degrees. Some funds only included ‘inhouse’ investment costs in financial statements but disclosed outsourced amounts in a schedule. As for all funds, marks were awarded for cost disclosures outside of the financial statements. But best practice is to include all costs in financial statements.

Governance

The Brazilian funds did not do well on this factor with an average overall score of 43 and a global ranking of 12th. The range of overall scores was remarkably tight: from a low of 40 to a high of 45. Disclosures for governance structure and mission were an area of relative strength and the Brazilian funds were about median on this component. In contrast, compensation, HR and organisational disclosures were a particular weak spot. Brazil was one of three countries where none of the funds disclosed board compensation. More Brazilian funds discussed desired board member competencies than in any other country. Unfortunately, the funds discussed what was desired, but did not disclose the actual competencies of their current board members.

Performance

The Brazilian funds did poorly on the performance factor with a country ranking of 15th and the lowest average country score of 51. Individual fund scores ranged from 35 to 67. Key performance components that scored poorly relative to other countries included: total fund/investment option and asset class return and value added reporting; benchmark clarity and quality; clarity for basis of return and value added disclosures, and risk management policies and practices.

Responsible Investment

The Brazilian funds also did relatively poorly on the responsible investing factor, with an average country score of 19 and a global ranking of 13th. Individual fund RI scores ranged from 8 to 27. RI implementation was the weakest component, especially related to active ownership and impact investing – disclosures were either minimal and most often missing. Scores were generally more mid-range for RI framework and reporting.

Example

Petros

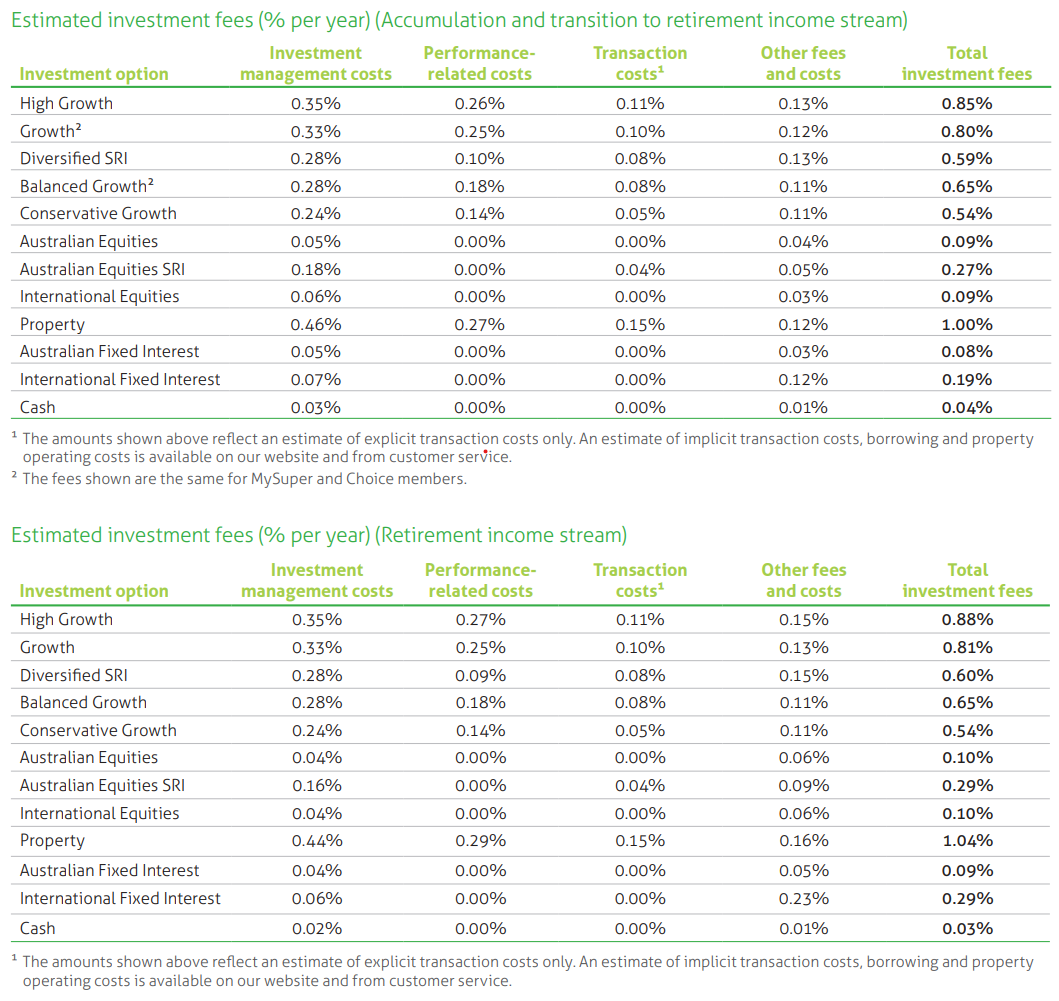

The Petros Annual Report discusses the budget for the current year relative to actual expenditure as well as the budget for the next year.

Resource optimisation: Policy and cost reduction

Petros’ resource optimisation and cost reduction policy intensified in 2019. At the end of the year, administrative expenses were R$269.62 million, which represents an 11% reduction compared to the R$302.68 million that had been initially estimated for the 2019 budget. For 2020, the budget is foreseen in R$265.08 million. The amount represents a decrease of 12.4% in compared to the budget initially projected for 2019 and also 1.7% compared to expenses actually incurred, ensuring control of spending. The economy is the result of a series of actions to ensure more efficiency.

In resource management, reducing Petros costs and ensuring equity of the participants. A successful strategy has been an intense negotiation of new service contracts services, renovations and additives. This has ensured, on average, a reduction in 5% in the cost of contracts. In addition, there are periodic contractual renegotiation, in which new opportunities are assessed cost cuts.

In recent years, the Foundation has increased control over the use of resources. Orderly control mechanisms have been implemented budget – creation of a reserve fund, based on surplus budgets and establishing limits of value and hierarchy for allocation of funds – and requirements for hiring. In 2019, Petros also reduced expenses that were planned with travel and training of its employees.

Petros compares budget and actual and projected administration expenses

Source: Petros Annual Report 2019 (page 76 and 69) – translated to English

Overall Results

Brazil.

Funds Analysed

Funcef

Funcef is the third largest pension fund in the country, with more than R$70 billion in assets and 135,000 participants. Its members are employees of CAIXA, a Brazilian bank that is the largest 100% government-owned financial institution in Latin America.

Itau Unibanco

Itau Unibanco provides a number of pension schemes for its employees and for subsidiary companies. Itau Unibanco is the largest private sector bank in Brazil and the largest in Latin America. It has operations in eight countries in the Americas as well as eight other countries.

Petros

Petros is a pension entity created by Petrobas, the national oil company. It has legacy DB plans for Petrobas and subsidiary companies, newer DC plans for them, and it now offers pension plan services for other employers and organisations in Brazil.

Previ

Previ has a long history, dating back to 1904. It is now among the largest pension funds in Latin America. Previ is the pension fund for employees of Banco do Brasil, and its own employees. There are two main plans: a DB scheme that has been closed to new entrants for some time, and a newer, open DC plan – Previ Futuro.

Vivest

Vivest was known as Funcesp until recently and it started as a provider of pension and health benefit programs for CESP, a large electricity generation company in the State of São Paulo. Today, Vivest is the largest private pension fund in Brazil.

Insights

Why transparency is a strategic initiative for Norway’s SWF

Norway’s giant sovereign wealth fund took out the top spot in this year’s Global Pension...

Global Pension Transparency Benchmark makes process improvements

The Global Pension Transparency Benchmark, a collaboration between Top1000funds.com and CEM...

Benchmark proves scrutiny on disclosure drives transparency improvements

Now in its fourth iteration, the Global Pension Transparency Benchmark shows that ongoing scrutiny...

Canadian funds shine in transparency benchmark

For the fourth year running, Canada is number one in the country rankings of the Global Pension Transparency Benchmark, according to the 2024...

Perfect score sees Norway take out top spot on transparency

Norway’s sovereign wealth fund, Government Pension Fund Global, has topped the list of the most transparent funds according to the Global Pension...

Asset owners proving trust goes hand-in-hand with transparency

Transparency is key to building trust according to executives at Norges Bank and the United Nations Staff Pension Fund. They discussed the benefits,...

Why Norges Bank leads the world in transparency

Norges Bank has taken the top spot again in the Global Pension Transparency Benchmark. But perhaps even more extraordinary than the consistency and...

Please note, your details will be shared with both CEM and Top1000funds.com. Your data will never be shared with any other organisations or third parties.

CEM Benchmarking is an independent provider of cost and performance benchmarking information for pension funds and other institutional asset owners worldwide. It believes ‘what gets measured gets managed’ and is deeply committed to helping clients run cost-effective operations that generate value for their stakeholders. With vast industry knowledge and a robust database spanning 28 years and $10+ trillion in AUM, CEM helps more than half of the world’s top 300 pension schemes understand and manage their costs and performance. CEM also facilitates better pension outcomes by sharing cutting edge research derived from its proprietary databases.

Top1000funds.com is the market leading news and analysis site for the world’s largest institutional investors. It focuses on leading the global investment industry to continuous improvement through case studies of best practice in governance and decision making, portfolio construction and efficient portfolio management, fees and costs, and sustainable investing. The publication pushes the industry to question whether status quo processes and behaviours to tackle risks and opportunities will be sufficient in the future, and actively campaigns for diversity, sustainability, transparency, innovation and better alignment of fees in the investment industry. Top1000funds.com is read by investment professionals in more than 40 countries.

Categories

Links

© 2021 Conexus Financial. Top1000funds.com. Please read our Terms and Conditions, Privacy Policy and Terms of use.